PDF attached

CFTC Commitment of Traders report

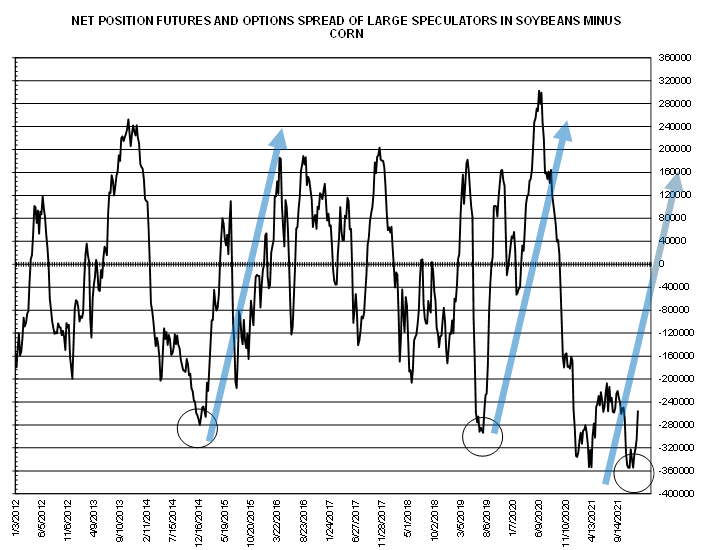

Soybeans going to rally over corn? Fund cycle suggest that…

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 240,207 -28,784 445,573 6,746 -657,116 1,120

Soybeans 85,287 -562 193,613 12,704 -243,874 -16,208

Soyoil 10,442 1,425 119,246 -1,724 -139,671 -2,593

CBOT wheat -45,177 -9,108 133,288 8,659 -78,392 720

KCBT wheat 17,171 -4,314 53,223 -6,348 -74,185 10,322

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 344,379 -21,526 286,103 24,936 -651,582 -2,728

Soybeans 106,879 7,961 149,123 9,067 -252,226 -19,490

Soymeal 72,920 2,152 94,070 7,003 -216,516 -5,530

Soyoil 55,907 2,719 88,570 -2,654 -145,139 -3,182

CBOT wheat -27,764 -7,920 87,148 9,751 -63,636 -1,198

KCBT wheat 42,674 -9,138 21,770 -3,022 -61,753 10,460

MGEX wheat 5,734 -3,747 2,334 691 -14,648 6,019

———- ———- ———- ———- ———- ———-

Total wheat 20,644 -20,805 111,252 7,420 -140,037 15,281

Live cattle 61,941 -10,405 80,445 168 -150,042 5,764

Feeder cattle 6,470 -856 4,036 244 -2,433 -437

Lean hogs 48,804 -6,870 59,402 2,577 -100,831 3,710

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 49,764 -21,600 -28,664 20,918 1,861,529 -4,162

Soybeans 31,250 -1,605 -35,026 4,066 833,968 44,628

Soymeal 20,862 -5,026 28,663 1,400 454,258 17,979

Soyoil -9,322 226 9,984 2,891 430,663 7,966

CBOT wheat 13,972 -362 -9,720 -271 455,595 16,109

KCBT wheat -6,483 1,360 3,792 341 242,770 -4,294

MGEX wheat 3,813 -3,048 2,768 84 71,192 -5,969

———- ———- ———- ———- ———- ———-

Total wheat 11,302 -2,050 -3,160 154 769,557 5,846

Live cattle 17,341 -1,591 -9,686 6,065 372,991 -8,788

Feeder cattle 628 269 -8,701 780 51,666 2,348

Lean hogs 8,956 860 -16,330 -277 267,471 2,646

=================================================================================

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.