by Terry Reilly | Aug 12, 2022

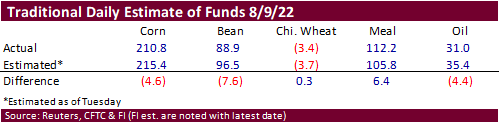

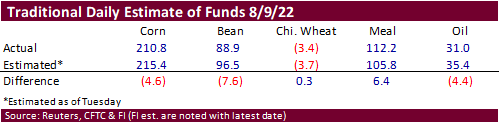

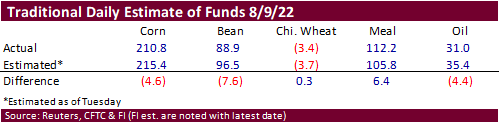

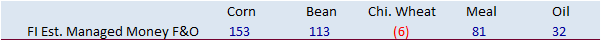

PDF attached CFTC Commitment of Traders Not much in the way of actual vs. estimate deviations for the week ending Tuesday, August 9. Funds were still short Chicago wheat (and are going home Friday), something to watch as they can easily add long positions....

by Terry Reilly | Aug 12, 2022

PDF Attached USDA released their August Acreage and Grain Stocks reports Reaction: Bearish soybeans as the initial USDA survey revealed a higher-than-expected yield than trade expectations, but the US lost 311,000 harvested acres. Corn was seen friendly...

by Terry Reilly | Aug 12, 2022

Attached 3 PDF’s Terry Reilly Senior Commodity Analyst – Grain and Oilseeds Futures International One Lincoln Center 18 W 140 Butterfield Rd. Oakbrook Terrace, Il. 60181 W: 312.604.1366 treilly@futures-int.com ICE IM: treilly1...

by Terry Reilly | Aug 12, 2022

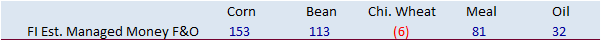

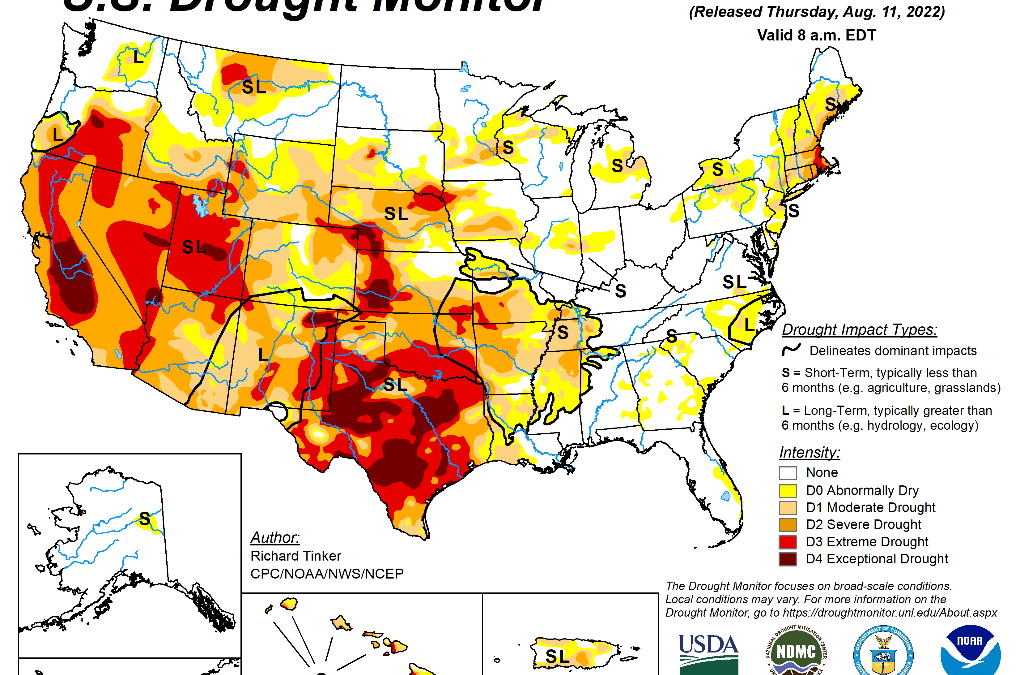

PDF attached Good morning. USDA S&D day. USD is up around 53 points and WTI is lower by nearly $1.70. US weather forecast improved for the US Midwest with a wetter bias for the southwestern areas early next week. GP is unchanged. A high-pressure...

by Terry Reilly | Aug 11, 2022

PDF attached does not include daily estimate of funds. FI snapshot for upcoming USDA report attached USDA positioning day. Private exporters reported sales of 103,400 tons of soybean cake and meal for delivery to Mexico during the 2022-23 marketing year....