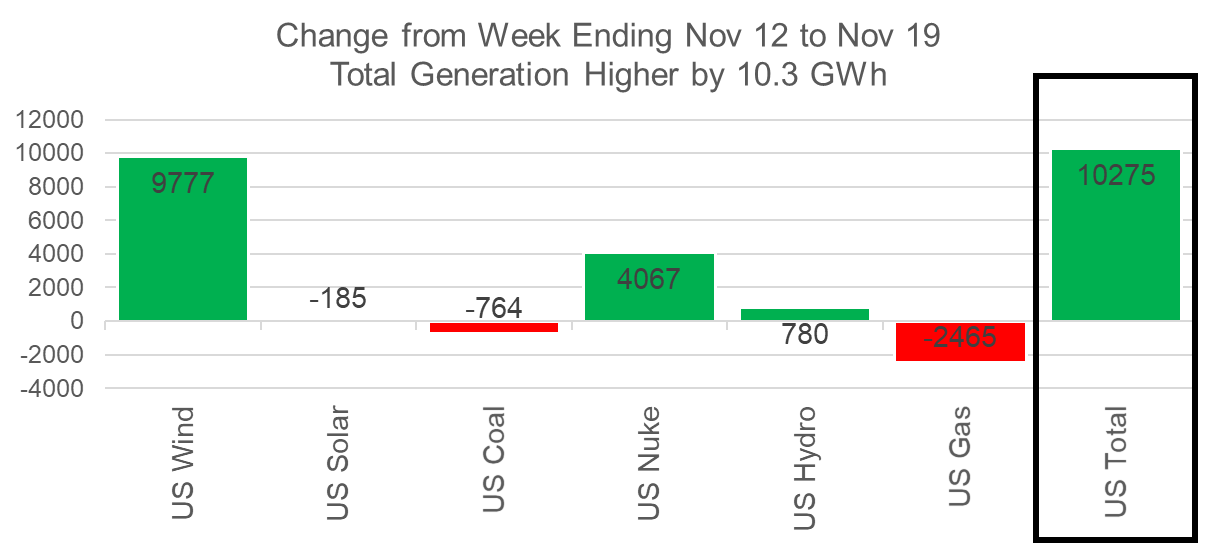

The EIA reported a +26 Bcf injection for week ending Nov 12th, which was close to the market consensus. The injection was less than the 28 Bcf build reported during the corresponding week in 2020, but far outweighed the five-year average draw of 12 Bcf. The data showed a big drop in power burns from the previous week with wind averaging 51 GWh (+19 GWh WoW), and nukes rapidly returning from maintenance/refueling.

For this current week (which will be reported next Thursday) we see HDDs starting to climb quickly leading to a big increased in heating demand. We see a jump of 6.1 Bcf/d in gas consumption by the ResCom and Industrial categories. Meanwhile, power will likely be slight lower as more wind an nuke once again show up week on week.

The storage outlook for the upcoming report is -22 Bcf today.

Today’s Fundamentals

Daily US natural gas production is estimated to be 95.8 Bcf/d this morning. Today’s estimated production is +0.2 Bcf/d to yesterday, and -0.55 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 92.4 Bcf today, +4.98 Bcf/d to yesterday, and +4.1 Bcf/d to the 7D average. US power burns are expected to be 27.4 Bcf today, and US ResComm usage is expected to be 32.5 Bcf.

Net LNG deliveries are expected to be 12 Bcf today. Yesterday’s Freeport nomination were revised lower from 2 Bcf/d to 1.6 Bcf/d during the evening cycle. Today’s nomination data once again shows Freeport taking 2+ Bcf/d of feedgas, but we will need to see if it hold in later cycles. If it does hold, then we could be seeing 12+ Bcf/d of LNG feedgas levels going forward.

Mexican exports are expected to be 6.1 Bcf today, and net Canadian imports are expected to be 4.7 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.