by Terry Reilly | Mar 7, 2022

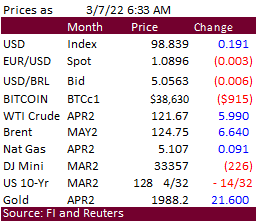

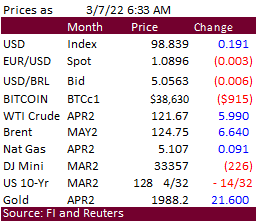

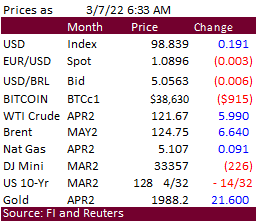

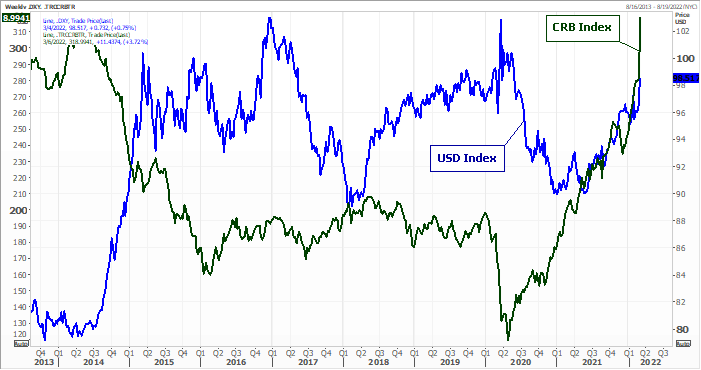

File(s) attached Good morning. Another eye-opening overnight session as many commodity markets make an impressive move higher, led by energy and wheat markets. To add fuel onto the fire, China’s AgMin warned their winter wheat conditions...

by Terry Reilly | Mar 4, 2022

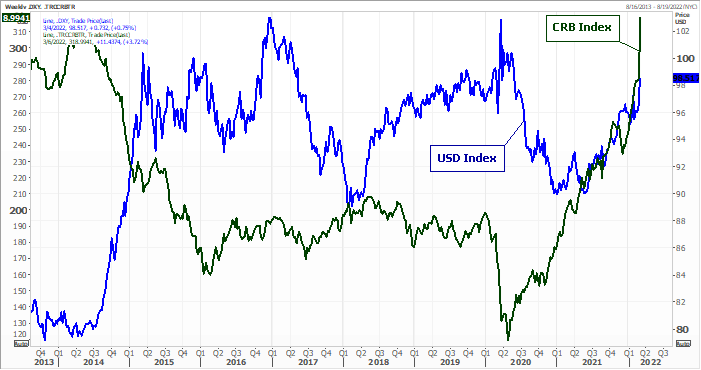

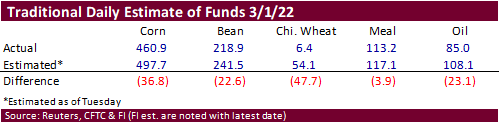

PDF Attached Source: Reuters and FI Private exporters report the following activity: -106,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year -108,860 metric tons of soybeans for delivery to Mexico during the 2021/2022...

by Terry Reilly | Mar 4, 2022

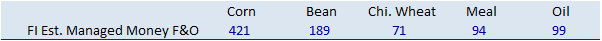

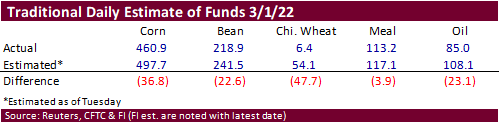

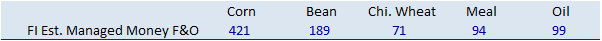

PDF attached No major records stand out this week. Note the positions below are from last Tuesday and don’t reflect the ongoing fireworks we saw over the past three trading days. However, as of March 1, the net fund positions were much less long than...

by Terry Reilly | Mar 4, 2022

PDF attached Good morning. Private exporters report the following activity: -106,000 metric tons of soybeans for delivery to China during the 2021/2022 marketing year -108,860 metric tons of soybeans for delivery to Mexico during the 2021/2022 marketing...

by Terry Reilly | Mar 4, 2022

File(s) attached Good morning. Day 9 of the invasion. Demand for EU wheat is very strong with Black Sea ports closed and this is sending EU and US futures sharply higher. All three US wheat markets are up limit for the May, July &...