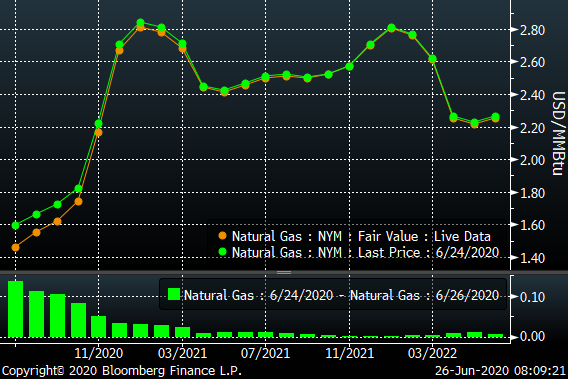

Yesterday, the EIA reported a 120 Bcf injection taking total gas inventories to 3012 Bcf for week ending June 20th. This number was beyond the high-side range of most analysts; hence prices reacted lower upon the release of the number. Stocks are now 739 Bcf higher than last year at this time and 466 Bcf above the five-year average of 2,546 Bcf.

The July contract expires today, with prices dropping significantly over the past 2 days. The current July price is 1.46.

The entire curve shifted lower over the past couple of days with the front end getting hit the most. Summer/Winter spreads are the widest they have been.

Today’s Fundamentals:

Daily US natural gas production is estimated to be 84.1 Bcf/d this morning. Today’s estimated production is -0.6 Bcf/d to yesterday, and -0.4 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 67.6 Bcf today, -0.05 Bcf compared to yesterday and -0.13 Bcf to the 7D average. US power burns are expected to be 37.4 Bcf today, and US ResComm usage is expected to be 7.8 Bcf.

Net LNG deliveries are expected to be 4.6 Bcf/d today.

Mexican exports are 6.2 Bcf/d. Net Canadian imports increased to 4.0 Bcf/d.

Bloomberg IM: Het Shah

enelyst DM: @het.co

Tel: 917-975-2960

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.