PDF attached

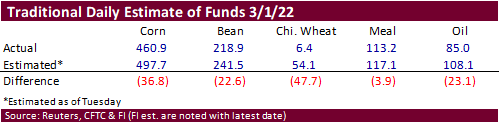

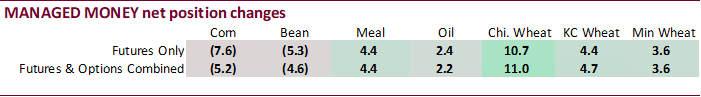

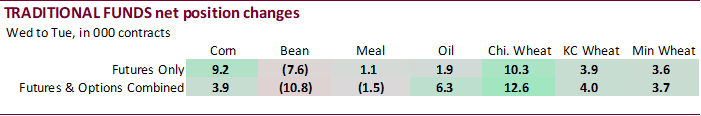

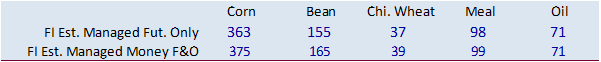

No major records stand out this week. Note the positions below are from last Tuesday and don’t reflect the ongoing fireworks we saw over the past three trading days. However, as of March 1, the net fund positions were much less long than expected for all five commodities we monitor on a daily basis, especially for Chicago wheat and soybean oil.

Estimates Friday afternoon

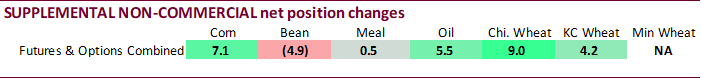

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 293,763 7,070 444,009 -1,026 -715,256 -12,428

Soybeans 139,999 -4,863 189,461 -3,202 -297,577 8,831

Soyoil 46,586 5,541 125,138 1,780 -186,629 -7,777

CBOT wheat -31,298 9,028 149,824 4,140 -111,237 -12,662

KCBT wheat 21,161 4,164 57,669 -689 -80,028 -4,108

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 349,222 -5,213 301,888 4,507 -717,411 -14,783

Soybeans 175,721 -4,614 133,869 1,732 -305,293 9,861

Soymeal 94,829 4,412 94,834 130 -230,729 1,864

Soyoil 81,431 2,231 90,765 -469 -189,506 -6,329

CBOT wheat -7,036 11,017 88,718 -3,245 -90,463 -8,838

KCBT wheat 45,481 4,702 25,173 -372 -69,066 -4,296

MGEX wheat 10,602 3,619 1,639 -833 -20,632 -1,795

———- ———- ———- ———- ———- ———-

Total wheat 49,047 19,338 115,530 -4,450 -180,161 -14,929

Live cattle 60,152 -25,281 81,898 -2,260 -145,363 23,322

Feeder cattle -3,875 -6,542 6,994 151 3,124 4,010

Lean hogs 74,506 -2,455 61,626 -2,377 -130,978 5,916

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 88,816 9,106 -22,515 6,383 1,977,728 30,408

Soybeans 27,585 -6,213 -31,882 -767 1,007,315 -29,625

Soymeal 12,278 -5,902 28,788 -504 452,265 -36,903

Soyoil 2,404 4,111 14,906 456 439,766 -17,674

CBOT wheat 16,071 1,572 -7,289 -506 508,287 36,374

KCBT wheat -2,786 -668 1,198 634 234,174 208

MGEX wheat 4,961 100 3,430 -1,091 71,037 104

———- ———- ———- ———- ———- ———-

Total wheat 18,246 1,004 -2,661 -963 813,498 36,686

Live cattle 17,592 -3,438 -14,279 7,657 416,307 1,813

Feeder cattle 649 -1,038 -6,892 3,419 63,109 5,681

Lean hogs 5,897 -3,247 -11,051 2,164 356,855 -5,274

=================================================================================

Source: Reuters via CFTC, and FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.