PDF attached

CFTC Commitment of Traders

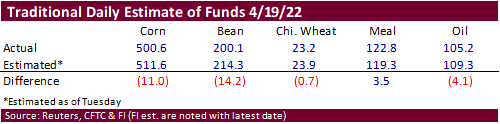

Funds were less long than estimated for corn, soybeans and soybean oil. There were no major surprises for the week ending April 19. Keep an eye on Chicago wheat as funds are near flat. At the end of March, they were net long 43,100 contracts.

Reuters table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 285,977 14,893 486,281 -5,414 -741,241 -15,082

Soybeans 103,552 5,656 211,720 2,806 -290,134 -10,518

Soyoil 64,470 9,314 117,361 -584 -204,499 -10,115

CBOT wheat -38,046 -1,072 160,776 -382 -120,063 1,584

KCBT wheat 16,030 334 63,076 215 -81,471 -716

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 379,110 9,157 285,998 -78 -735,187 -20,506

Soybeans 179,723 7,852 111,505 -1,350 -280,092 -8,384

Soymeal 99,542 6,131 89,889 -456 -241,081 -6,092

Soyoil 96,088 12,026 84,252 -1,304 -208,219 -9,580

CBOT wheat 14,470 -2,170 68,179 -510 -93,574 1,789

KCBT wheat 49,841 449 25,420 1,432 -73,470 -2,620

MGEX wheat 19,867 1,747 627 -15 -30,314 -2,800

———- ———- ———- ———- ———- ———-

Total wheat 84,178 26 94,226 907 -197,358 -3,631

Live cattle 46,807 7,309 74,096 241 -132,822 -4,043

Feeder cattle -4,410 390 5,361 147 2,529 -1,113

Lean hogs 56,507 1,833 54,473 58 -110,663 -3,366

Other NonReport Open

Net Chg Net Chg Interest Chg

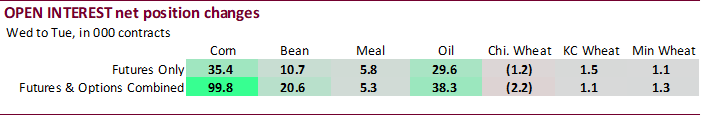

Corn 101,096 5,823 -31,017 5,604 2,363,241 99,846

Soybeans 14,004 -173 -25,139 2,056 1,005,019 20,608

Soymeal 15,846 314 35,803 104 466,468 5,332

Soyoil 5,213 -2,528 22,666 1,386 471,333 38,336

CBOT wheat 13,591 1,020 -2,666 -129 484,604 -2,217

KCBT wheat -4,156 573 2,366 167 211,504 1,065

MGEX wheat 5,184 631 4,636 436 77,613 1,284

———- ———- ———- ———- ———- ———-

Total wheat 14,619 2,224 4,336 474 773,721 132

Live cattle 25,347 -3,239 -13,428 -269 360,036 1,344

Feeder cattle 449 -3 -3,929 579 58,224 -1,664

Lean hogs 5,607 802 -5,924 672 298,882 -20,880

Source: Reuters, CFTC, and FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.