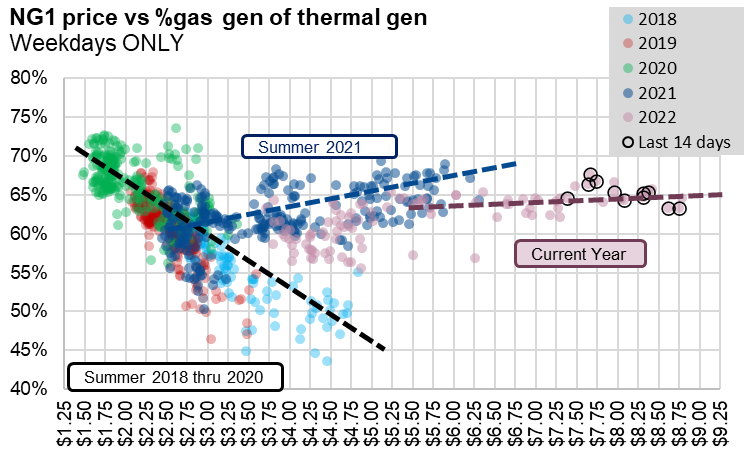

Overnight weather runs saw the GFS Ensemble cool off in the 11-15 day period. The Euro EN is still overall cooler for the next 15 days. With the strong temps we have observed over the last few weeks and high prices, natgas burns have remained quite strong relative to coal. Natgas gen has maintained at ~65% share of thermal burns even as prices have climbed above $8.

Today’s Fundamentals

Daily US natural gas production is estimated to be 95.3 Bcf/d this morning. Today’s estimated production is -1.1 Bcf/d to yesterday, and -0.39 Bcf/d to the 7D average. The drop comes from the SC and NE regions, but we expect there to be a revision higher in later nomination cycles.

Natural gas consumption is modelled to be 69.2 Bcf today, -2.34 Bcf/d to yesterday, and -1.86 Bcf/d to the 7D average. US power burns are expected to be 28.6 Bcf today, and US ResComm usage is expected to be 11.7 Bcf.

Net LNG deliveries are expected to be 12.4 Bcf today after reaching 13.3 Bcf/d yesterday. The drop today comes from various plants, including Sabine which is expected to take only 3.8 Bcf/d.

Mexican exports are expected to be 6.8 Bcf today, and net Canadian imports are expected to be 4.7 Bcf today. Canadian imports have dropped of significantly with pipe maintenance along two major exit points in WestCan.

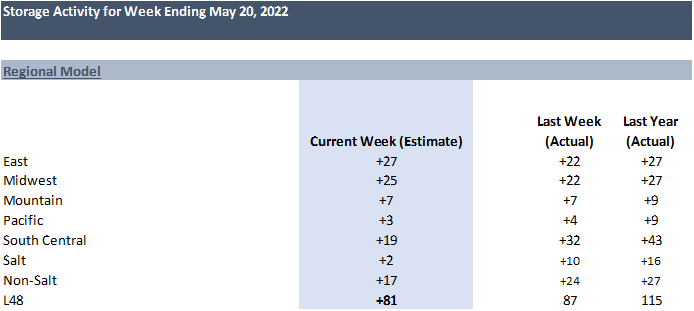

For week ending May 20th, our S/D storage model is pointing to a +91 Bcf injection while our flow model is much lower with a +82 Bcf. Below is the regional break down of the flow based model + the week storage activity at the 4 facilities that report on a weekly basis.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.