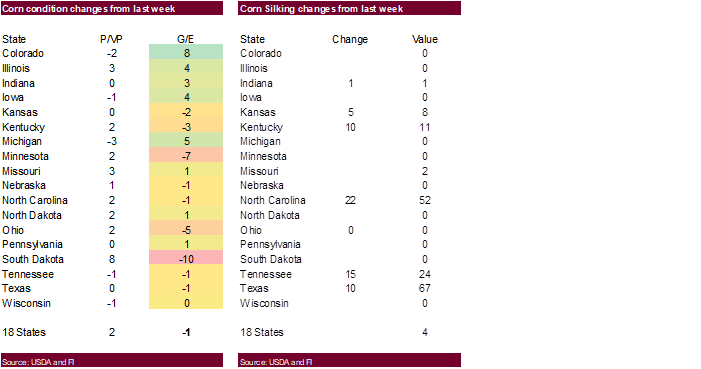

Corrects corn silking to reflect 4 percent

PDF Attached

Talk

of warmer and drier month of July for the US Midwest sent prices higher. Record-breaking temperature across the Globe

http://coolwx.com/record/usamovie.day.php

Calls:

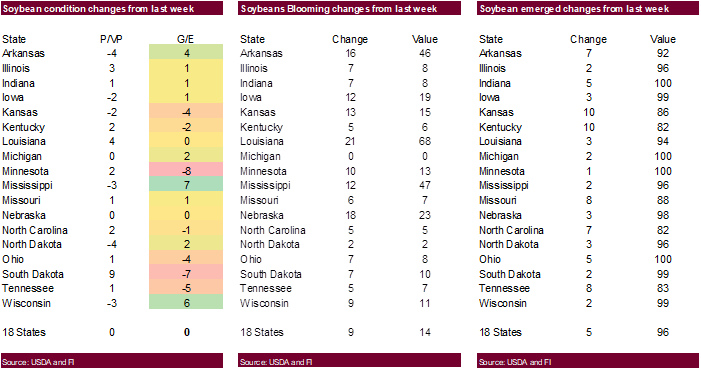

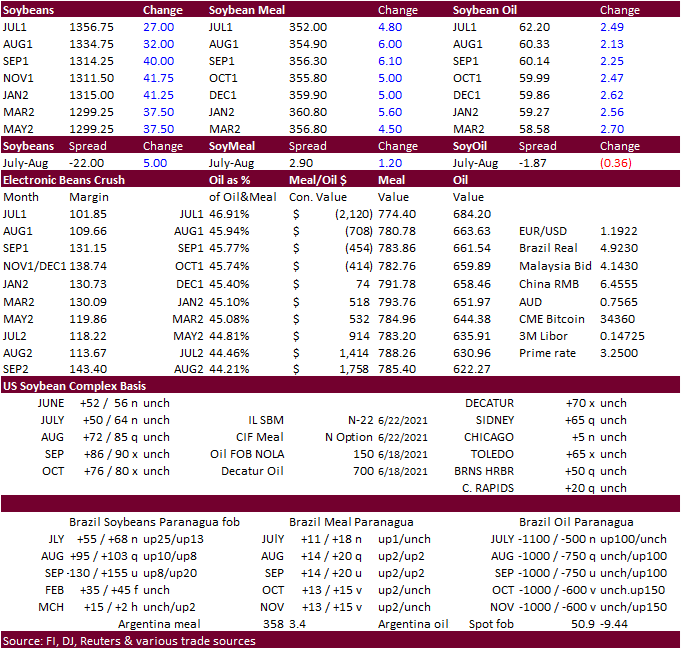

Soybeans

10 higher

Corn

5-7 higher

Chicago

& KC wheat 10 higher

Minneapolis

15 cents higher

|

|

Corn |

Bean |

Chi. |

Meal |

Oil |

|

FI |

243 |

69 |

(4) |

16 |

52 |

|

FI |

243 |

69 |

4 |

16 |

52 |

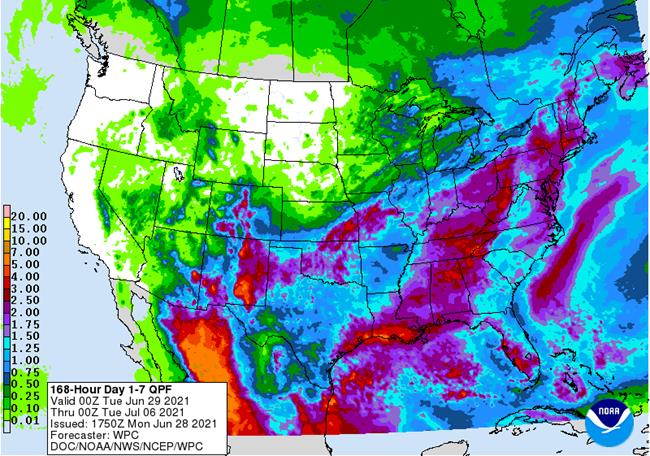

1-7

DAY

WORLD

WEATHER INC.

MOST

IMPORTANT WEATHER OF THE DAY

-

Super

strong high pressure ridge over the U.S. Pacific Northwest will creep to the east northeast over the next few days moving more solidly over the Canadian Prairies

o

Some of the excessive heat from the system will be lost in the Rocky Mountains, but it will be very hot in the Prairies during the middle to latter part of this week with widespread temperatures in the 90s to 108 degrees Fahrenheit

-

Hottest

in southern Alberta and western Saskatchewan

o

Crop stress in southern Alberta and throughout Saskatchewan to parts of Manitoba will reach extreme levels for a while

-

Western

and northern Alberta has a little more moisture in the soil to buffer the heat a bit, but crops will still be stress in those areas as well -

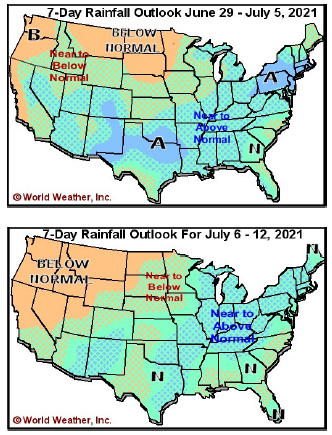

A

weaker ridge of high pressure will be in place over the U.S. Rocky Mountain region and the high Plains during the week next week still promoting very warm to hot temperatures, but some showers and thunderstorms should evolve from the Pacific Northwest into

western and northern Saskatchewan while areas farther east are dry -

High

pressure ridge will slowly drift more into the Plains by the end of the second week of July bringing warmer and drier conditions to the western Corn Belt -

Feedback

moisture from recent significant rainfall in the Midwest will perpetuate showers and thunderstorms this coming weekend and next week slowing the expansion of dryness form the northern Plains and Canada’s Prairies for a little while

o

Eventually the expansion of dryness will reach more deeply into Nebraska, Iowa southern Minnesota and Wisconsin during July

o

World Weather, Inc. still believes the next round of excessive heat in the Plains and western Corn Belt will occur in the latter part of July

NOT

MUCH CHANGE ELSEWHERE IN THE WORLD TODAY

-

U.S.

weather during the weekend did not bring many surprises; however, southeastern Iowa, northwestern Illinois and northeastern Missouri were not as wet as expected with rainfall of 0.25 to 1.15 inches

o

The greatest rainfall occurred form the heart of Oklahoma and southeastern Kansas through west-central Missouri and then from east-central Missouri through central Illinois to southern lower Michigan

-

Rainfall

extremes reached 7.84 inches at Chanute, Kansas, 6.38 inches at Bloomington/Normal, Illinois and 5.15 inches at Ionia County Airport in southern Michigan -

Rainfall

in central Oklahoma ranged from 2.68 to 6.38 inches with the greatest rainfall northwest of Carnegie -

Southeastern

and east-central Kansas into west-central Missouri rain totals were 2.50 to 5.75 inches with the local amounts noted above to 7.84 inches -

Most

of the heavy rain from east-central Missouri through central Illinois to central Michigan was more localized with South Bend, Ind. reporting 5.48 inches and Middleville, Michigan reported 7.77 inches

o

Flooding occurred in all of the wetter areas

o

In contrast, rainfall in the Ohio River Valley including the southern half of Ohio and much of Kentucky varied from nothing to 0.77 inch.

-

Northern

U.S. Plains, upper Midwest rainfall was mostly as expected, but a few pockets of heavy rain were noted

o

Torrential rainfall occurred in a few localized areas near the southeastern Minnesota, northeastern Iowa, west-central Wisconsin common borders with local totals of 2.75 to more than 6.00 inches resulting

-

Lynxville

Dam, Wisc. reported 9.50 inches, although that was not confirmed -

Another

small pocket of heavy rain occurred in the interior southeast of Minnesota with 1.00 to 2.74 inches officially reported and radar suggesting greater amounts.

-

Most

of this occurred between Mankato and Stanton, MN

o

Western Minnesota was left mostly dry

o

Several areas in interior eastern North Dakota received 0.30 to more than 1.00 inch

o

Another area in north-central North Dakota received up to 0.56 inch

-

U.S.

southeastern states experienced net drying conditions during the weekend with some rain near the Gulf of Mexico Coast, in much of Florida and along the south Atlantic Coast -

U.S.

West Texas rainfall varied from 0.80 to 2.50 inches in general, but several areas reported 2.50 to more than 5.00 inches of rain

o

Local flooding resulted

o

Northwestern parts of West Texas cotton country and the northwestern Texas Panhandle were driest

o

Southeastern parts of the Texas Panhandle and the Low Plains of West Texas were wettest

-

Excessive

heat and dryness continued in the far western United States

o

Extreme highs to 110 Fahrenheit occurred in south-central Washington and north-central Oregon with extremes of 95 to 108 common in the interior parts of Oregon and Washington

-

The

Dalles, Oregon reached 115 degrees Sunday afternoon

o

Southwestern desert areas peaked out with temperatures around 116

o

Northern California reached 115

o

Much of California’s central Valley reached 100 Sunday afternoon

-

Temperatures

were much milder in the northern Plains and seasonable across the Midwest during the weekend many 70- and 80-degree highs and some 60s and 70s in the northern Plains -

Excessive

heat will continue in the northwestern United States this week with some of the heat expanding across Canada’s Prairies and into the northwestern U.S. Plains

o

The U.S. Plains will be coolest relative to normal this week many 70- and lower 80-degree highs

o

Temperatures in the Midwest, Delta and southeastern states will be more seasonable with a slight cooler bias toward the end of this week

o

Late week weather will be warm to hot in the western and north-central U.S. and mild in the Midwest and parts of the southern Plains, Delta and interior southeastern states

-

Western

Canada heat wave will dominate this entire week with British Columbia and Alberta experiencing temperatures well above average along with Saskatchewan and Manitoba later this week and into the weekend.

o

The northwestern U.S. Plains will also be excessively hot

o

Extreme highs over 100 are expected from the U.S. Pacific Northwest and British Columbia into Alberta and western Saskatchewan and Montana with 90s in other areas to the east

o

Next week’s temperatures will continue warmer than usual throughout all of the northern Plains and Canada’s Prairies as well as the western United States and British Columbia, but the extremes may not be quite as great as those

of this week

-

Rainfall

will be quite limited in British Columbia, Alberta and the U.S. Pacific Northwest in this coming week with restricted rainfall in the northern Plains and remaining Canada Prairies as well as the upper Midwest

o

Rainfall will be greater than usual over the next two weeks from the central and southern Plains through the lower and eastern Midwest, Delta and southeastern states excepting Florida where rainfall will be lighter than usual

-

South

Texas and northeastern Mexico will also be drier than usual during the next two weeks -

The

bottom line for U.S. and Western Canada remains one of grave concern for crops and livestock from the U.S. Pacific Northwest and British Columbia into western Saskatchewan and Montana. Soil moisture is best going into this period over western and northern

Alberta crop areas where the ground will dry down, but crops may not be lost. The heat and dryness in western Saskatchewan and southern Alberta will be more threatening because of dryness that is already present. Crop stress is also expected to expand across

central and eastern Saskatchewan later this week and eventually into the drier areas of Manitoba as the heat advances farther to the east. In contrast, lower and eastern U.S. Midwest crop areas will remain plenty wet and in a very good environment for summer

crop development, although temperatures will eventually get a little cool. The upper Midwest crop areas will continue to deal with restricted rainfall and warm temperatures leaving the door wide open for potential greater crop stress later this summer when

hotter days and more stable air settles into the region allowing for accelerated crop stress to have a negative impact on production potentials. The northwestern Plains are already experiencing such conditions, but the eastern Dakotas, parts of Nebraska, northwestern

Iowa and Minnesota will get involved with similar conditions later in July especially if late June and early July rainfall is no greater than advertised. West Texas crop areas will get sufficient rain to maintain an improved cotton, corn and sorghum outlook.

Winter wheat harvesting in the southern Plains may be slowed additionally and there could be a few areas of grain quality concerns because of wet conditions. Crop and livestock stress will be quite serious in the U.S. Pacific Northwest and western Canada resulting

milk production cuts, livestock weight gain reductions and a serious threat to crops without significant rain soon.

-

Hurricane

Enrique is expected to bring moisture northward into western and some north-central Mexico crop areas this week

o

Landfall is expected in southern Baja California during mid-week as a tropical storm

o

Heavy rain will fall in coastal areas of Jalisco and in southern Baja California and in a few Sinaloa locations

o

Drought relief is expected in some areas, but much more rain will be needed to knock the drought out

-

Tropical

cyclone may form off the South Carolina/Georgia coast early this week before landfall in South Carolina Tuesday

o

The system is not expected to be very significant, but it will bring some moderate to heavy rainfall inland

-

Three

tropical waves in the tropical Atlantic will be closely monitored over the next ten days with one expected to reach the Antilles during mid- to late-week this week producing some heavy rainfall

o

The system is not likely to evolve into a significant tropical cyclone in the next few days, but it will be closely monitored

o

The second wave is west of the West Africa coast and may run into some trouble organizing further

-

Kazakhstan

and neighboring areas of Russia endured some very warm to hot temperatures during the weekend with a drying wind at times stressing many spring cereal and sunseed crops

o

The high pressure ridge responsible for the adverse weather will advance to the east this week bringing rain to western Russia through Wednesday and to the New Lands late this week and into the weekend

o

Temperatures will cool back to a more seasonably mild range by the end of this week

o

Scattered showers and thunderstorms will be welcome this week into early next week, but the precipitation distribution should be closely monitored due to the potential for a new high pressure ridge to form over western Russia

next week

o

Russia’s Southern Region and parts of Kazakhstan will not receive much rain and will need to be closely monitored for ongoing potential dryness threatening spring wheat, sunseed and a few other crops

-

A

good mix of weather is expected to continue in western Russia, Ukraine and eastern Europe over the next two weeks

o

Crop development should advance well

-

Europe

weather will be favorably mixed over the next two weeks supporting crops in most of the continent

o

The Mediterranean countries will be driest

o

Temperatures will be cooler than usual in France and northwestern Spain this week and warmer next week

o

Rainfall should be greater than usual this week in Germany, France, southern parts of the U.K., northern Italy, Romania, Bulgaria and western parts of the CIS

-

Drying

will occur next week in France and northwestern Germany while showers occur in other areas -

Western

Balkan Countries of Europe were very warm to hot and drier than usual during the weekend stressing more unirrigated crops in the region

o

The area will continue drier and warmer than usual this week before showers and cooling begin this weekend and continue next week

-

Significant

rainfall is needed to east reducing drying and heat -

North

Africa has been and will continue to be dry favoring late season small grain harvesting -

India

rainfall during the weekend was erratic and mostly lighter than usual

o

Temperatures were warmer than usual in the northwest due to abundant sunshine and dry conditions

-

India

rainfall will continue lighter than usual in many areas this week, although a few areas in south-central parts of the nation and the far east could experience some greater than usual rainfall

o

Some increase in rainfall is possible next week from central through northeastern parts of the nation, but the northwest may continue drier than usual

-

China

rainfall during the weekend was greatest in three areas

o

The first was from eastern Hebei to Liaoning and western Jilin where 2.00 to more than 5.00 inches resulted

-

Local

totals reached up to 7.12 inches

o

A second area of heavy rain occurred form southern Shaanxi and eastern Sichuan through southern Henan and parts of Hubei and then reaching Anhui, Zhejiang and parts of Jiangxi where 1.50 to more than 6.00 inches resulted and local

totals nearly reaching over 10.00 inches in southern Shaanxi

o

A third area of heavy rain occurred in eastern Guangxi and Guangdong where 1.70 to 6.00 inches resulted

o

Net drying occurred in many other areas in the nation and temperatures were warm enough for net drying outside of the heavier rainfall areas

o

Flooding occurred in many areas, but the long term impact on production was considered low

-

China

weather will continue to be very well mixed over the next two weeks with periods of rain and sunshine supporting most crop needs

o

A little too much rain will fall this week near and south of the Yangtze River resulting in some flooding

o

East-central parts of the nation will be driest this week, but that area got some rain during the weekend and will get some more again next week

o

Temperatures cooler than usual in the interior south due to abundant rain and cloudiness and more seasonable elsewhere

-

Australia

showers during the weekend were greatest in the east, but most were light -

Australia

will experience a good mix of rain and sunshine in most of its crop areas during the next two weeks

o

Greater rain is now advertised for Queensland for this week and that should result in better topsoil moisture

-

Thailand,

Cambodia and Vietnam will continue drier biased in this first week of the outlook with Vietnam getting greater rain July 2-8

o

A general boost in precipitation is possible in many mainland areas of Southeast Asia next week

-

Thailand,

corn, rice, sugarcane and other crops are all becoming stressed because of dryness. The same may be occurring in some Cambodia and Vietnam locations -

Indonesia

and Malaysia rainfall is expected to be sufficient to maintain or improve soil moisture for all crops -

Philippines

rainfall will be near to below average for at least the next ten days -

Some

areas may experience net drying -

Argentina

temperatures were turning colder during the weekend and will remain cold early this week

o

Freezes have already occurred in much of the nation and more are expected, but winter crops are not likely to be damaged

o

Unharvested summer crops will also not be impacted by the cold

o

Dry weather is expected most of this week after light rain evolved briefly during the weekend

o

Wheat is in much better shape this year than last year at this time, but would benefit from additional moisture

-

Argentina

will trend warmer later this week and stay warm through much of next week

o

Not much rain is expected this week, but some showers may evolve during the middle part of next week

-

Southern

Brazil will trend colder this week

o

Frost and freezes are expected from the grain areas of Parana into northeastern Rio Grande do Sul

-

Most

Safrinha crops are not likely to be impacted by freezes, but some of the wheat is in the pre-reproductive stage of development and could be harmed if temperatures get too cold

o

Coffee, citrus and sugarcane areas of southern Brazil will not likely get cold enough for a threatening frost event, but Wednesday and Thursday will be chilly

-

Some

soft frost cannot be ruled out for some of the corn areas if western Parana or southeastern Mato Grosso do Sul

-

Southeastern

Canada corn, soybean and wheat conditions are rated mostly good, although a greater boost in rainfall might be welcome near the U.S. border at some point into time over the next few weeks.

o

Some of that precipitation need is expected over the coming week as rain from the U.S. Midwest streams into the region

o

Weekend rain was significant in southwestern and eastern parts of Ontario where 1.00 to 3.00 inches resulted except near the northern shore of Lake Erie where less than 1.00 inch resulted

-

A

part of eastern Ontario received 4.00 to nearly 6.00 inches -

Interior

southern Quebec also received 1.00 to 2.50 inches of rain except along the U.S. border where rainfall was no more than 0.50 inch -

Western

Xinjiang, China weather has improved recently with warmer temperatures and less rain

o

Highest weekend temperatures were in the lower 90s Fahrenheit with no rain

o

Northeastern Xinjiang was quite cool again and periods of showers and thunderstorms

-

Highest

temperatures were limited to the 70s Fahrenheit and coldest lows in the upper 40s to near 50

o

Rainfall was mostly less than 0.50 inch except near the mountains

o

Weather conditions will improve in northeastern Xinjiang later next week

-

Northeastern

Xinjiang weather over the coming week will improve with warmer temperatures, but some scattered showers will continue and temperatures may not rise back to normal for a few days

o

Western Xinjiang will continue near to slightly cooler than usual with no rain

-

West

Africa rainfall in Ivory Coast and Ghana will be near average during the coming ten days

o

Nigeria and Cameroon will see a mix of precipitation during the next ten days with most crops benefiting well from the pattern

-

A

part of Nigeria will receive less than usual rainfall during this period, but timely rain is still expected -

Erratic

rainfall has been and will continue to fall from Uganda and Kenya into parts of Ethiopia

o

A boost in precipitation is needed

-

Ethiopia

rainfall is expected to gradually improve while a boost in precipitation will continue needed in other areas -

South

Africa was dry during the weekend except for scattered showers in the far west

o

Additional showers will occur in the far west periodically this week

-

The

moisture will be good for winter crops, but more moisture will be needed in Free State and other eastern wheat production areas

o

Summer crop harvesting has advanced well this year and the planting of winter grains has also gone well, but there is need for moisture in eastern winter crop areas

-

Mexico

rainfall will continue in southern parts and western of the nation over the coming week

o

The precipitation will bring some drought relief to Sonora, Baja California, western Chihuahua, Sinaloa, western Durango and parts of Zacatecas

o

Northeastern and north-central Mexico will have need for more rain

-

Nicaragua

and Honduras have received some welcome rain recently, but moisture deficits are continuing in some areas

o

Additional improvement is needed and may come slowly

-

Southern

Oscillation Index is mostly neutral at -1.06 and the index is expected to move erratically this week -

New

Zealand rainfall during the coming week to ten days will be less than usual and temperatures will be a little cooler biased

Source:

World Weather, Inc.

Bloomberg

Ag Calendar

Monday,

June 28:

- USDA

export inspections – corn, soybeans, wheat, 11am - U.S.

crop conditions — corn, cotton, soybeans, wheat, 4pm - EU

weekly grain, oilseed import and export data - Ivory

Coast cocoa arrivals

Tuesday,

June 29:

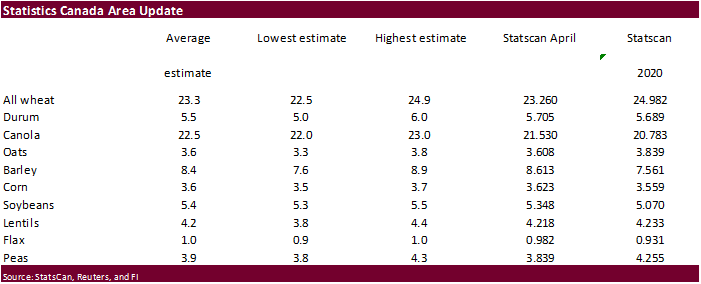

- Canada

Statcan data on seeded area for wheat, durum, canola, barley and soybeans - South

Africa updates corn production

Wednesday,

June 30:

- EIA

weekly U.S. ethanol inventories, production - U.S.

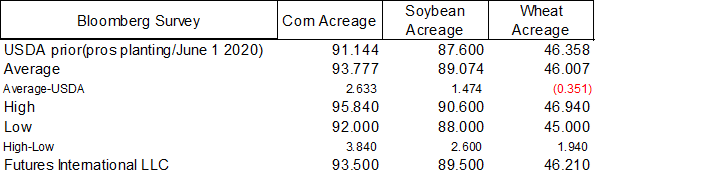

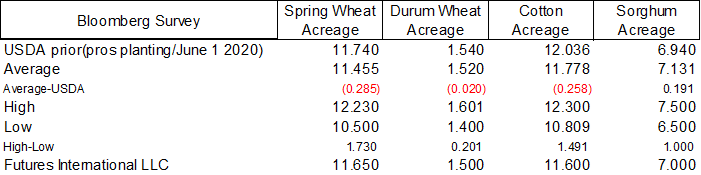

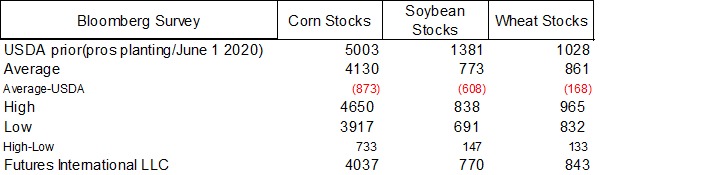

acreage data for corn, wheat, soybeans and cotton; quarterly grain stockpiles - Bloomberg

New Economy Catalyst; climate and agriculture - Malaysia

June 1-30 palm oil export data - U.S.

agricultural prices paid, received

Thursday,

July 1:

- USDA

weekly crop net-export sales for corn, soybeans, wheat, cotton, pork, beef, 8:30am - World

cotton outlook update from International Cotton Advisory Committee - Costa

Rica, Honduras monthly coffee exports - U.S.

corn for ethanol, DDGS production, 3pm - USDA

soybean crush, 3pm - Port

of Rouen data on French grain exports - Australia

Commodity Index - AB

Sugar trading update - HOLIDAY:

Canada, Hong Kong

Friday,

July 2:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - FranceAgriMer

weekly update on crop conditions - Source:

Bloomberg and FI

Source:

Bloomberg and FI

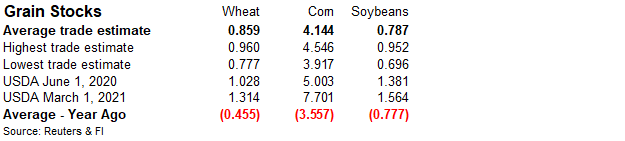

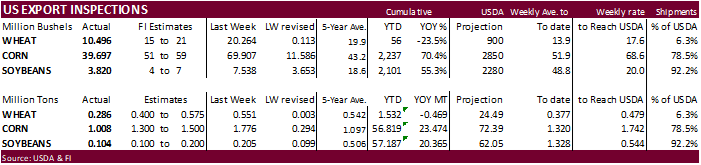

USDA

inspections versus Reuters trade range

Wheat

285,654 versus 400000-600000 range

Corn

1,008,351 versus 1200000-1700000 range

Soybeans

103,965 versus 100000-300000 range

Macros

US

Core CPI Inflation To Rise Further Before Easing In 2022 – Fitch

OPEC+

Data Said To Show 1.7M Bpd Deficit In Oil Market In August

- US

corn ended higher on hot WCB temperatures and strength in soybeans & wheat. Sharply higher soybean oil lent support. July temperatures and precipitation forecasts are calling for net drying and heat across the middle of the US, PNW, and Canadian Prairies.

One analyst noted the US rainfall over the past 10 days came up shorter than expected. Brazil’s weather forecast again calls for frost/freeze conditions. This supported spot Brazil cash export prices in turn supported US futures. The USDA Attaché lowered

their total corn crop estimate, 4.5MMT below USDA official. Frosts are also threatening the Paraguay late corn crop. US hog futures traded sharply higher after China announced they would buy pork for reserves. Look for them to take it from their domestic

market before turning to imports. Internal China hog futures are down about 60 percent from January. Note US hog futures hit their lowest level since April last week.

- We

saw a good amount of spreading ahead of First Notice Day deliveries. (estimates in the soybean section).

- Funds

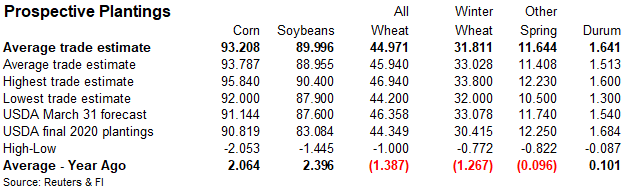

bought an estimated net 28,000 corn. - US

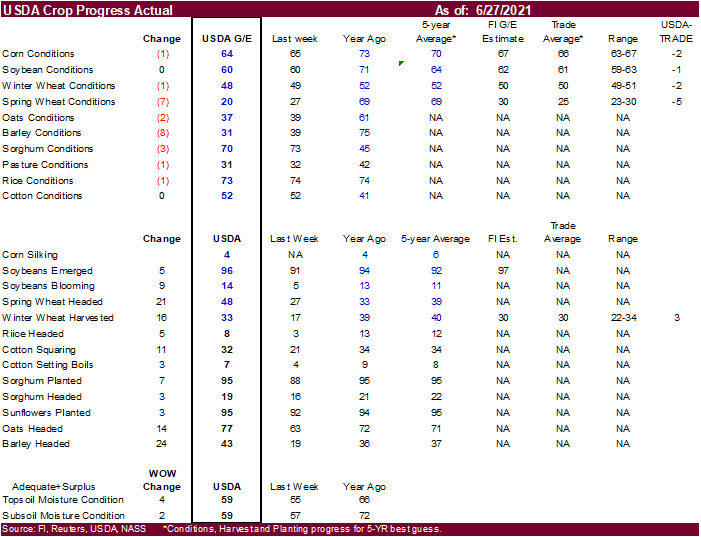

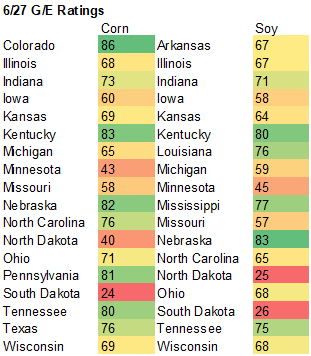

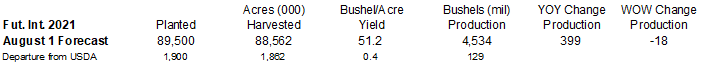

corn conditions fell 1 point to 64 percent G/E. Traders were looking for a one point increase in crop conditions. We left out corn yield unchanged. 7-year average is 70.

- USDA

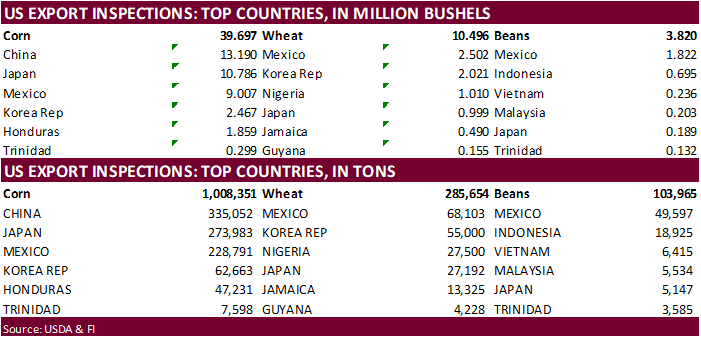

export inspections fell below expectations but an upward revision to last week and China taking a large amount of US corn was seen supportive. USDA US corn export inspections as of June 24, 2021 were 1,008,351 tons, below a range of trade expectations, below

1,775,716 tons previous week and compares to 1,241,038 tons year ago. Major countries included

China for 335,052 tons, Japan for 273,983 tons, and Mexico for 228,791 tons.

- Bloomberg

“Freezing temperatures pose risk to second corn crop in northern Parana, western and southern Sao Paulo and central and southern Mato Grosso do Sul states starting June 30.”

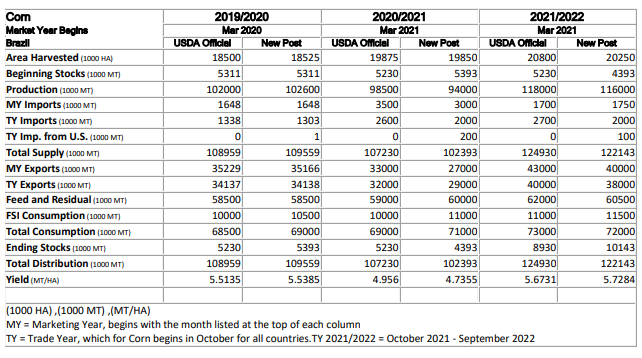

USDA

Attaché Brazil: Grain and Feed Update. They are using 94MMT versus 98.5 by official USDA (11 million lower from previous)

Export

developments.

Updated

6/25/21

December

corn is seen in a $4.25-$6.00 range.

Soybeans

-

Soybeans

ended higher following a sharply higher soybean oil market and limit higher move (earlier) in Canadian canola. Soybean meal was the defensive earlier but ended higher in part to higher corn. This supported the July crush that ended 11.50 cents higher at

$1.025 (Friday made a low of 74 cents). Excessive heat stretching from the upper Great Plains into Canadian Prairies and US PNW is depleting soil moisture across key canola and outlying soybean production areas. This was the primary reason Canada canola

was very strong today. -

Meanwhile

the midday weather discussion revealed conflicting information from the dry weather forecast put out this morning, suggesting storms over the top of the ridge July 7-8. Morning model calls for rigging during the second week bias central and ECB.

-

Funds

bought an estimated net 15,000 soybean contracts, bought 7,000 soybean meal and bought 5,000 soybean oil contracts.

-

US

soybean conditions were unchanged at 60 percent vs. 64 average. Traders were looking for a one point increase in crop conditions. We slightly lowered our US soybean yield.

-

We

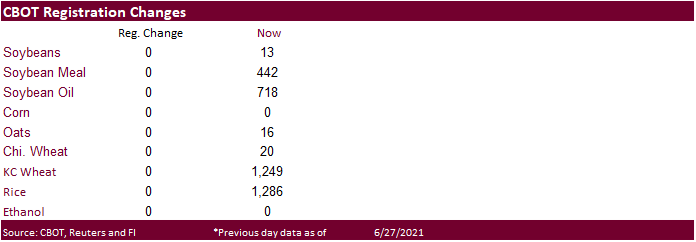

look for little or zero initial First Notice Day deliveries for the soybean complex (SBO zero to 150, meal 0-25, soybeans zero). We are hearing soybean meal could zero for FND, but some circulate during the period. Soybean meal basis is weak despite the

recent increase in export interest. Corn no deliveries expected and Chicago wheat 0-50. MN wheat zero and KC 0-150.

-

USDA

US soybean export inspections as of June 24, 2021 were 103,965 tons, barely within a range of trade expectations, below 205,155 tons previous week and compares to 334,642 tons year ago. Major countries included Mexico for 49,597 tons, Indonesia for 18,925

tons, and Vietnam for 6,415 tons. -

Palm

oil was slightly lower on Monday. Indonesia finally applied the revised export levy structure allowing them to better be situated to compete with Malaysian for exporting palm oil. Indonesia set CPO reference price at $1,094/ton for July, and CPO export duty

at $116/ton (37% below this month), export levies at $175/ton. -

Strategie

Grains raised its European Union rapeseed crop to 17 million tons, compared with the 16.82 million tons last month, 3.3% above last year.

- None

reported

Updated

6/25/21

August

soybeans are seen in a $12.15-$14.50 range; November $11.50-$14.75

August

soybean meal – $320-$390; December $320-$400

August

soybean oil – 48.50-65; December 46-65 cent range

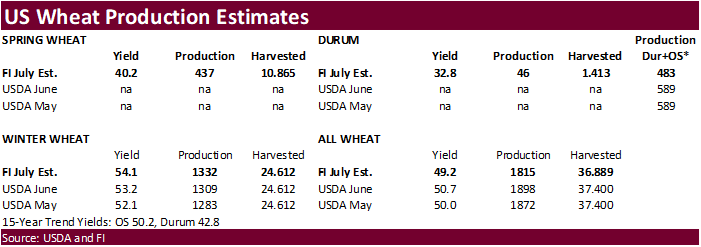

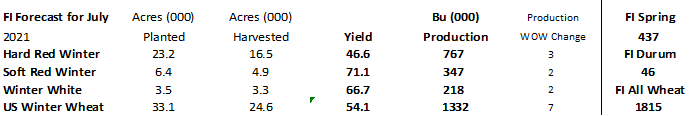

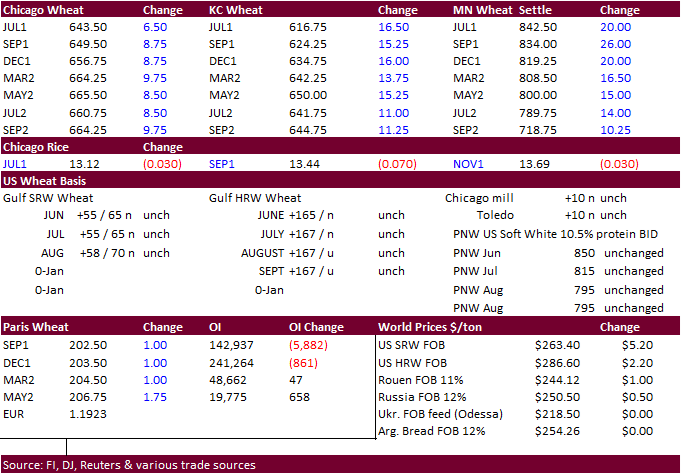

- US

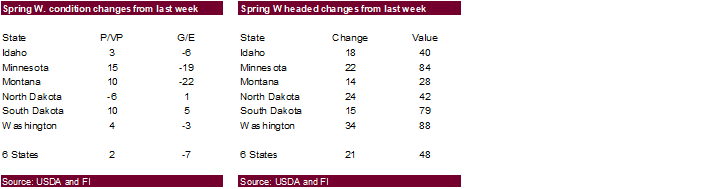

wheat futures were higher on spring crop wheat crop stress across the PNW to the upper Great Plains and Canadian Prairies, despite strong Russian wheat exports last week (500k) and Romania winning the Egypt GASC import tender. MN type wheat was today’s leader

for US wheat. Look for a higher trade in Minneapolis wheat after USDA surprised the trade by reported a 7 point drop in the G/E conditions for spring wheat. Traders were looking for a two point decrease in spring wheat crop conditions. At 20 percent G/E,

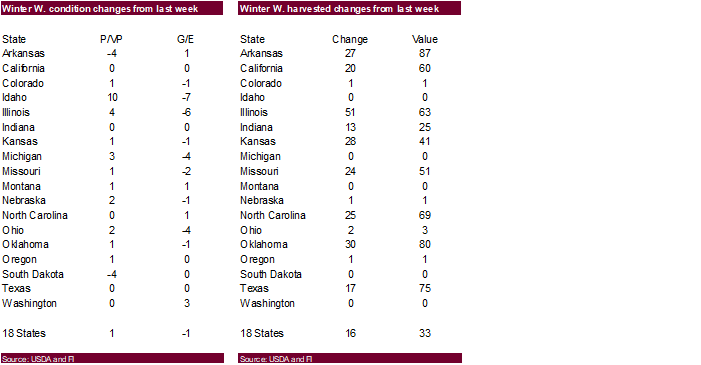

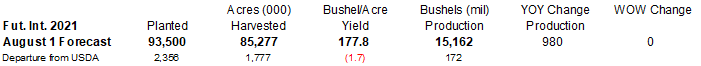

this is the lowest in USDA’s working history for this time of year. - Winter

wheat conditions were down 1 point. Traders were looking for a one point increase in winter wheat crop conditions. See attached FI production estimates. Adjusting to our state by state crop progress, we actually raised winter production by s a slight amount

and lowered spring wheat. These estimates are what we think USDA will report next month.

- Funds

bought an estimated net 8,000 Chicago wheat contracts. - US

winter wheat harvest progress was estimated at 33 percent, up from 17 percent last week and 3 points above a trade guess. .

- Record

breaking heat was seen across the PNW over the weekend into today. Hot temperatures promote higher protein content, but producers would rather see above normal temperatures just before harvest rather than the developmental stages.

- Meanwhile

too much rain across the US Midwest is slowing harvest progress.

- USDA

US all-wheat export inspections as of June 24, 2021 were 285,654 tons, below a range of trade expectations, below 551,490 tons previous week and compares to 515,359 tons year ago. Major countries included Mexico for 68,103 tons, Korea Rep for 55,000 tons,

and Nigeria for 27,500 tons. - Bangladesh

will allow wheat imports of up to 500,000 tons of Russian wheat. - September

Paris wheat was up 1.50 euros at 203.00/ton.

- Egypt

bought 180,000 tons of Romanian origin wheat for Aug 25-Sep 5 shipment. Reuters breakdown:

-

60,000

tons of Romanian wheat at $242.93 + $27.85 freight from NNC = $270.78 -

2×60,000

tons of Romanian wheat at $242.93 + $27.85 freight from NNC = $270.78 - Taiwan

bought 55,000 tons of US milling wheat for Aug 12-26 shipment from the PNW. Reuters: “The purchase involved 26,791 tons of U.S. dark northern spring wheat of 14.5% protein content bought at $350.16 a ton FOB U.S. Pacific Northwest coast, 22,405 tons of hard

red winter wheat of 12.5% protein bought at $291.47 a ton FOB and 5,804 tons of soft white wheat of 10.5% protein bought at $343.00 a ton FOB.” - Jordan

retendered for 120,000 tons of feed barley set to close July 7 for Nov/Dec 2021 shipment.

- Jordan

retendered for 120,000 tons of wheat set to close July 6 for Jan/Feb 2022 shipment.

- Ethiopia

seeks 400,000 tons of wheat on July 19.

Rice/Other

- Bangladesh

seeks 50,000 tons of rice from India.

Updated

6/25/21

September

Chicago wheat is seen in a $5.90-$7.00 range

September

KC wheat is seen in a $5.60-$6.70

September

MN wheat is seen in a $7.00-$8.50

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.