Yesterday was one of the wildest days in the market. The Feb contracted ripped in the afternoon with all signs pointing to a short-cover rally as afternoon weather runs pointed to more cooler weather. The Feb contract was trading below $4.50 most of the yesterday’s session until around 12:45 pm EST, until a surge of buying pushed prices above $7 for a short period of time. The front month contract settled at $6.27. The rally was mainly contained to the Feb contract, with the Mar/Apr spread only up modestly.

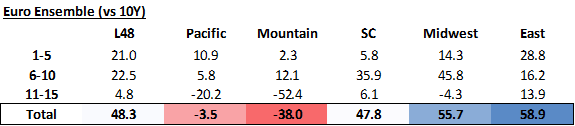

Today’s 00z run verifies the jump in HDDs in the Euro Ensemble. This move helps it further align with the GEFS Ensemble which was already indicating cool temps during the first week of Feb. Today’s 00z Euro EN run added 18HDDs to the national view, while the GEFS was fairly neutral.

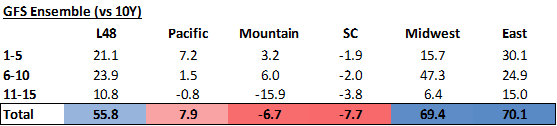

Here is view of the TDDs vs the 10Y normal by EIA storage region. The cooler weather is very much focused over the Midwest and East.

Today’s Fundamentals

Daily US natural gas production is estimated to be 91.2 Bcf/d this morning. Today’s estimated production is -4.06 Bcf/d to yesterday, and -3.55 Bcf/d to the 7D average. The day-on-day drop looks to be in the Southwest (Permian), but I believe this will be revised higher back to yesterday’s levels later in the day.

Natural gas consumption is modelled to be 114.1 Bcf today, -1.47 Bcf/d to yesterday, and -4.6 Bcf/d to the 7D average. US power burns are expected to be 30.1 Bcf today, and US ResComm usage is expected to be 50.3 Bcf.

Net LNG deliveries are expected to be 8.4 Bcf today.

Mexican exports are expected to be 6.4 Bcf today, and net Canadian imports are expected to be 6.8 Bcf today.

The storage outlook for the upcoming report is -271 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.