PDF attached

CFTC Commitment of Traders

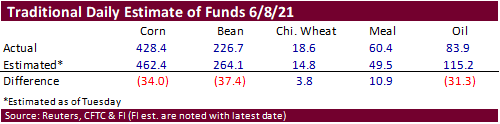

Funds were less long than expected in corn, soybeans, and soybean oil as of last Tuesday.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 236,556 -14,075 426,777 -6,239 -641,420 17,454

Soybeans 95,060 3,677 184,049 -1,451 -281,763 -10,158

Soyoil 54,738 -2,083 123,413 -4,598 -195,649 6,887

CBOT wheat -36,635 416 158,139 -2,206 -114,974 -2,543

KCBT wheat 5,040 411 62,527 -77 -65,795 -1,982

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 275,599 -14,337 235,797 -9,171 -603,651 24,640

Soybeans 141,483 2,695 85,432 -3,749 -255,023 -8,754

Soymeal 26,720 5,835 84,162 1,801 -162,187 -3,221

Soyoil 81,320 -4,764 114,404 -83 -216,444 7,275

CBOT wheat -1,374 -4,600 76,633 -6,339 -86,537 3,187

KCBT wheat 19,713 626 41,182 -1,460 -58,111 -988

MGEX wheat 13,590 128 3,936 229 -28,048 -1,199

———- ———- ———- ———- ———- ———-

Total wheat 31,929 -3,846 121,751 -7,570 -172,696 1,000

Live cattle 52,940 2,741 86,390 -700 -153,269 -2,544

Feeder cattle 3,273 -840 6,659 150 -1,159 835

Lean hogs 84,621 1,989 63,431 777 -153,804 -4,421

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 114,168 -3,992 -21,914 2,860 2,559,044 31,373

Soybeans 25,454 1,878 2,654 7,931 1,195,861 30,125

Soymeal 23,225 -1,776 28,081 -2,638 463,283 6,083

Soyoil 3,221 -2,222 17,498 -206 667,461 17,150

CBOT wheat 17,809 3,418 -6,531 4,334 524,595 14,429

KCBT wheat -1,012 173 -1,772 1,648 227,637 -13,332

MGEX wheat 1,177 117 9,345 725 88,510 3,325

———- ———- ———- ———- ———- ———-

Total wheat 17,974 3,708 1,042 6,707 840,742 4,422

Live cattle 23,650 717 -9,712 -213 339,017 -24,991

Feeder cattle 1,564 -690 -10,337 546 49,388 931

Lean hogs 14,196 1,710 -8,445 -54 381,717 9,730

=================================================================================

Source: CFTC, Reuters and FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.