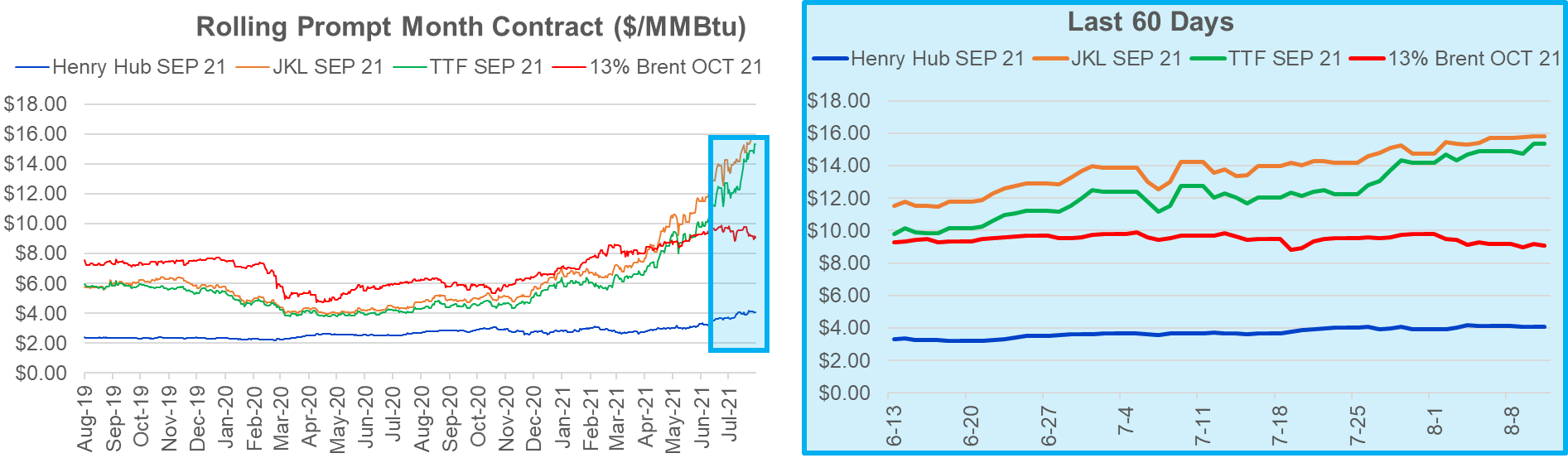

Global natgas prices continue to rise with every global region fighting for each flex cargo of LNG available. The strong Asian industrial demand (specifically China) come with new pipeline connectivity making gas more accessible while pushing out coal-fired gen. In Europe the low storage levels as we head into winter is raising concerns, while South America deals with lack of hydro gen due to a massive seasonal drought. So far, ICIS LNG Analytics indicated that Brazil’s LNG demand will be 6.8m tonnes this year, nearly triple 2020 imports.

strong Asian industrial demand, a pull from

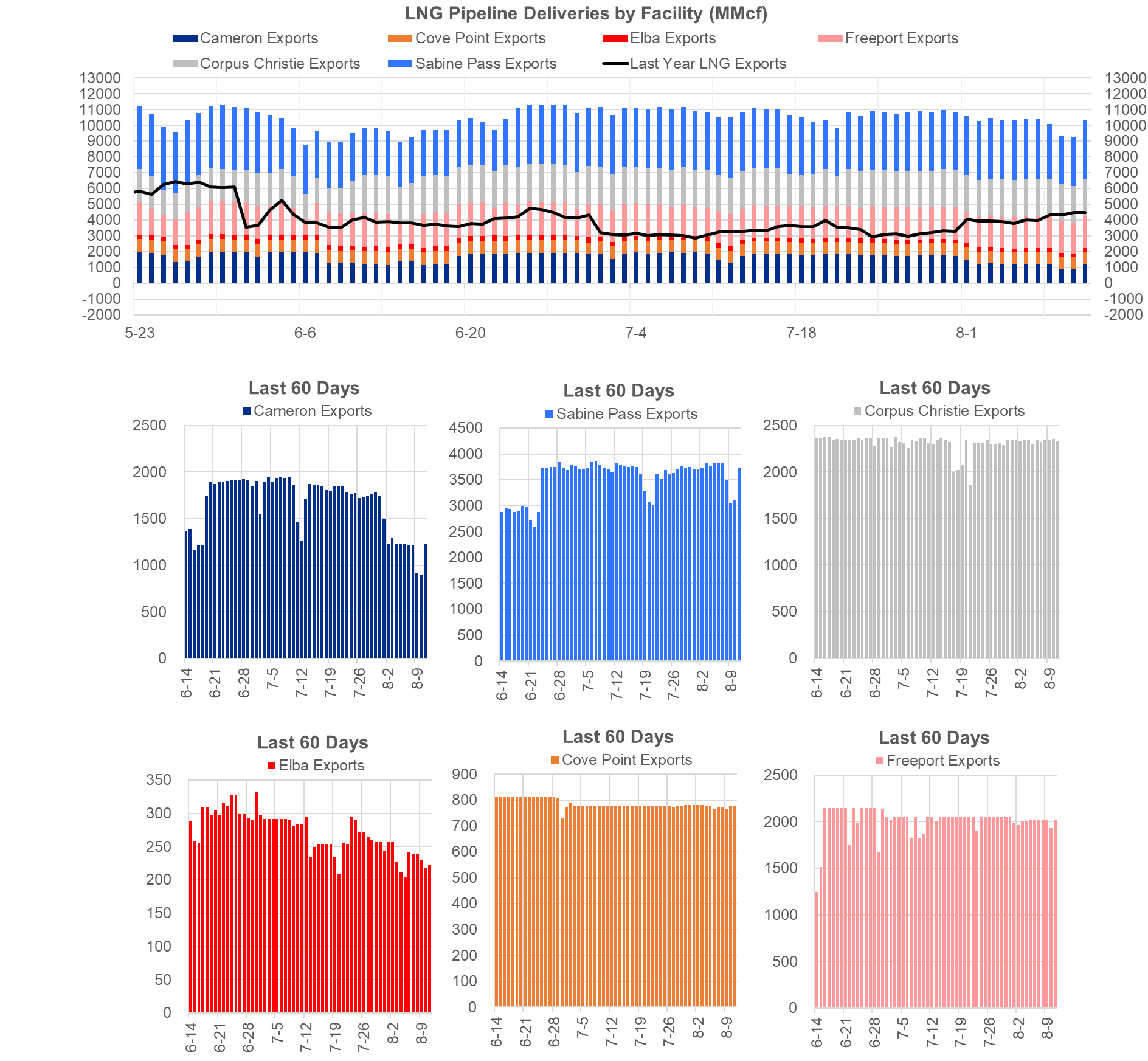

Sabine Pass volumes have started to return today after being lower since the weekend. The lower feedgas volumes look to be tied to a short maintenance on Creole Trail’s Gillis compressor.

Today’s Fundamentals

Daily US natural gas production is estimated to be 91.6 Bcf/d this morning. Today’s estimated production is -0.65 Bcf/d to yesterday, and -0.39 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 79.6 Bcf today, -0.1 Bcf/d to yesterday, and +3.3 Bcf/d to the 7D average. US power burns are expected to be 42.6 Bcf today, and US ResComm usage is expected to be 8.2 Bcf.

Net LNG deliveries are expected to be 10.3 Bcf today.

Mexican exports are expected to be 7.1 Bcf today, and net Canadian imports are expected to be 5.3 Bcf today.

The storage outlook for the upcoming report is +42 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.