PDF attached

CFTC Commitment of Traders

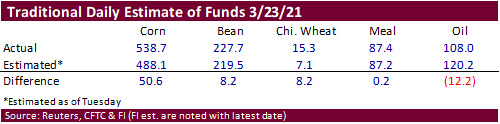

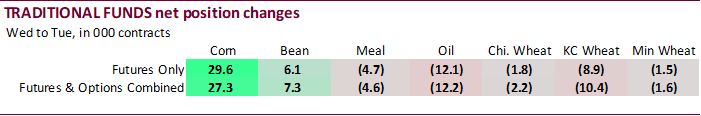

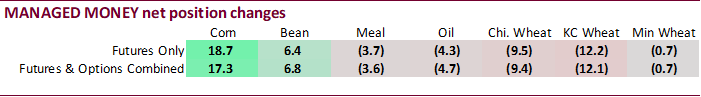

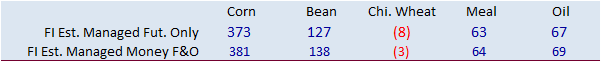

Traders missed estimating the corn traditional net fund futures only position by a very large 50,600 contracts (509,100 versus 488,100 estimated). Funds were also more long than estimated for soybeans and wheat, and less short for SBO.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 355,482 11,815 418,008 3,825 -749,296 -7,241

Soybeans 126,385 8,071 166,599 -1,686 -284,885 -3,210

Soyoil 61,209 -11,784 122,068 -955 -205,249 14,496

CBOT wheat -20,773 -8,443 158,591 1,635 -126,703 7,621

KCBT wheat 5,294 -7,960 66,551 -2,008 -70,341 12,425

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 388,175 17,275 242,955 -18,692 -722,807 -172

Soybeans 162,853 6,813 91,647 -1,090 -272,802 -2,997

Soymeal 57,620 -3,618 71,553 114 -178,996 2,851

Soyoil 93,977 -4,709 93,122 -695 -220,214 14,614

CBOT wheat 8,160 -9,365 93,530 -3,494 -109,395 6,509

KCBT wheat 26,242 -12,100 43,381 987 -63,270 11,817

MGEX wheat 15,224 -659 4,937 311 -25,769 2,128

———- ———- ———- ———- ———- ———-

Total wheat 49,626 -22,124 141,848 -2,196 -198,434 20,454

Live cattle 79,555 -4,005 84,435 955 -167,942 5,157

Feeder cattle 707 -1,720 7,455 197 -2,688 616

Lean hogs 76,095 262 58,458 62 -141,607 298

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 115,870 9,987 -24,194 -8,398 2,341,060 -48,603

Soybeans 26,401 447 -8,098 -3,175 1,176,773 -2,738

Soymeal 18,238 -959 31,587 1,612 472,467 -4,600

Soyoil 11,143 -7,456 21,972 -1,756 615,294 10,316

CBOT wheat 18,821 7,163 -11,116 -813 515,700 2,946

KCBT wheat -4,849 1,751 -1,504 -2,455 238,843 6,596

MGEX wheat 1,342 -958 4,266 -823 89,489 2,428

———- ———- ———- ———- ———- ———-

Total wheat 15,314 7,956 -8,354 -4,091 844,032 11,970

Live cattle 17,400 -2,815 -13,448 706 388,868 -3,230

Feeder cattle 4,863 345 -10,337 561 54,837 644

Lean hogs 15,093 -341 -8,038 -282 341,311 6,875

=================================================================================

FUTURES ONLY Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 379,509 18,723 262,143 -20,686 -763,441 -1,947

Soybeans 151,572 6,370 90,775 -2,201 -306,769 -1,742

Soymeal 56,799 -3,657 71,307 -157 -186,067 3,331

Soyoil 92,176 -4,320 90,594 -948 -219,769 15,124

CBOT wheat 2,718 -9,453 93,794 -3,878 -98,974 6,379

KCBT wheat 26,071 -12,224 43,406 1,049 -67,032 10,243

MGEX wheat 15,224 -659 4,937 320 -26,269 2,066

———- ———- ———- ———- ———- ———-

Total wheat 44,013 -22,336 142,137 -2,509 -192,275 18,688

Live cattle 75,177 -3,512 85,236 1,109 -154,752 5,383

Feeder cattle 478 -1,429 7,444 225 -2,955 100

Lean hogs 74,169 481 58,427 184 -130,875 1,110

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 159,191 10,893 -37,402 -6,983 1,747,316 -43,465

Soybeans 76,092 -237 -11,670 -2,190 853,452 -2,701

Soymeal 30,642 -1,083 27,319 1,566 408,654 -5,838

Soyoil 15,848 -7,808 21,151 -2,048 498,432 1,706

CBOT wheat 12,538 7,653 -10,076 -701 420,748 1,627

KCBT wheat -1,259 3,312 -1,186 -2,380 220,866 4,827

MGEX wheat 2,174 -865 3,934 -862 85,389 2,368

———- ———- ———- ———- ———- ———-

Total wheat 13,453 10,100 -7,328 -3,943 727,003 8,822

Live cattle 3,453 -3,143 -9,114 163 335,893 -3,645

Feeder cattle 3,175 696 -8,142 408 48,069 264

Lean hogs 6,622 -957 -8,343 -818 275,026 3,712

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.