PDF attached

CFTC Commitment of Traders

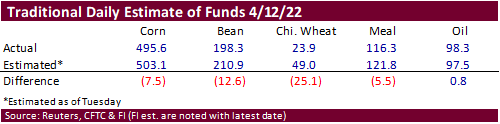

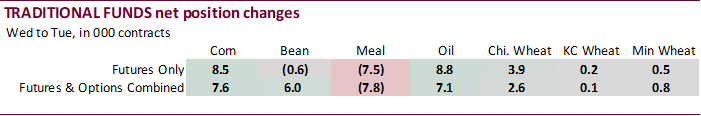

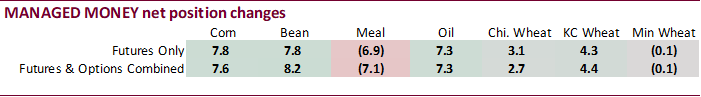

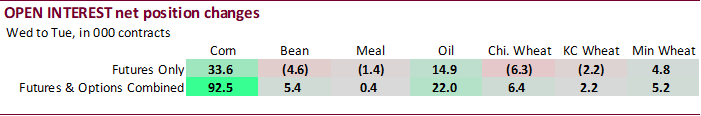

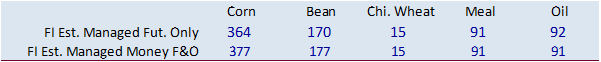

Traditional funds were less long than expected for Chicago wheat (by 25,100 contracts), corn, soybeans, and soybean meal. Money managers extended their net long position for the major agriculture commodities with exception of soybean meal. We see no price reaction from the less than expected Chicago wheat net fund position as traders were busy buying that market mid last week before taking some profits on Friday. The net position futures and options of speculators and index funds for combined SRW, HRW, corn, soybeans, soymeal and soyoil, remains near a record long.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 271,085 5,107 491,696 -2,040 -726,160 -14,117

Soybeans 97,896 4,286 208,914 -1,144 -279,616 -5,000

Soyoil 55,157 5,718 117,946 1,036 -194,383 -12,749

CBOT wheat -36,974 707 161,157 -2,293 -121,646 -646

KCBT wheat 15,695 1,504 62,862 -956 -80,755 -1,912

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 369,952 7,647 286,077 -4,837 -714,681 -13,812

Soybeans 171,873 8,218 112,854 -6,179 -271,708 -1,692

Soymeal 93,411 -7,133 90,345 940 -234,989 4,996

Soyoil 84,063 7,313 85,555 -1,422 -198,640 -11,698

CBOT wheat 16,639 2,679 68,689 -5,089 -95,363 250

KCBT wheat 49,392 4,364 23,988 472 -70,849 -1,958

MGEX wheat 18,120 -135 642 243 -27,514 -1,572

———- ———- ———- ———- ———- ———-

Total wheat 84,151 6,908 93,319 -4,374 -193,726 -3,280

Live cattle 39,498 -766 73,856 -3,007 -128,779 -987

Feeder cattle -4,800 -2,207 5,214 -1 3,644 855

Lean hogs 54,675 -3,076 54,415 -1,121 -107,298 2,737

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 95,273 -48 -36,621 11,050 2,263,395 92,529

Soybeans 14,176 -2,205 -27,195 1,860 984,410 5,374

Soymeal 15,533 -715 35,700 1,912 461,136 356

Soyoil 7,740 -189 21,281 5,995 432,997 22,039

CBOT wheat 12,572 -71 -2,537 2,231 486,821 6,367

KCBT wheat -4,731 -4,241 2,199 1,364 210,439 2,157

MGEX wheat 4,553 890 4,199 574 76,329 5,212

———- ———- ———- ———- ———- ———-

Total wheat 12,394 -3,422 3,861 4,169 773,589 13,736

Live cattle 28,586 4,630 -13,160 128 358,692 5,586

Feeder cattle 452 72 -4,508 1,281 59,887 3,427

Lean hogs 4,805 -541 -6,596 2,000 319,762 4,306

Source: CFTC, Reuters and FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Suite 1450

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.