The EIA reported a -129 Bcf withdrawal for the week ending Feb 18th, which came in on the high end of the estimates range. Yesterday’s report continues to point to the tight market conditions. We estimate this report was 2.9 Bcf/d tight vs LY (wx adjusted). This tight level benefited from very strong wind. Wind averaged 63.3 GWh on average during the week, which was 37% above normal levels based on our calculations. Adjusting this week’s storage report to more normal wind conditions, we estimate this report was actually 6 Bcf/d tight vs LY (wx adjusted).

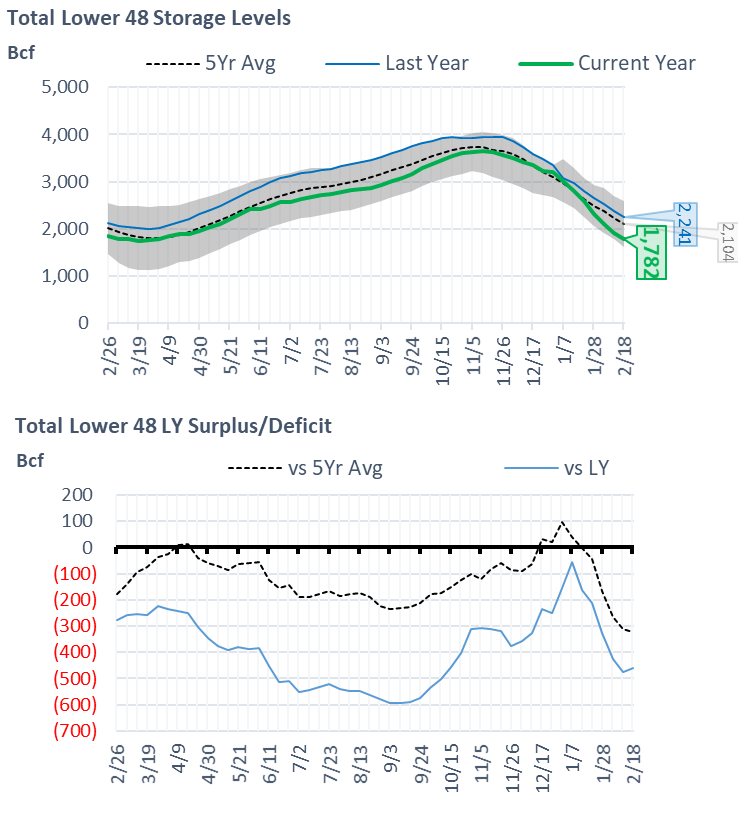

With the current report, the outright storage levels now sit at 1782 Bcf (-459 vs LY, -322 vs. 5Yr)

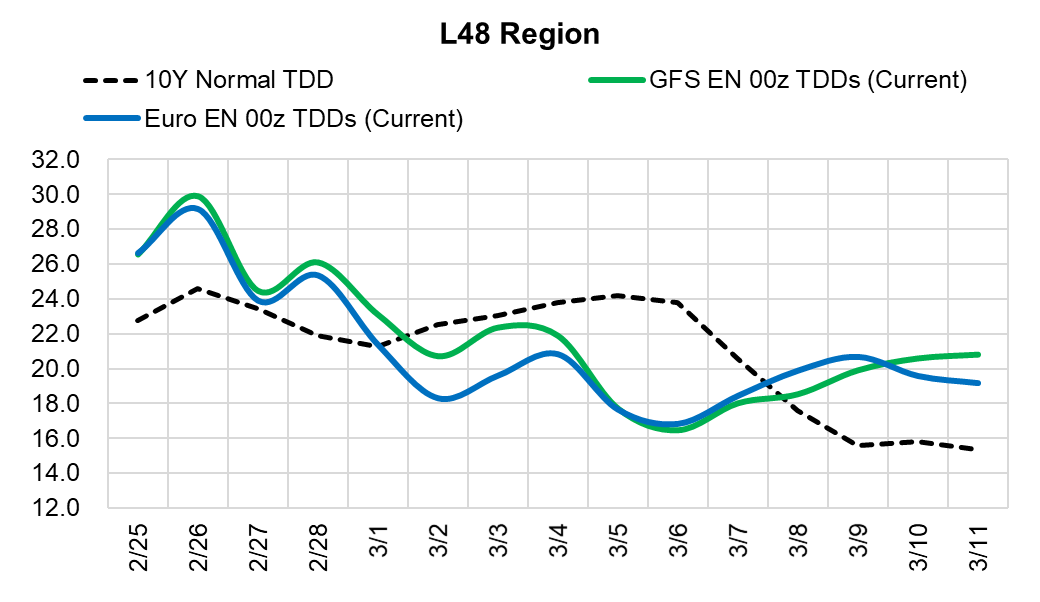

We have a few more days of cool weather after which March looks like it will start with temps well-above normal at the national level. Both models are generally lined up as see in the chart below. This warmer weather should help reduce demand but also help bring back production that has been recently lost to freeze-offs.

Today’s Fundamentals

Daily US natural gas production is estimated to be 93.3 Bcf/d this morning. Today’s estimated production is +1.29 Bcf/d to yesterday, and -0.98 Bcf/d to the 7D average. Today’s nomination data suggest that some of the freeze-offs in TX have returned, while the cooler temps across the Appalachian basin resulted in more freeze-offs. Overall, we expect production to start moving higher as all the freeze-offs roll off over the week.

Natural gas consumption is modelled to be 109.3 Bcf today, -4.98 Bcf/d to yesterday, and +8.6 Bcf/d to the 7D average. US power burns are expected to be 29.7 Bcf today, and US ResComm usage is expected to be 46.5 Bcf.

Net LNG deliveries are expected to be 11.7 Bcf today. Freeport looks to have fully returned based on nomination data today, while Sabine has come off 1.5 Bcf/d over the past 2 days.

Mexican exports are expected to be 6.6 Bcf today, and net Canadian imports are expected to be 6.8 Bcf today.

The storage outlook for the upcoming report is -126 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.