PDF attached

CFTC Commitment of Traders

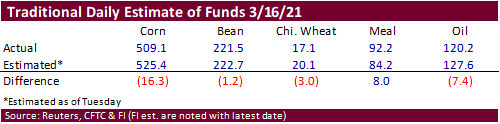

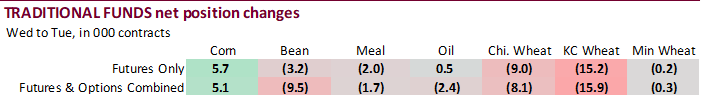

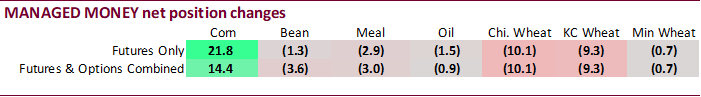

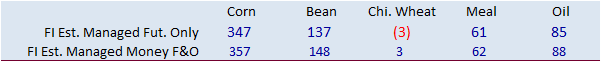

Misses this week between trade estimates and actual CFTC data may not have a impact on Sunday’s CBOT open. Corn was not as long as expected but the net long position for traditional funds and managed money remains very large.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 343,666 3,864 414,183 6,085 -742,054 -3,344

Soybeans 118,314 -11,456 168,285 2,518 -281,676 9,569

Soyoil 72,994 -1,594 123,024 -2,324 -219,745 538

CBOT wheat -12,330 -8,096 156,957 3,355 -134,324 1,142

KCBT wheat 13,255 -14,998 68,559 -503 -82,766 9,842

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 370,900 14,386 261,648 970 -722,634 559

Soybeans 156,040 -3,560 92,736 2,169 -269,805 7,951

Soymeal 61,236 -3,008 71,439 1,133 -181,848 3,449

Soyoil 98,686 -888 93,816 -1,306 -234,828 282

CBOT wheat 17,525 -10,051 97,023 3,471 -115,904 987

KCBT wheat 38,342 -9,322 42,394 646 -75,087 9,623

MGEX wheat 15,883 -707 4,625 709 -27,897 -220

———- ———- ———- ———- ———- ———-

Total wheat 71,750 -20,080 144,042 4,826 -218,888 10,390

Live cattle 83,560 1,900 83,480 215 -173,100 -3,284

Feeder cattle 2,428 2,048 7,257 -167 -3,304 -573

Lean hogs 75,833 1,545 58,396 3,027 -141,906 -7,448

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 105,883 -9,310 -15,795 -6,605 2,389,663 14,944

Soybeans 25,953 -5,929 -4,923 -631 1,179,511 -14,132

Soymeal 19,196 1,274 29,976 -2,848 477,067 5,565

Soyoil 18,599 -1,470 23,728 3,381 604,977 14,483

CBOT wheat 11,658 1,995 -10,303 3,599 512,754 9,218

KCBT wheat -6,600 -6,606 951 5,659 232,247 -989

MGEX wheat 2,300 442 5,088 -224 87,062 -384

———- ———- ———- ———- ———- ———-

Total wheat 7,358 -4,169 -4,264 9,034 832,063 7,845

Live cattle 20,215 418 -14,154 750 392,097 10,240

Feeder cattle 4,516 525 -10,898 -1,833 54,193 3,507

Lean hogs 15,433 1,566 -7,756 1,309 334,436 14,487

Source: Reuters, CFTC & FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.