PDF attached

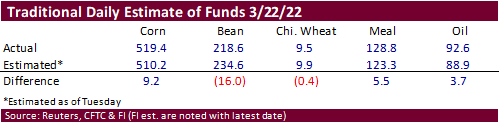

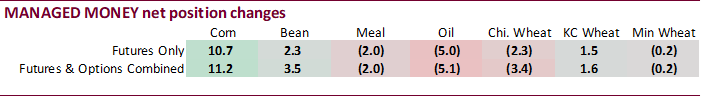

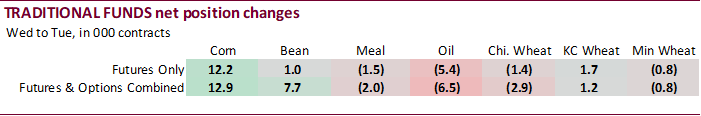

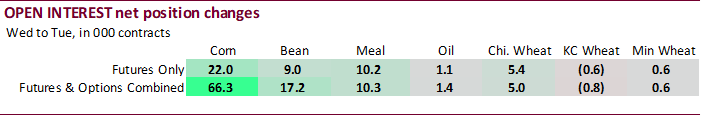

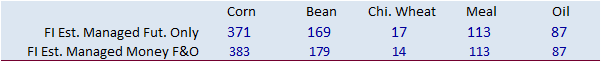

Combined soybeans, soybean oil, soybean meal, corn, soft wheat and KC wheat net long managed money position was again a record at 808,835 contracts. As true for the combined soybeans, soybean oil, soybean meal, corn, soft wheat and KC wheat net long index fund position at a record 1,171,253 contracts. Open interest for the week ending 3/22 was up sharply for corn.

Reuters Table via CFTC

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 304,695 8,651 474,754 7,722 -743,092 -7,291

Soybeans 112,072 6,028 217,249 9,224 -302,760 -14,468

Soyoil 53,412 -5,849 117,878 -995 -189,426 3,333

CBOT wheat -41,255 -3,782 165,037 -412 -120,684 829

KCBT wheat 16,289 731 64,996 -317 -80,695 506

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 384,101 11,192 282,310 6,910 -737,088 -10,770

Soybeans 174,192 3,502 124,835 -4,166 -298,311 -2,769

Soymeal 101,164 -1,995 92,830 426 -245,261 2,372

Soyoil 84,078 -5,093 88,244 41 -194,523 2,962

CBOT wheat 19,511 -3,434 79,089 -2,186 -95,401 1,741

KCBT wheat 45,789 1,553 23,138 -1,540 -71,045 1,288

MGEX wheat 14,222 -165 602 -179 -27,004 339

———- ———- ———- ———- ———- ———-

Total wheat 79,522 -2,046 102,829 -3,905 -193,450 3,368

Live cattle 41,878 1,734 76,583 -1,030 -125,848 73

Feeder cattle -1,382 1,682 6,562 -349 1,267 -929

Lean hogs 62,434 -910 58,954 475 -114,381 2,093

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 107,034 1,749 -36,358 -9,082 2,149,285 66,274

Soybeans 25,846 4,218 -26,562 -786 1,016,326 17,229

Soymeal 19,100 -1 32,166 -802 457,776 10,279

Soyoil 4,064 -1,421 18,137 3,512 415,464 1,447

CBOT wheat -100 515 -3,098 3,364 518,617 5,021

KCBT wheat 2,707 -379 -589 -921 208,907 -785

MGEX wheat 6,920 -655 5,261 661 68,469 554

———- ———- ———- ———- ———- ———-

Total wheat 9,527 -519 1,574 3,104 795,993 4,790

Live cattle 22,021 -148 -14,634 -630 366,192 -2,904

Feeder cattle 859 -502 -7,306 98 58,366 -1,316

Lean hogs 3,134 -1,271 -10,142 -388 315,861 -6,763

=================================================================================

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.