Nat gas markets looked to be in free fall this morning, as it passes through some key technical support levels. The sell of started early this morning at 1:52am, which looks to coincide with the release of the Euro Ensemble. As a reminder, the Euro Ensemble 00z starts around 1:45am EST and take about an hour to complete.

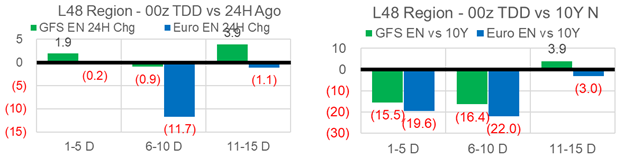

The GEFS Ensemble added a few HDDS, while the Euro showed a massive drop warming trend in the 6-10 day. With the current forecast, November will probably go down as one of the warmest on record but December so far looks to be starting nearing the 10Y normal.

The chart below is the rolling prompt month. The current price is hanging around the low set on Oct 2nd. The next support level below is at 2.50.

Today’s Fundamentals

Daily US natural gas production is estimated to be 92.4 Bcf/d this morning. Today’s estimated production is -0.3 Bcf/d to yesterday, and +1.02 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 82.1 Bcf today, -7.72 Bcf/d to yesterday, and -3.77 Bcf/d to the 7D average. US power burns are expected to be 25.44 Bcf today, and US ResComm usage is expected to be 25.3 Bcf.

Net LNG deliveries are expected to be 10.3 Bcf today.

Mexican exports are expected to be 6.2 Bcf today, and net Canadian imports are expected to be 4.1 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.