by Terry Reilly | Dec 9, 2022

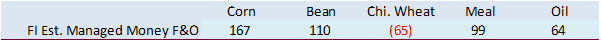

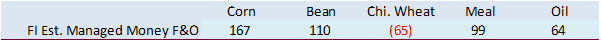

PDF attached CFTC Commitment of Traders Report The got it wrong for the fund position for corn and soybean oil, by a mile. Funds sold more than 55,000 contracts and 40,000 contracts than expected by trade estimates. Funds and managed money were large...

by Terry Reilly | Dec 9, 2022

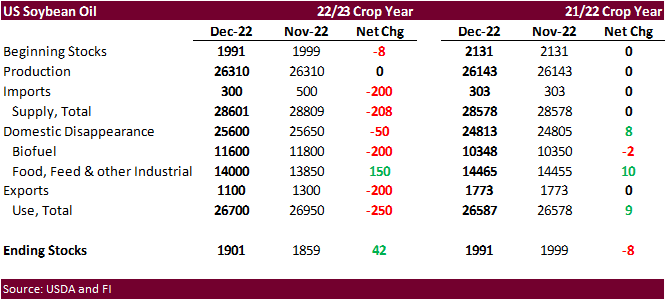

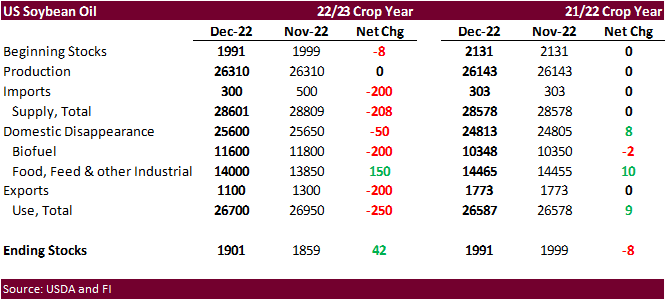

PDF Attached Includes unchanged price projections USDA released their December S&D report Reaction: Neutral USDA NASS briefing https://www.nass.usda.gov/Newsroom/Executive_Briefings/index.php USDA OCE Secretary’s Briefing...

by Terry Reilly | Dec 9, 2022

2 attached USDA’s report was perceived neutral as prices have not changed much. We look for the trade to focus on weather and demand fundamentals going forward. Largest surprise in today’s report was an unchanged Argentina corn and soybean...

by Terry Reilly | Dec 9, 2022

PDF attached Good morning. US PPI Final Demand (M/M) Nov: 0.3% (est 0.2%; prev 0.2%) US PPI Core (M/M) Nov: 0.4% (est 0.2%; prev 0.0%) US PPI Final Demand (Y/Y) Nov: 7.4% (est 7.2%; prev 8.0%) US PPI Core (Y/Y) Nov: 6.2% (est 5.9%; prev 6.7%) The...

by Terry Reilly | Dec 8, 2022

PDF Attached Private exporters reported the following sales activity: 118,000 metric tons of soybeans for delivery to China during the 2022/2023 marketing year 718,000 metric tons of soybeans for delivery to unknown destinations during the 2022/2023 marketing...