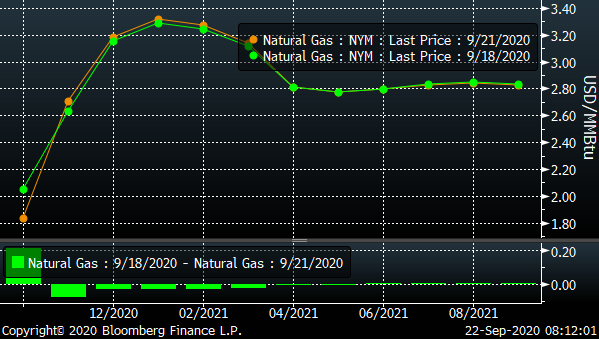

The front month took a dive yesterday on concerns that demand will be impacted from TS Beta and storage is nearing capacity. Yesterday, the October contract fell 0.235 to 1.835 while the winter strip was higher on concerns of not having adequate supply.

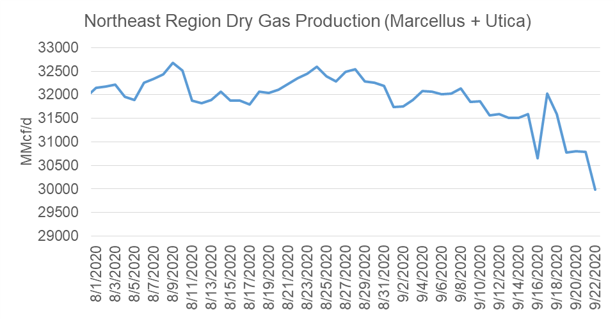

In the Northeast, lower cash prices (as result of lack of storage capacity and lower demand with Cove Point) is leading to lower production levels. Today’s pipeline nomination show overall Northeast production from the Marcellus and Utica dropping to 30 Bcf/d, which is 2.2 Bcf/d lower than the August average.

Today’s Fundamentals:

Daily US natural gas production is estimated to be 84.7 Bcf/d this morning. Today’s estimated production is -2.3 Bcf/d to yesterday, and -2.31 Bcf/d to the 7D average.

Natural gas consumption is modelled to be 66.4 Bcf today, -1.39 Bcf/d to yesterday, and -1.14 Bcf/d to the 7D average. US power burns are expected to be 30.34 Bcf today, and US ResComm usage is expected to be 9.9 Bcf.

Net LNG deliveries are expected to be 3.9 Bcf today.

Mexican exports are expected to be 6.6 Bcf today, and net Canadian imports are expected to be 3.1 Bcf today.

Bloomberg IM: Het Shah

enelyst DM: @het.co

Tel: 917-975-2960

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.