PDF attached

CFTC COT

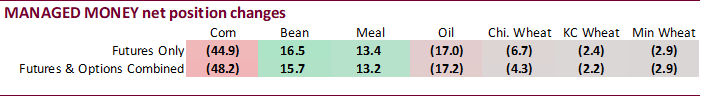

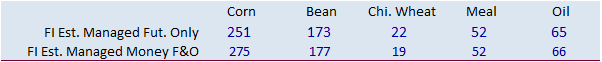

Fund position for wheat was a shock as funds futures old was much more long than estimated, a complete reversal from that we saw from large selling for the previous week pushing then into a thought of net negative position. With wheat net long again, we think the funds were bottom picking as prices fell. Add that to countries to look at restricting rice exports, wheat may have opportunity for another upside run.

As of Friday

Reuters table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 204,496 -46,229 476,780 -6,169 -635,698 62,432

Soybeans 90,022 7,779 189,481 8,056 -249,177 -12,620

Soyoil 48,512 -13,886 110,215 -2,377 -178,261 18,232

CBOT wheat -31,578 494 153,343 -2,860 -119,848 1,397

KCBT wheat 12,371 50 63,869 -1,271 -77,351 2,367

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 291,469 -48,242 284,369 -5,293 -635,456 58,078

Soybeans 163,067 15,732 105,815 4,035 -245,822 -12,294

Soymeal 49,154 13,232 90,026 -888 -190,331 -10,254

Soyoil 68,994 -17,242 86,374 872 -184,801 17,881

CBOT wheat 22,254 -4,331 60,766 -6,086 -92,019 3,374

KCBT wheat 44,546 -2,244 27,183 -624 -68,785 2,710

MGEX wheat 15,231 -2,943 830 67 -26,987 3,175

———- ———- ———- ———- ———- ———-

Total wheat 82,031 -9,518 88,779 -6,643 -187,791 9,259

Live cattle 16,314 -9,315 70,752 730 -103,972 8,466

Feeder cattle -8,996 -2,262 5,196 -119 5,418 1,132

Lean hogs 14,881 4,318 51,643 1,064 -61,611 -922

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 105,197 5,490 -45,578 -10,035 2,188,145 -68,143

Soybeans 7,263 -4,257 -30,325 -3,216 932,993 12,745

Soymeal 21,596 -805 29,554 -1,285 405,915 -7,352

Soyoil 9,900 459 19,533 -1,969 436,457 -10,627

CBOT wheat 10,916 6,076 -1,917 969 453,693 -29,741

KCBT wheat -4,053 1,303 1,110 -1,147 203,755 -878

MGEX wheat 5,162 -525 5,762 225 78,292 -689

———- ———- ———- ———- ———- ———-

Total wheat 12,025 6,854 4,955 47 735,740 -31,308

Live cattle 21,741 -2,988 -4,835 3,106 365,006 -1,735

Feeder cattle -297 550 -1,321 699 63,381 2,238

Lean hogs 1,442 -3,116 -6,355 -1,345 266,011 -8,119

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.