PDF attached

CFTC Commitment of Traders

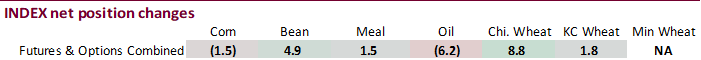

Index funds for the major commodity markets are at record net long.

Reuters table via CFTC

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 324,098 30,336 442,534 -1,475 -733,875 -18,620

Soybeans 129,222 -10,778 194,374 4,914 -294,096 3,481

Soyoil 57,500 10,914 118,969 -6,169 -193,052 -6,422

CBOT wheat -27,361 3,938 158,596 8,772 -122,756 -11,518

KCBT wheat 25,286 4,125 59,497 1,829 -84,316 -4,288

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 368,784 19,561 296,182 -5,705 -731,987 -14,576

Soybeans 171,714 -4,007 137,078 3,209 -302,167 3,126

Soymeal 96,627 1,797 93,793 -1,041 -239,954 -9,226

Soyoil 85,669 4,239 91,883 1,118 -199,119 -9,612

CBOT wheat 20,208 27,244 84,596 -4,121 -99,142 -8,678

KCBT wheat 44,706 -775 26,095 923 -72,785 -3,719

MGEX wheat 12,914 2,312 927 -712 -24,864 -4,233

———- ———- ———- ———- ———- ———-

Total wheat 77,828 28,781 111,618 -3,910 -196,791 -16,630

Live cattle 38,551 -21,600 81,687 -211 -126,617 18,746

Feeder cattle -4,132 -256 7,003 9 2,538 -586

Lean hogs 66,019 -8,488 61,376 -250 -121,057 9,921

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 99,777 10,961 -32,756 -10,241 2,054,595 76,867

Soybeans 22,873 -4,712 -29,499 2,383 1,003,054 -4,261

Soymeal 17,059 4,781 32,477 3,688 439,326 -12,939

Soyoil 4,984 2,579 16,582 1,677 418,231 -21,535

CBOT wheat 2,818 -13,253 -8,480 -1,191 518,859 10,572

KCBT wheat 2,451 5,237 -467 -1,665 214,381 -19,793

MGEX wheat 6,060 1,099 4,963 1,534 69,700 -1,337

———- ———- ———- ———- ———- ———-

Total wheat 11,329 -6,917 -3,984 -1,322 802,940 -10,558

Live cattle 18,634 1,043 -12,256 2,023 386,272 -30,035

Feeder cattle 1,042 393 -6,451 441 62,488 -622

Lean hogs 3,883 -2,014 -10,221 830 324,248 -32,607

=================================================================================

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.