Yesterday, the EIA reported a +55 Bcf storage injection for the week ending June 18th. This report came in ~7 Bcf/d below market consensus and 5 Bcf/d below our S/D model. Unlike last week, which was showed balances being loose vs LY this report came in 3.5 Bcf/d tighter wx adjusted. The market took this report to be quite bullish and it resulted in a 10+ cent rally in price. In fact, prices rose above the levels observed during February’s winter storm Uri.

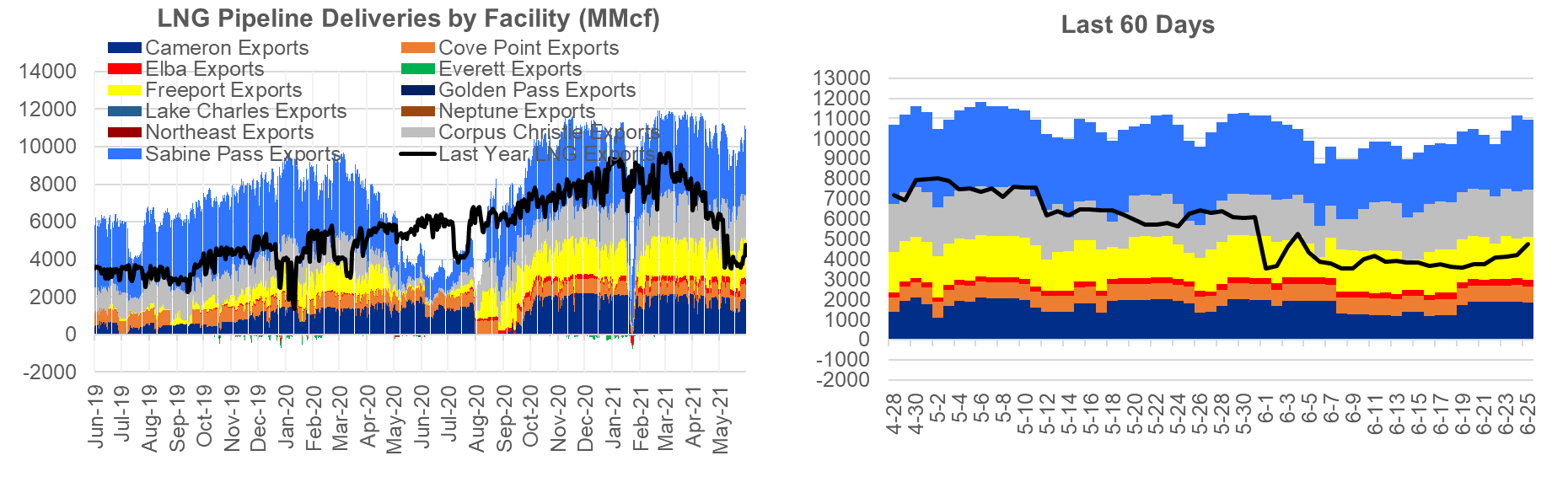

Going forward the storage injections are expected to decrease further with the return of LNG feedgas levels to above 11 Bcf/d (Sabine trains are all running once again as of yesterday) and more heat expected in July. At the moment, July is expected to come in warmer than the 10Y average leading to strong power burns.

Today’s Fundamentals

Daily US natural gas production is estimated to be 91.7 Bcf/d this morning. Today’s estimated production is -1.02 Bcf/d to yesterday, and -1.04 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 70.7 Bcf today, +1.42 Bcf/d to yesterday, and +0.9 Bcf/d to the 7D average. US power burns are expected to be 33.9 Bcf today, and US ResComm usage is expected to be 7.8 Bcf.

Net LNG deliveries are expected to be 10.9 Bcf today.

Mexican exports are expected to be 7.6 Bcf today, and net Canadian imports are expected to be 4.3 Bcf today.

The storage outlook for the upcoming report is +70 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.