For the storage report for week ending Sept 4, our estimates are pointing to a 71 Bcf injection. The S/D balances is looser week -on-week, with both power gen and LNG deliveries being the main culprits. LNG during the storage week decreased by 0.8 Bcf/d to average 3.0 Bcf/d with Sabine and Cameron out, and power demand dropped by 4.4 Bcf/d with cooler temps.

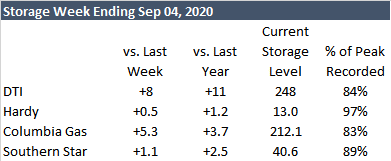

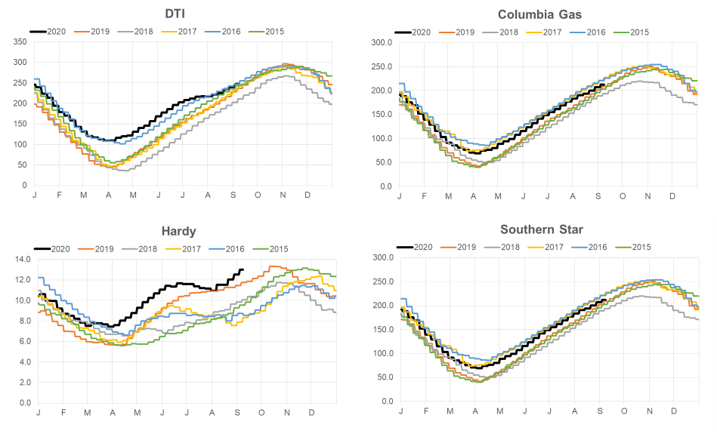

Data from the DTI, TCO (Columbia Gas) and SSE (Southern Star) continue to show injection. DTI is 84% full, TCO is 83% full, and SSE is 89% full. As seen in the charts below, all storage facilities, with the exception of Hardy, are now within the 5Yr range.

Today’s Fundamentals:

Daily US natural gas production is estimated to be 86.7 Bcf/d this morning. Today’s estimated production is -1.59 Bcf/d to yesterday, and -1.01 Bcf/d to the 7D average. We expect the production to rebound to yesterday’s levels in intraday nomination cycles.

Natural gas consumption is modelled to be 73.3 Bcf today, -0.01 Bcf/d to yesterday, and +2.6 Bcf/d to the 7D average. US power burns are expected to be 35.34 Bcf today, and US ResComm usage is expected to be 9.9 Bcf.

Net LNG deliveries are expected to be 6.7 Bcf today. Sabine Pass has been ramping up deliveries with Cameron still unavailable today. This is the highest level of US LNG deliveries we have seen since May 11th.

Mexican exports are expected to be 6.5 Bcf today, and net Canadian imports are expected to be 3.6 Bcf today.

Bloomberg IM: Het Shah

enelyst DM: @het.co

Tel: 917-975-2960

This email, any information contained herein and any files transmitted with it (collectively, the Material) are the sole property of OTC Global Holdings LP and its affiliates (OTCGH); are confidential, may be legally privileged and are intended solely for the use of the individual or entity to whom they are addressed. Unauthorized disclosure, copying or distribution of the Material, is strictly prohibited and the recipient shall not redistribute the Material in any form to a third party. Please notify the sender immediately by email if you have received this email by mistake, delete this email from your system and destroy any hard copies. OTCGH waives no privilege or confidentiality due to any mistaken transmission of this email.