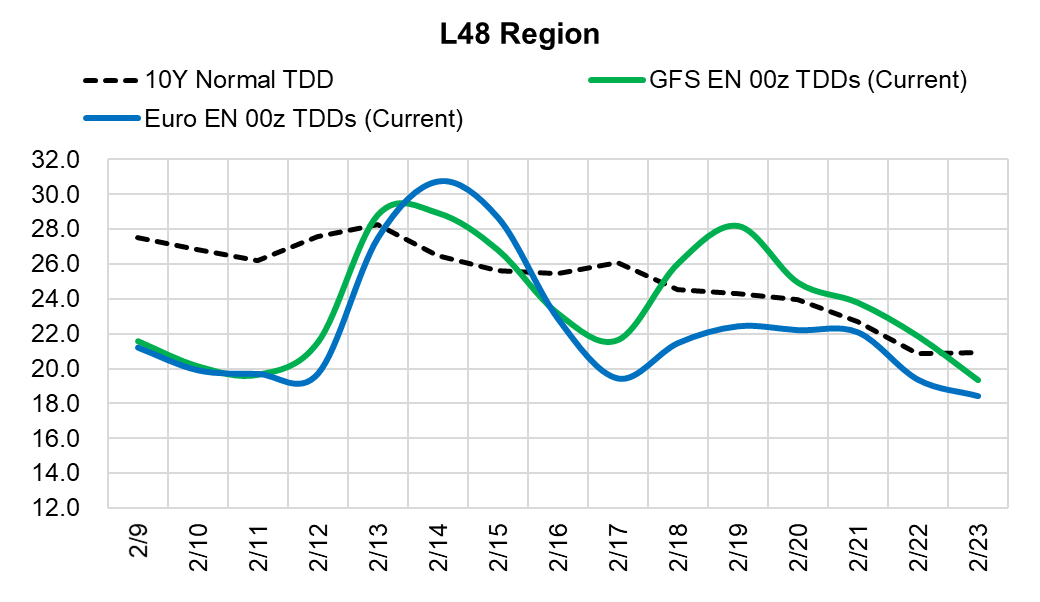

Weather models continue to jump around. Today we see some day-on-day stability out of the GFS Ensemble, but a big warming trend in the Euro Ensemble. The Euro Ensemble lost a total of 12+ GWHDDs over the next 15 days, with most of that come off in the 2nd week. This now pushes the Euro Ensemble outlook well below the 10Y normal except for a brief period around the 14th and 15th of the month.

Here is the latest forecast from the two models:

Today’s Fundamentals

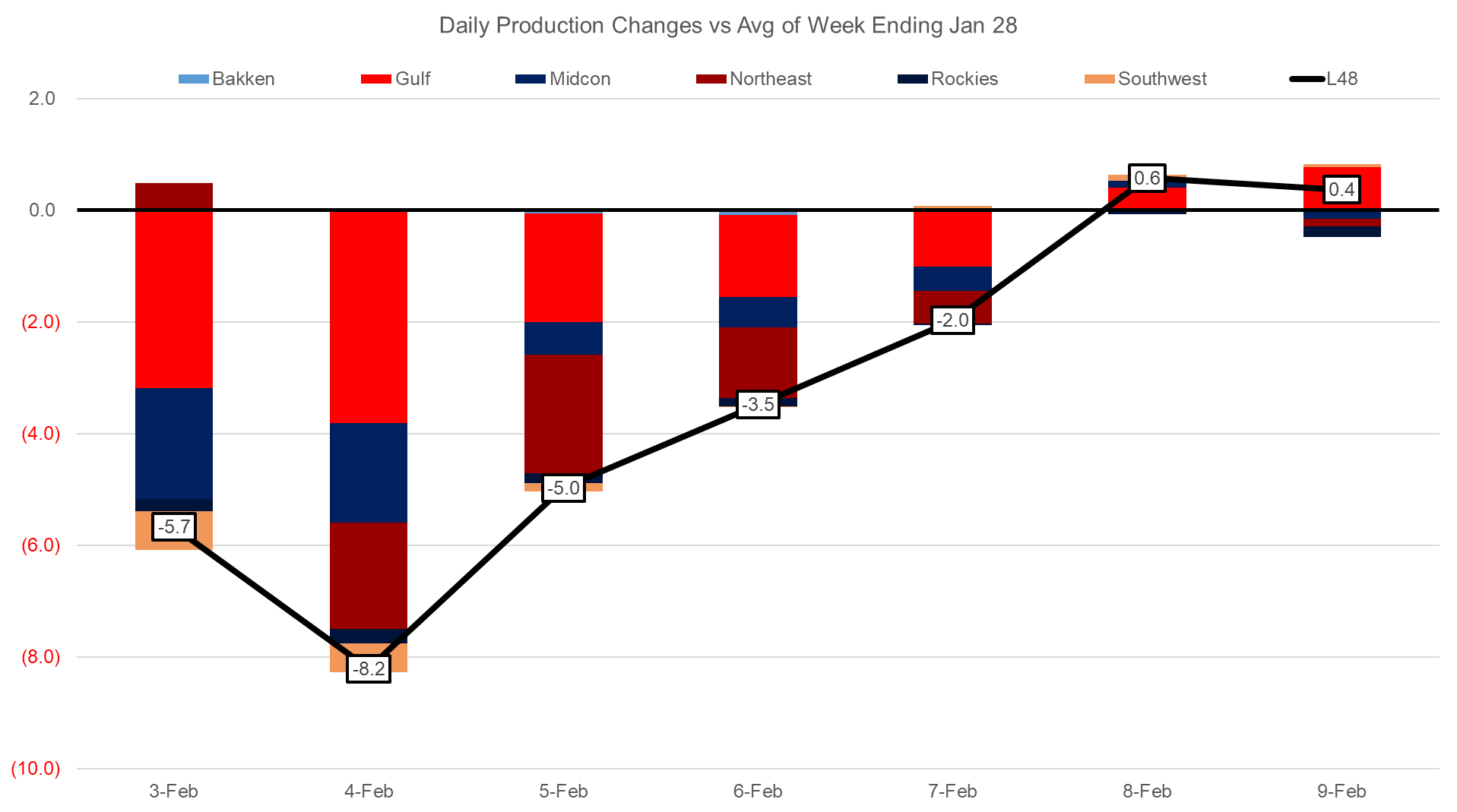

Daily US natural gas production is estimated to be 95.4 Bcf/d this morning. Today’s estimated production is +0.28 Bcf/d to yesterday, and +4.48 Bcf/d to the 7D average. At this point production is above the average seen during week ending Jan 28th, i.e. before the cooler weather started to creep in to the South Central.

Natural gas consumption is modelled to be 99.4 Bcf today, -6.46 Bcf/d to yesterday, and -16.12 Bcf/d to the 7D average. US power burns are expected to be 28.6 Bcf today, and US ResComm usage is expected to be 37.1 Bcf.

Net LNG deliveries are expected to be 12.3 Bcf today. Freeport operations back at normal levels today, while Sabine still lower due to some upstream pipe maintenance.

Mexican exports are expected to be 6.3 Bcf today, and net Canadian imports are expected to be 5.7 Bcf today. Canadian imports have treated from 8+ Bcf/d as L48 production has rebounded.

The storage outlook for the upcoming report is -235 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.