The EIA reported a +107 Bcf injection for the week ending Oct 28th, which came in higher than market expectations of ~100-102 and our estimate of +98. This storage report takes the total level to 3501 Bcf, which is 101 Bcf less than last year at this time and 135 Bcf below the five-year average of 3,636 Bcf. This is the 6th triple-digit build in Q4.

Our fundamental storage model underestimated injections for the reporting period by almost 1.5 Bcf/d. Here are the details we gather from the fundamentals:

- Total domestic production grew by 0.7 Bcf/d week-on-week. The growth in Midcon and Northeast production zones were the two standout regions.

- Cooling at the national level took a pause this past week, with the East and Midwest finishing warmer than normal. At the national level, we saw HDDs drop by 2.7F which translated into -5.0 Bcf/d of RC demand.

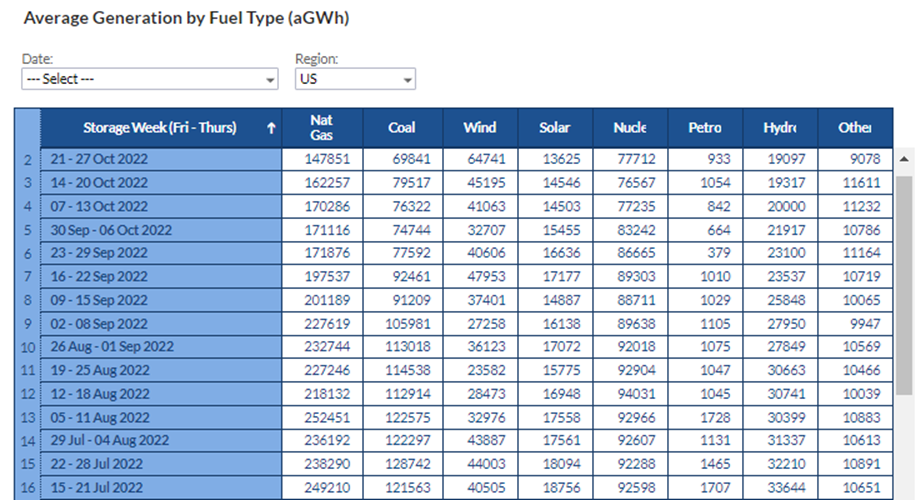

- With CDDs fading away, so is power loads. The power load dropped by 1.7%, but the real story was the monstrous wind levels. Wind jumped by 43% week-on-week to an average of 64.7 aGWh. This exception wind level drop nat gas generation lower by 14.4 aGWh leading to 2+ Bcf/d of lower power burns.

See the full history of the Generation Stats by storage week + charts here: http://www.analytix.ai/generation-by-fuel-type.html

- LNG feedgas was flat week-on-week. Cove Point returned on Oct 29th, and its increased feedgas level will show up in next week’s report.

Today’s Fundamentals

Daily US natural gas production is estimated to be 100.2 Bcf/d this morning. Today’s estimated production is -0.66 Bcf/d to yesterday, and -0.84 Bcf/d to the 7D average.

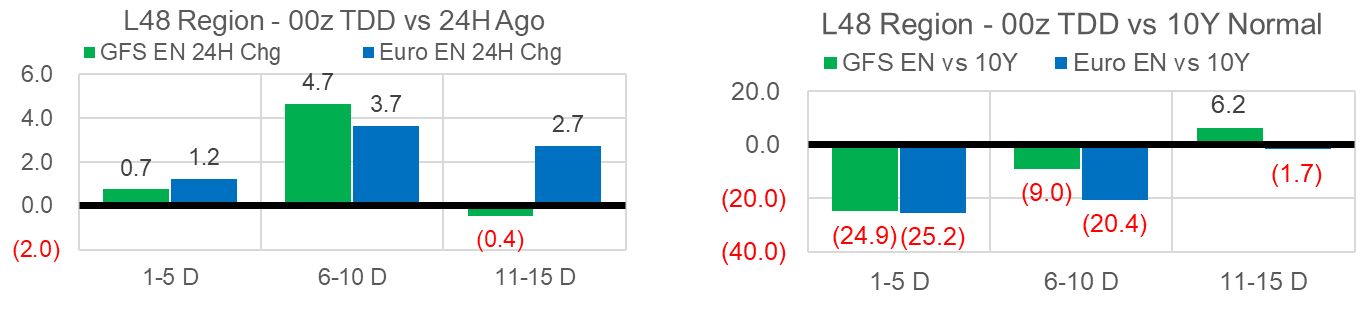

Natural gas consumption is modelled to be 75.1 Bcf today, -1.63 Bcf/d to yesterday, and -1.3 Bcf/d to the 7D average. US power burns are expected to be 29 Bcf today, and US ResComm usage is expected to be 15.4 Bcf. Both major weather models added some HDDs over the next 15 days leading to higher forecasts of RC consumption. Here is the change in weather vs yesterday 00z, and the current outlook vs 10Y Normals:

Net LNG deliveries are expected to be 11.1 Bcf today. We expect LNG volumes to rebound over the weekend with completion of maintenance on a Sabine Pass inlet pipe.

Mexican exports are expected to be 6 Bcf today, and net Canadian imports are expected to be 4.3 Bcf today.

The storage outlook for the upcoming report is +78 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.