Yesterday the EIA reported a +15 Bcf storage injection for week ending April 23rd. This was higher than the market consensus of +10 and therefore we saw natural gas prices lower on the release of the report. Of interest in the report was the East region which reported an early summer draw of -6 Bcf, when it typically injects +17 Bcf in the same week.

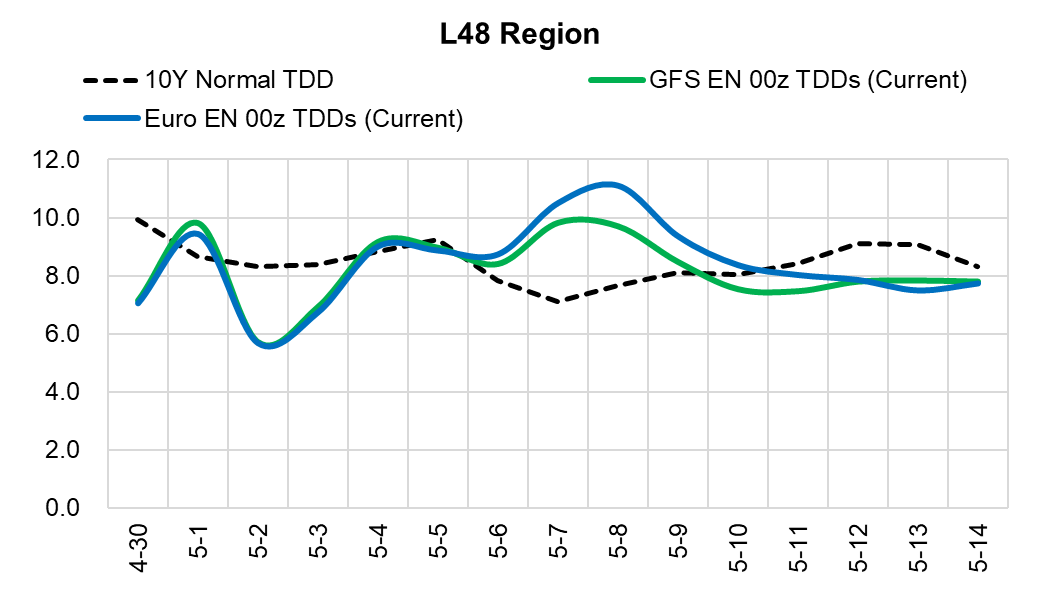

Overnight weather runs show both models picking up some total degree days (TDD) in the 6-10 day frame. Overall the TDD forecast looks quite aligned with the 10Y normal curve due with reduced HDDs, CDDs above normal by a bit. This is not a big issue just yet, but if this trend continues, then above normal CDDs becomes more bullish later in May, and beyond.

Today’s Fundamentals

Daily US natural gas production is estimated to be 89.9 Bcf/d this morning. Today’s estimated production is -0.66 Bcf/d to yesterday, and -1.04 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 66.9 Bcf today, -0.48 Bcf/d to yesterday, and -2.52 Bcf/d to the 7D average. US power burns are expected to be 26.54 Bcf today, and US ResComm usage is expected to be 13.9 Bcf.

Net LNG deliveries are expected to be 11.4 Bcf today.

Mexican exports are expected to be 6.8 Bcf today, and net Canadian imports are expected to be 4.8 Bcf today.

The storage outlook for the upcoming report is +58 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.