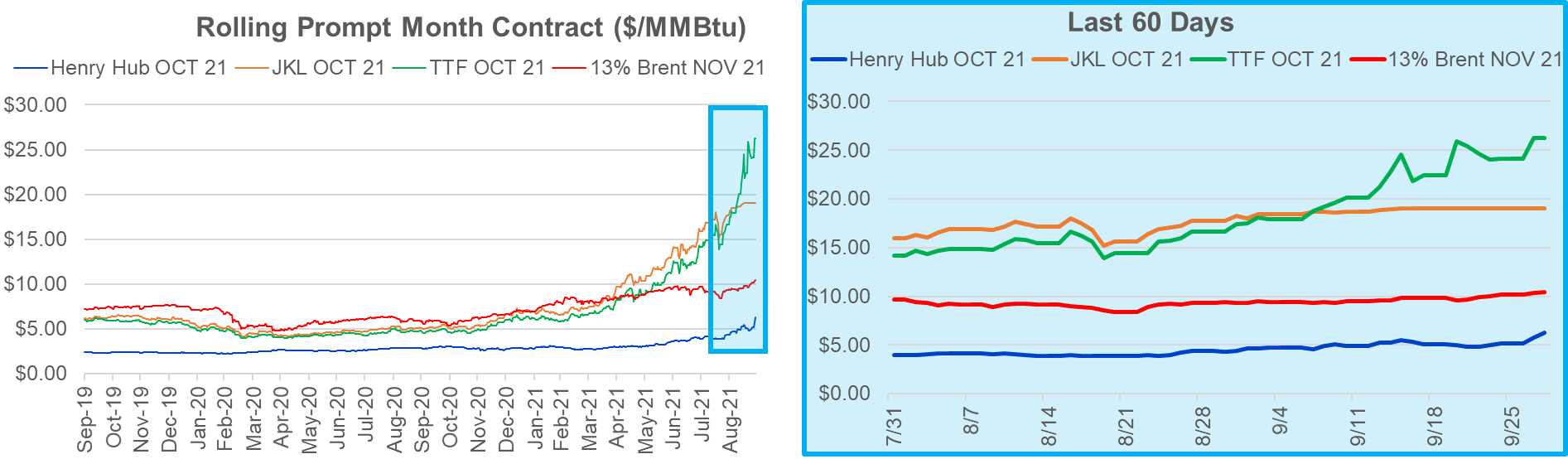

Yesterday’s price action continued after hours in a thinly traded market. With no real big shift in the fundamentals, the market move looked more related to option expiry and the bullish momentum in global natgas markets. NBP and TTF now trading well above JKM to pull any flex LNG to the European shores.

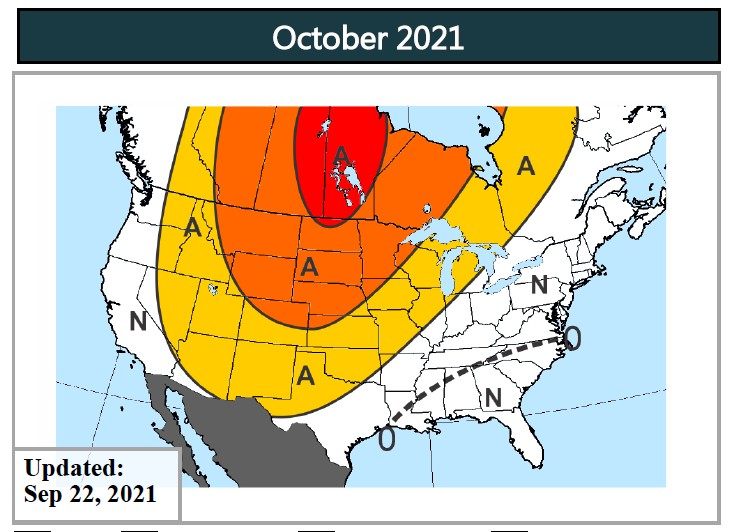

In the US, weather was once again bearish this morning with the GFS Ensemble losing a few TDDs and the Euro Ensemble being flat vs yesterday’s 00z. The longer-term forecasts are still showing bearish picture for Oct which should help with larger storage injections.

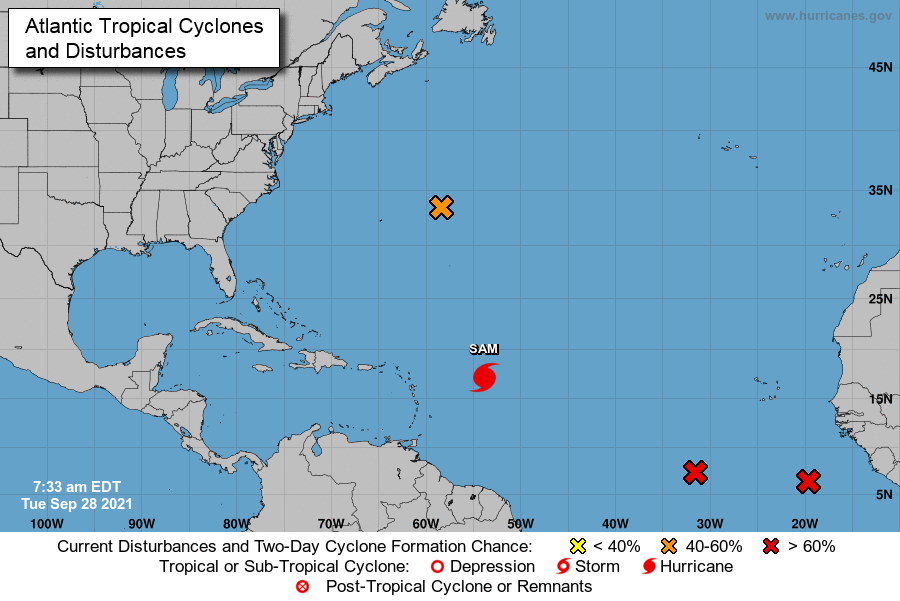

The tropical Atlantic has major hurricane Sam and a few other areas of interest. Sam likely remains a major hurricane for the balance of the week, tracking to the east of Bermuda. It is NOT a threat to the U.S. East Coast. The remnants of Peter are still being watched but also not a threat. The other two ‘areas of interest’ in the eastern Atlantic will have to be monitored, but the models are currently not showing these as being threats to the U.S./Gulf of Mexico.

Today’s Fundamentals

Daily US natural gas production is estimated to be 91.7 Bcf/d this morning. Today’s estimated production is -1.73 Bcf/d to yesterday, and -1.02 Bcf/d to the 7D average. As with yesterday, we expect production to be restated to ~93 Bcf/d in the evening cycle. GoM production continued to come back this week, and overall production reached 93 Bcf/d over the weekend. This level is similar to pre-Ida levels.

Natural gas consumption is modelled to be 66 Bcf today, -0.24 Bcf/d to yesterday, and -0.3 Bcf/d to the 7D average. US power burns are expected to be 30.7 Bcf today, and US ResComm usage is expected to be 7.9 Bcf.

Net LNG deliveries are expected to be 10.2 Bcf today.

Mexican exports are expected to be 6.7 Bcf today, and net Canadian imports are expected to be 5.6 Bcf today.

The storage outlook for the upcoming report is +92 Bcf today.

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.