PDF attached

CFTC Commitment of Traders

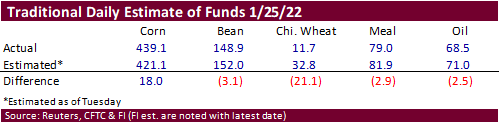

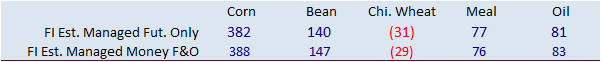

After a volatile week leading up to January 25, traditional funds were 18,000 contracts more long than expected in corn, and 21,100 contracts less long than expected for Chicago wheat.

Reuters table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 276,521 51,693 442,390 234 -681,756 -49,211

Soybeans 89,651 18,334 191,114 -14,149 -243,793 -5,938

Soyoil 27,538 15,582 119,470 468 -158,080 -17,648

CBOT wheat -33,001 9,143 138,222 402 -97,077 -10,568

KCBT wheat 15,775 3,951 56,055 1,104 -72,632 -2,796

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 365,605 39,082 291,383 -310 -678,313 -47,538

Soybeans 114,895 15,255 144,350 -15,711 -257,085 -7,581

Soymeal 64,334 -410 100,095 -26 -204,726 4,405

Soyoil 68,773 10,565 88,119 -815 -167,464 -20,169

CBOT wheat -13,427 11,474 88,186 -4,203 -80,838 -7,957

KCBT wheat 40,634 4,516 25,844 -316 -62,479 -2,724

MGEX wheat 3,340 -516 1,949 -28 -13,326 -1,926

———- ———- ———- ———- ———- ———-

Total wheat 30,547 15,474 115,979 -4,547 -156,643 -12,607

Live cattle 49,321 -12,855 81,365 -915 -135,998 16,724

Feeder cattle 184 -5,281 4,638 107 645 2,719

Lean hogs 66,907 18,113 60,350 59 -116,933 -16,939

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 58,480 11,482 -37,155 -2,715 1,903,794 75,478

Soybeans 34,813 6,283 -36,972 1,752 883,842 42,369

Soymeal 11,911 -2,384 28,387 -1,585 451,424 -7,199

Soyoil -498 8,821 11,071 1,598 455,930 21,131

CBOT wheat 14,224 -336 -8,145 1,022 498,029 29,251

KCBT wheat -4,800 784 803 -2,259 242,083 2,211

MGEX wheat 3,813 774 4,224 1,697 72,609 682

———- ———- ———- ———- ———- ———-

Total wheat 13,237 1,222 -3,118 460 812,721 32,144

Live cattle 15,579 -3,087 -10,267 134 386,440 8,865

Feeder cattle 1,100 313 -6,567 2,144 57,392 4,258

Lean hogs 4,610 -2,556 -14,934 1,322 314,486 38,018

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.