Markets tumbled yesterday with the EPA denying Cheniere’s request to exempt it from the turbine pollution rule. Earlier this year, the EPA announced a change to its regulatory regime for gas-fired turbines under the National Emission Standards for Hazardous Air Pollutants (NESHAP). Particularly, the EPA is looking to end an 18-year deferral in enforcing the formaldehyde criteria of the rule for two subclasses of turbines and would now force all units to show compliance with the whole rule by September 5, 2022. This change impacts a wide array of natural gas infrastructure – ranging from gas-fired power generators, interstate/intrastate gas compressors, and LNG. The most vocal about this regulatory change has been Cheniere, which stated in March that this ruling would require expensive upgrades and temporarily force an outage. [Our August 14th weekend report covered the issue in detail: Click here to see it.]

The fear in the market was that LNG exports would be reduced immediately in order to meet this new compliance, but this does not seem to be the case based on today’s nominations to LNG plants.

There was a good piece from Energy Aspects that was posted on enelyst regarding the impacts of this ruling.

“The rule in the Federal Registrar states that the EPA is responsible for assigning a penalty in the case of NESHAP noncompliance and that the severity of the penalty could be adjusted according to the good-faith efforts of the violator. Given the European energy crunch and promises from the Biden Administration to work to supply more LNG to US allies in Europe, we believe the EPA is likely to allow Cheniere to continue normal operations in the near term while both sides work toward finding a permanent solution. Cheniere had previously asserted it would be unable to retrofit its turbines into electricity-driven turbines (as Freeport uses) for at least a year, although in the event that the company attempts to initiate turbine replacement processes, it is possible Cheniere could escape with few financial repercussions. Cheniere’s first step will likely be to install oxidation catalysts at its terminals, which can help scrub formaldehyde from the air.

More will likely be known in the coming days as Cheniere’s efforts to work with the EPA continue. There are 62 turbines impacted by the ruling—44 at Sabine Pass and 18 at Corpus Christi. If Cheniere is forced to comply with the rulings, this would not require a full shutdown at either terminal. NESHAP regulations state an upper threshold for formaldehyde emissions of 91 parts per billion, which the terminals can reach by limiting operations rather than fully shutting down. The rate at which utilisation trains can run while limiting formaldehyde emissions to that level is unknown, as Cheniere has not publicly released its current emissions levels. Running at reduced rates is a worst-case scenario, however, as the two sides continue to work toward finding a solution that will allow LNG exports to continue uninterrupted.”

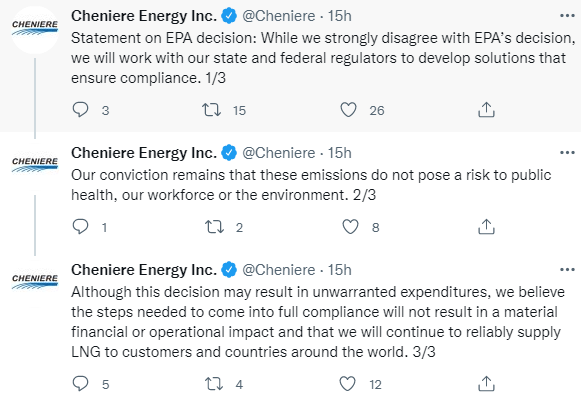

Finally, Cheniere tweeted a short response yesterday evening eluding to no immediate change in operations.

Today’s Fundamentals

Daily US natural gas production is estimated to be 98.9 Bcf/d this morning. Today’s estimated production is -1.97 Bcf/d to yesterday, and -1.48 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 76.6 Bcf today, -2.93 Bcf/d to yesterday, and -1.55 Bcf/d to the 7D average. US power burns are expected to be 39.1 Bcf today, and US ResComm usage is expected to be 7.9 Bcf.

Net LNG deliveries are expected to be 11.2 Bcf today. Cheniere’s nominations to their LNG plants have remained consistent today.

Mexican exports are expected to be 6.7 Bcf today, and net Canadian imports are expected to be 5.8 Bcf today.

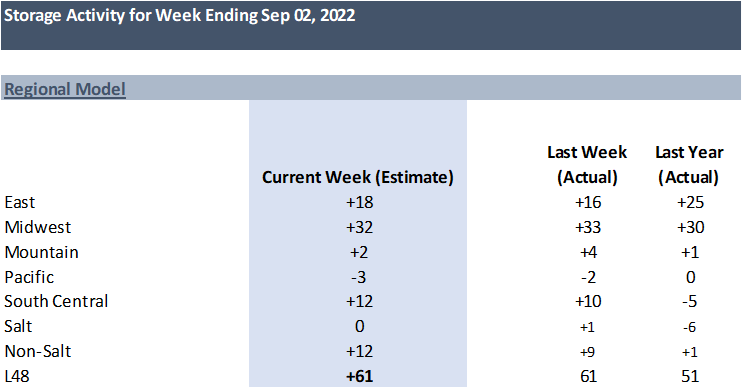

For week ending Sept 2nd, the S/D storage and flow model are pointing to a +61 Bcf injection. LY we injected +48 Bcf during the same week.

This is the results of our flow estimate:

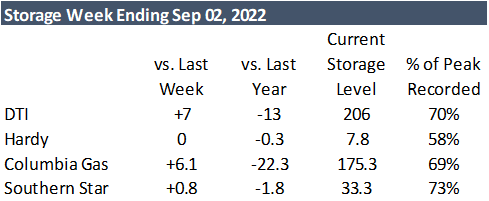

Below is the storage activity at the facilities that report at the weekly level:

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.