Our storage estimate for tomorrow’s report stands at -4 Bcf. This looks to be a tricky report (with a wide range of estimates) as we transition from summer to winter. In addition to fluctuating demand, exports are becoming a major component of the US natural gas S/D. This includes both LNG, and piped.

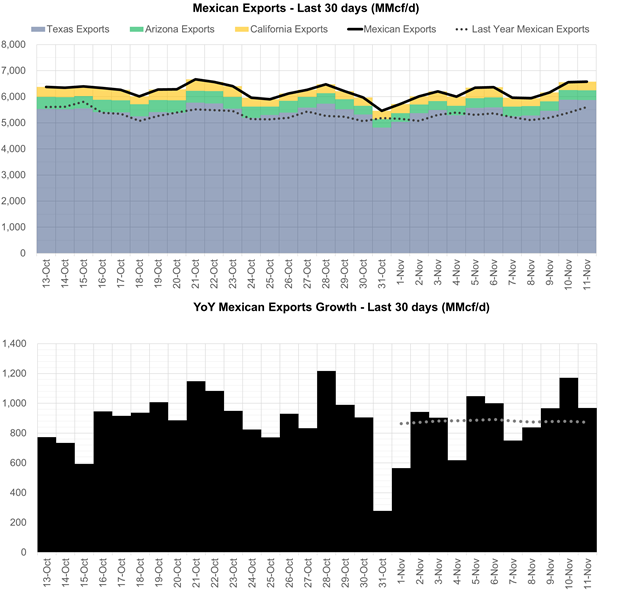

US exports of natural gas to Mexico, almost all of which are transported by pipeline, have continued to increase in 2020. These increases have more than offset declines in Mexico’s imports of liquefied natural gas (LNG) and relatively smaller declines in Mexico’s domestic natural gas production.

The industrial and electric power sectors accounted for all of the natural gas consumption in Mexico in 2019, with industrial at 54% and electric power at 46% of the total. Natural gas use in both of these sectors declined earlier this year because of the measures taken to contain the spread of the COVID-19. By August 2020, Mexico’s natural gas consumption started to recover and surpassed last year’s levels.

In November the piped export to Mexico averaged 6.17 Bcf/d, which is 0.89 Bcf/d higher than last year.

Today’s Fundamentals

Daily US natural gas production is estimated to be 87.8 Bcf/d this morning. Today’s estimated production is -0.05 Bcf/d to yesterday, and -1.6 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 77.9 Bcf today, +3.77 Bcf/d to yesterday, and +7.65 Bcf/d to the 7D average. US power burns are expected to be 26.34 Bcf today, and US ResComm usage is expected to be 19.6 Bcf.

Net LNG deliveries are expected to be 10.4 Bcf today.

Mexican exports are expected to be 6.6 Bcf today, and net Canadian imports are expected to be 4.7 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.