PDF attached

CFTC Commitment of Traders

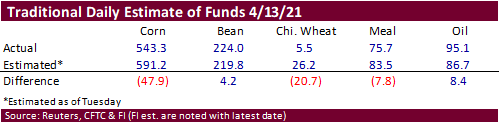

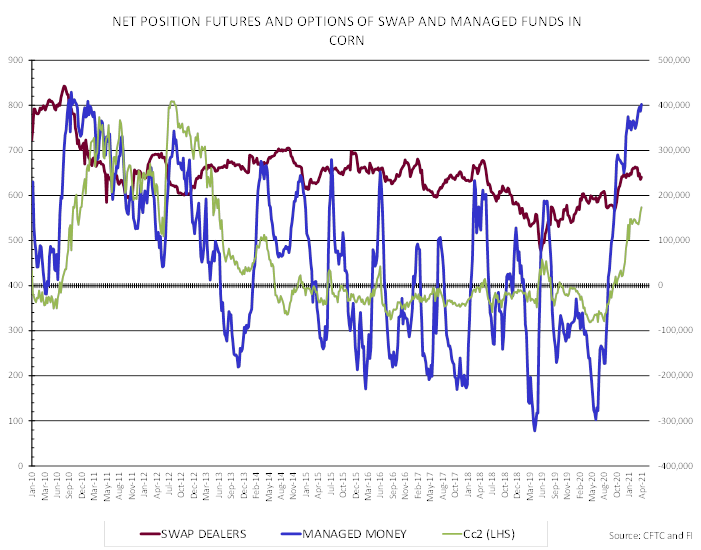

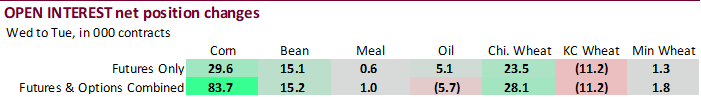

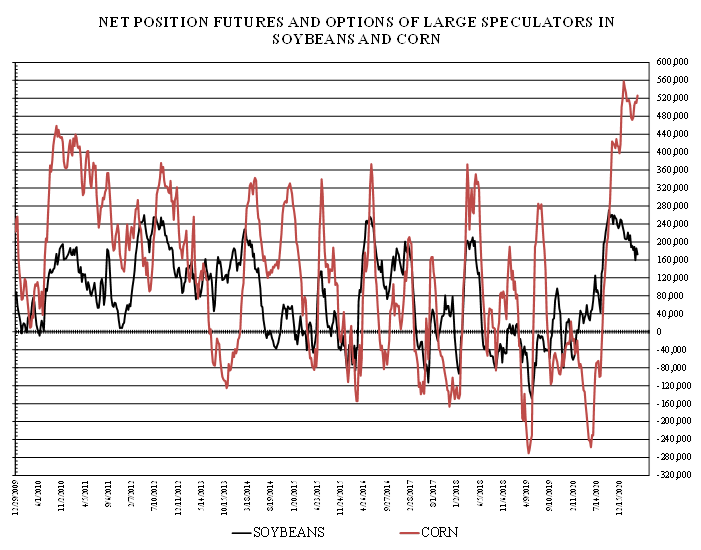

- Traditional funds futures only net long for corn was not a record for the week ending 4/13 as the net long position fell short of estimates by a large 47,900 contracts. Traditional funds for corn futures only were net long 543,286 contracts, short of its record net long of 547,677 contracts established 1/26/2021.

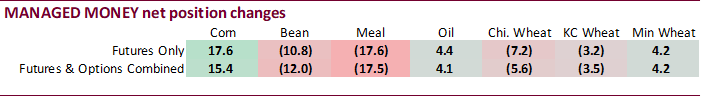

- Managed money futures and options combined in corn was not a record net long but close to it. At 401,993 net long contracts, it did take out the short-term net long position of 395,584 established two weeks earlier and has not been above 400,000 since January 21, 2011. Record net long position was 429,189 net long contracts as of 10/1/2010.

- Traditional funds futures and options combined for corn was net long 526,059 just short of its record 557,581 net long position established 1/12/21.

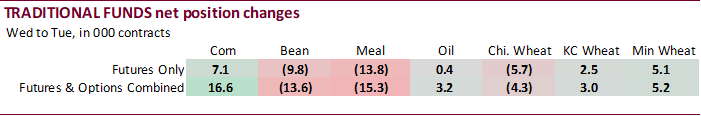

- The funds futures only net long position for Chicago wheat and soybean meal fell short of expectations and soybeans and soybean oil were little more long than expected.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 375,789 20,046 413,405 -1,031 -758,138 -18,805

Soybeans 102,025 -12,466 171,422 -645 -270,214 13,196

Soyoil 53,275 6,640 115,253 -5,264 -186,200 -74

CBOT wheat -40,459 -4,984 160,376 4,991 -107,696 -738

KCBT wheat -369 2,701 62,700 1,639 -62,471 -5,681

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 401,993 15,374 240,603 5,269 -735,606 -21,700

Soybeans 142,258 -12,048 71,142 -2,566 -240,245 16,274

Soymeal 43,830 -17,514 74,845 4,598 -167,463 12,536

Soyoil 81,165 4,128 102,844 2,471 -211,533 -4,348

CBOT wheat -13,217 -5,634 92,307 1,997 -89,525 1,602

KCBT wheat 11,028 -3,482 45,267 3,488 -56,627 -7,781

MGEX wheat 9,680 4,197 4,233 -211 -19,991 -5,575

———- ———- ———- ———- ———- ———-

Total wheat 7,491 -4,919 141,807 5,274 -166,143 -11,754

Live cattle 87,231 -4,654 85,639 3 -180,855 2,978

Feeder cattle 5,781 -334 7,567 102 -3,294 202

Lean hogs 77,960 1,027 58,678 -346 -146,133 -897

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 124,067 1,267 -31,056 -210 2,448,675 83,716

Soybeans 30,080 -1,575 -3,233 -84 1,208,328 15,222

Soymeal 19,994 2,225 28,794 -1,845 477,525 998

Soyoil 9,851 -952 17,672 -1,300 598,089 -5,747

CBOT wheat 22,656 1,304 -12,221 731 528,463 28,132

KCBT wheat 192 6,434 140 1,342 238,080 -11,183

MGEX wheat -12 1,027 6,090 561 83,605 1,848

———- ———- ———- ———- ———- ———-

Total wheat 22,836 8,765 -5,991 2,634 850,148 18,797

Live cattle 22,560 1,842 -14,574 -168 381,970 -2,813

Feeder cattle 3,519 -694 -13,574 724 52,020 -493

Lean hogs 15,255 -419 -5,759 635 366,677 3,628

Source: CFTC, Reuters and CFTC

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.