PDF attached

CFTC Commitment of Traders

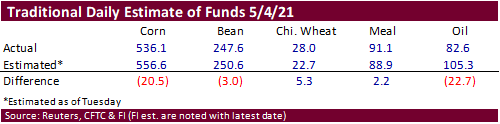

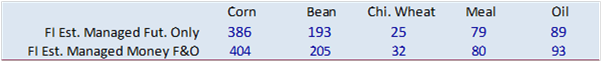

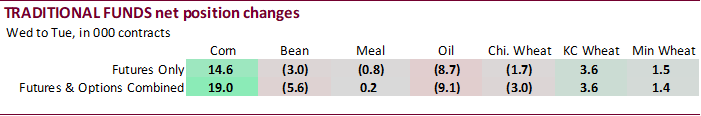

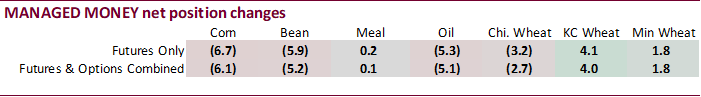

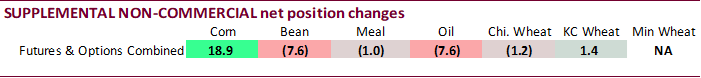

No records as of Tuesday and it looks like there is room for more longs to enter the market by the investment funds. We are pleased the net positions came in near expectations as over the past two weeks the estimated fund position for corn was well from what was reported by CFTC. Estimates were less long in corn and soybean oil, but that can be overlooked after three solid days of higher prices. Current position estimates below.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 354,564 18,933 415,765 1,934 -747,827 -14,166

Soybeans 126,299 -7,612 186,986 3,932 -311,142 9,127

Soyoil 49,670 -7,637 124,621 3,826 -193,385 3,642

CBOT wheat -19,723 -1,214 159,157 -1,174 -130,895 425

KCBT wheat 14,929 1,401 68,750 85 -81,668 -517

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 372,548 -6,115 239,526 -247 -722,640 -12,043

Soybeans 174,799 -5,215 82,482 11,336 -283,920 -296

Soymeal 54,150 63 77,788 3,131 -187,651 899

Soyoil 87,505 -5,082 106,969 1,212 -211,095 7,736

CBOT wheat 10,723 -2,675 79,382 -1,442 -103,412 2,516

KCBT wheat 34,000 3,961 43,111 -2,293 -75,020 -300

MGEX wheat 15,906 1,826 3,871 391 -30,864 -2,429

———- ———- ———- ———- ———- ———-

Total wheat 60,629 3,112 126,364 -3,344 -209,296 -213

Live cattle 48,865 -6,031 86,685 1,142 -151,608 6,389

Feeder cattle -913 -1,592 6,808 -955 -1,072 1,502

Lean hogs 71,577 460 60,900 1,764 -140,802 -4,349

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 133,068 25,105 -22,502 -6,699 2,438,342 39,113

Soybeans 28,783 -377 -2,145 -5,448 1,139,988 -27,115

Soymeal 26,589 165 29,125 -4,258 457,234 -2,061

Soyoil -2,472 -4,035 19,094 169 585,496 13,306

CBOT wheat 21,847 -362 -8,540 1,963 544,240 -4,126

KCBT wheat -78 -399 -2,013 -969 241,762 4,547

MGEX wheat 2,900 -402 8,187 613 82,141 -2,346

———- ———- ———- ———- ———- ———-

Total wheat 24,669 -1,163 -2,366 1,607 868,143 -1,925

Live cattle 23,800 -763 -7,741 -737 375,020 -2,075

Feeder cattle 3,822 -111 -8,646 1,156 55,296 -258

Lean hogs 14,130 285 -5,804 1,841 358,691 15,043

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.