PDF attached

CFTC Commitment of Traders

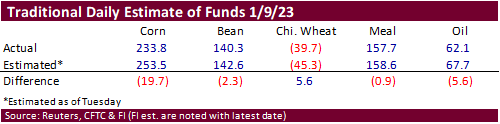

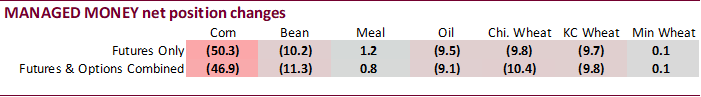

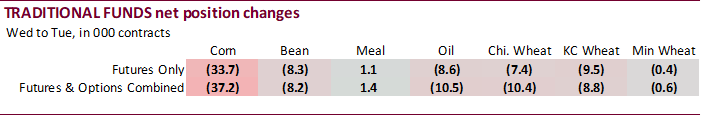

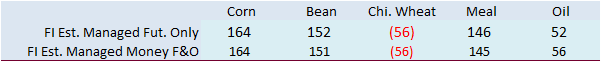

No major surprises in the CFTC COT report. The corn position was less long than expected. Money managers were heavy sellers of corn for the week ending January 10. They unloaded 46,900 corn futures and options contracts. They also reduced net long positions for soybeans and soybean oil.

Reuters table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 77,454 -36,354 355,818 -5,252 -378,783 46,136

Soybeans 96,363 -3,829 121,780 -2,932 -178,269 5,976

Soyoil 28,241 -7,798 95,562 -4,779 -133,651 13,368

CBOT wheat -73,459 -10,660 98,234 -2,792 -22,747 11,399

KCBT wheat -23,951 -7,807 46,519 -458 -22,046 6,853

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 149,605 -46,852 218,958 -4,568 -372,866 46,347

Soybeans 131,704 -11,290 67,821 61 -166,462 7,385

Soymeal 142,711 833 72,065 -5,097 -250,120 462

Soyoil 54,614 -9,147 88,727 1,476 -156,604 9,793

CBOT wheat -63,134 -10,420 65,072 -1,566 -19,196 9,896

KCBT wheat -8,023 -9,780 36,345 1,174 -23,553 6,238

MGEX wheat -2,704 127 1,574 162 794 1,288

———- ———- ———- ———- ———- ———-

Total wheat -73,861 -20,073 102,991 -230 -41,955 17,422

Live cattle 91,489 8,727 48,008 -3,796 -137,100 -4,320

Feeder cattle 42 -302 2,531 5 3,004 -336

Lean hogs 22,735 -27,624 47,085 269 -61,408 18,175

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 58,792 9,603 -54,489 -4,530 1,481,932 11,999

Soybeans 6,810 3,060 -39,874 784 727,769 23,773

Soymeal 12,549 576 22,796 3,224 454,472 8,859

Soyoil 3,415 -1,331 9,848 -791 408,665 1,711

CBOT wheat 19,287 37 -2,028 2,051 394,847 6,675

KCBT wheat -4,247 956 -522 1,412 176,931 11,977

MGEX wheat 1,747 -733 -1,411 -844 57,437 2,366

———- ———- ———- ———- ———- ———-

Total wheat 16,787 260 -3,961 2,619 629,215 21,018

Live cattle 9,584 -796 -11,982 186 385,715 -13,678

Feeder cattle -1,026 1,010 -4,551 -379 56,237 1,852

Lean hogs -2,708 1,663 -5,704 7,518 255,641 7,767

Terry Reilly

Futures International

One Lincoln Center

18W140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 3126041366

DISCLAIMER:

The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. This communication may contain links to third party websites which are not under the control of FI and FI is not responsible for their content.

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.

#non-promo