PDF attached

CFTC Commitment of Traders

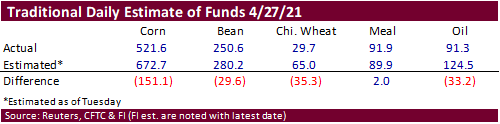

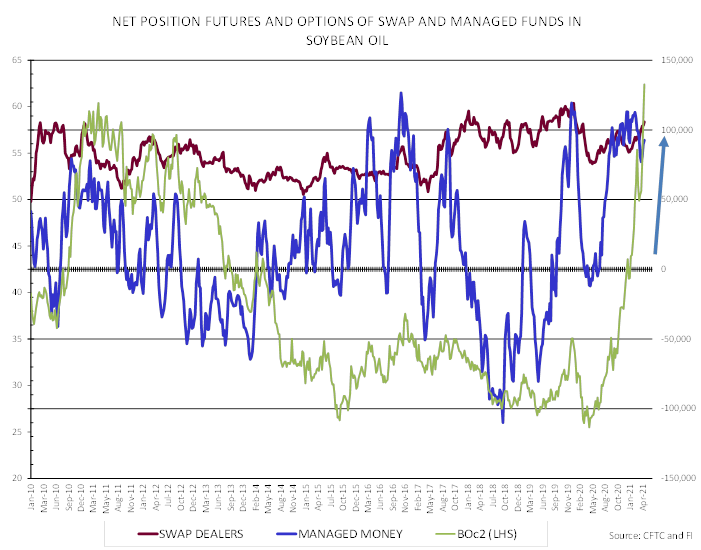

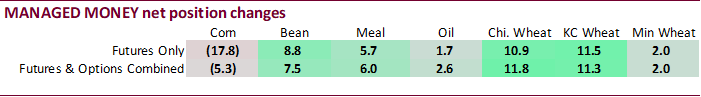

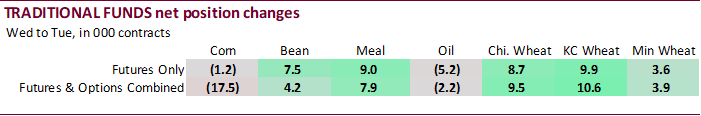

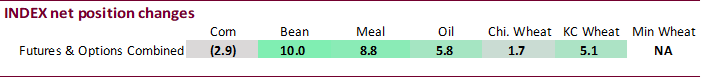

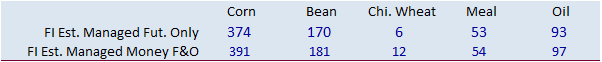

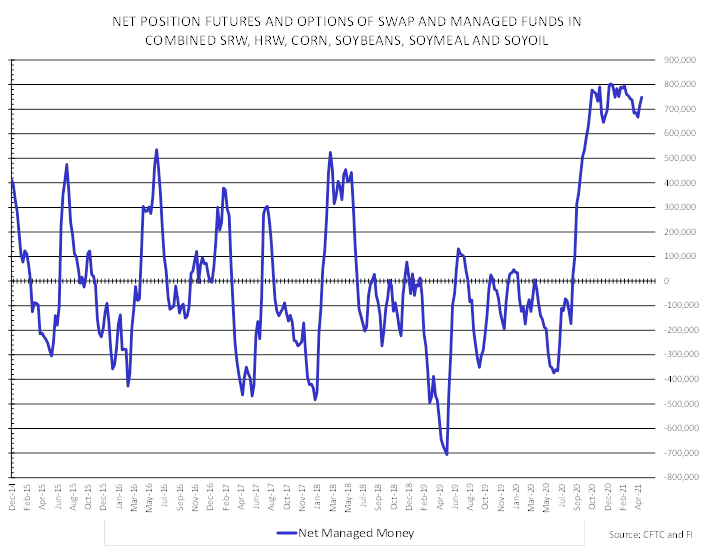

There were no notable record positions this week. SBO prices have managed to climb substantially despite the net fun position unable to test its record long position established 2016. Managed money for corn is near a recent record. Managed money for Chicago wheat ticked higher with nearby prices at highs not seen since 2012. As we said in the past, we caution taking the daily estimate of funds literally, rather look at the momentum of buying. Funds estimates missed the corn position by most for the week ending April 27 in our recorded history dating back to 2012.

Speculators cut corn net long position-CFTC – Reuters News

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 335,631 -19,286 413,831 -2,948 -733,660 21,448

Soybeans 133,912 924 183,053 9,994 -320,269 -11,244

Soyoil 57,308 -3,850 120,794 5,846 -197,028 -1,566

CBOT wheat -18,508 6,831 160,331 1,671 -131,321 -10,531

KCBT wheat 13,528 6,699 68,666 5,058 -81,151 -9,838

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 378,663 -5,336 239,774 -1,299 -710,596 18,036

Soybeans 180,014 7,470 71,146 2,279 -283,625 -6,847

Soymeal 54,086 6,039 74,657 -532 -188,549 -7,517

Soyoil 92,587 2,595 105,756 2,752 -218,831 -146

CBOT wheat 13,399 11,816 80,823 -5,530 -105,929 -6,036

KCBT wheat 30,038 11,292 45,405 649 -74,720 -9,374

MGEX wheat 14,079 1,962 3,480 -189 -28,435 -2,995

———- ———- ———- ———- ———- ———-

Total wheat 57,516 25,070 129,708 -5,070 -209,084 -18,405

Live cattle 54,895 -16,424 85,543 -171 -157,997 10,079

Feeder cattle 679 -1,569 7,763 67 -2,574 230

Lean hogs 71,117 -2,129 59,136 -551 -136,454 3,188

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 107,963 -12,188 -15,803 785 2,399,229 -148,475

Soybeans 29,160 -3,229 3,303 327 1,167,102 -82,399

Soymeal 26,423 1,867 33,383 141 459,296 -17,824

Soyoil 1,562 -4,770 18,925 -431 572,191 -49,898

CBOT wheat 22,209 -2,280 -10,502 2,030 548,366 -196

KCBT wheat 321 -647 -1,044 -1,919 237,214 3,537

MGEX wheat 3,302 1,955 7,574 -733 84,487 2,877

———- ———- ———- ———- ———- ———-

Total wheat 25,832 -972 -3,972 -622 870,067 6,218

Live cattle 24,563 2,323 -7,004 4,193 377,095 -399

Feeder cattle 3,934 109 -9,802 1,162 55,554 2,643

Lean hogs 13,846 -74 -7,644 -433 343,649 2,684

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.