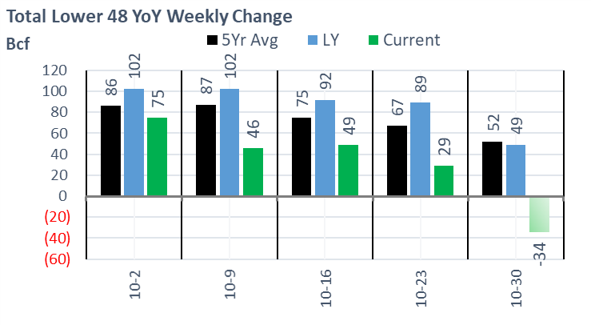

Despite more warmth showing up in the 15D forecast, market prices are higher this morning. The Dec contract rallied above 3.11 this morning, but has since come off. The last two storage reports have indicated a tighter than expected number, and this week the analyst range is all over the place. We are expecting a 34 Bcf withdrawal at the national level, but that includes an injection in the East. Two of the larger storage operators reported injection for the week ending Oct 30ths.

A -34 Bcf would take storage levels down to 3921, and would be quite far from the typical storage activity we would see for this time of the year. The storage surplus is also dissipating quickly, where we could be +202/3 of LY and the 5Yr after today’s report.

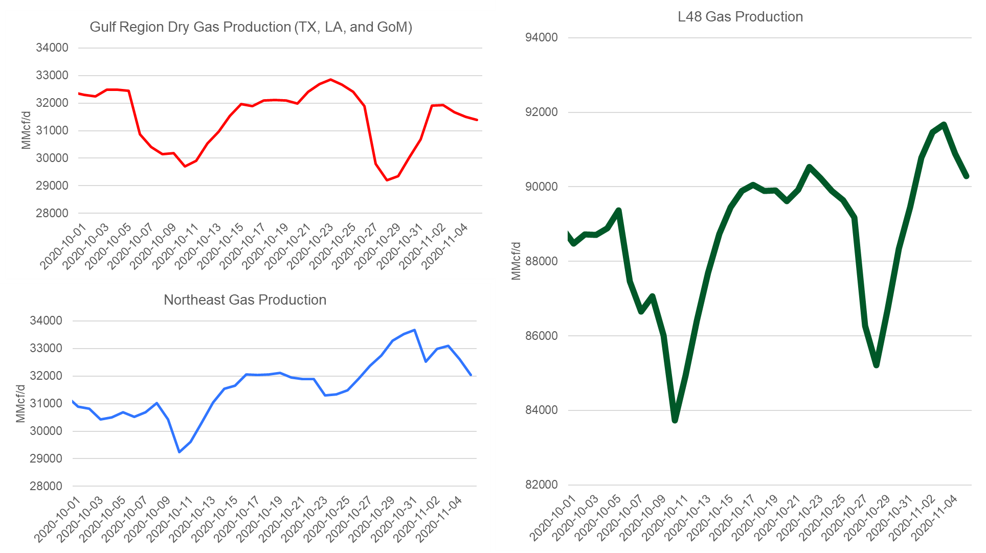

US production is also down this morning from the pipeline nomination data. A weaker Northeastern level as basis pricing drops in Marcellus and Utica basins seems to be the trigger.

Today’s Fundamentals:

Daily US natural gas production is estimated to be 90.3 Bcf/d this morning. Today’s estimated production is -0.61 Bcf/d to yesterday, and +0.38 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 69.6 Bcf today, -1.94 Bcf/d to yesterday, and -12.96 Bcf/d to the 7D average. US power burns are expected to be 254 Bcf today, and US ResComm usage is expected to be 14.8 Bcf.

Net LNG deliveries are expected to be 10.2 Bcf today.

Mexican exports are expected to be 6.2 Bcf today, and net Canadian imports are expected to be 3.6 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.