PDF attached

CFTC Commitment of Traders

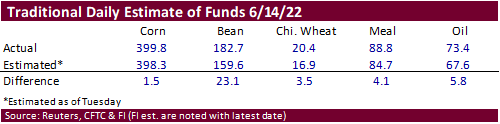

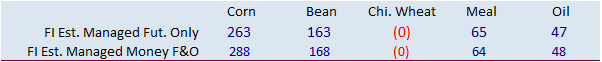

Traditional funds were more long than expected for soybeans by 23,100 contracts. At 182,700 net long, they added 6,000 from the previous week. The other major commodities also posted more than expected net long positions but were near expectations.

Reuters table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 192,123 7,677 453,628 -4,138 -599,917 -2,738

Soybeans 77,630 -5,955 198,624 8,721 -247,712 -3,508

Soyoil 43,824 -3,434 101,071 -2,899 -158,962 9,003

CBOT wheat -41,243 -689 145,720 -2,644 -102,590 1,447

KCBT wheat 5,635 -1,115 62,894 -877 -66,147 2,935

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 278,185 13,858 275,168 -223 -594,891 -747

Soybeans 163,146 4,217 106,264 -1,734 -243,400 -1,329

Soymeal 52,457 -712 87,840 -454 -190,462 2,415

Soyoil 62,996 -5,829 81,506 -722 -166,890 9,473

CBOT wheat 6,939 -5,736 56,072 1,170 -74,683 2,251

KCBT wheat 36,386 -1,113 28,425 152 -59,003 2,516

MGEX wheat 13,191 -731 297 123 -23,380 1,858

———- ———- ———- ———- ———- ———-

Total wheat 56,516 -7,580 84,794 1,445 -157,066 6,625

Live cattle 31,926 10,576 69,441 -898 -113,635 -5,733

Feeder cattle -3,553 1,354 4,431 -122 3,594 -858

Lean hogs 18,832 -3,641 54,416 135 -63,339 2,939

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 87,372 -12,087 -45,834 -802 2,214,773 -2,902

Soybeans 2,532 -1,896 -28,542 741 971,426 -7,677

Soymeal 21,041 -1,644 29,124 396 435,560 5,718

Soyoil 8,321 -253 14,067 -2,671 453,471 -17,582

CBOT wheat 13,560 430 -1,887 1,886 465,751 3,288

KCBT wheat -3,426 -614 -2,382 -943 202,723 -2,615

MGEX wheat 3,851 -217 6,041 -1,034 73,779 611

———- ———- ———- ———- ———- ———-

Total wheat 13,985 -401 1,772 -91 742,253 1,284

Live cattle 18,938 -2,500 -6,670 -1,445 332,773 -16,645

Feeder cattle 432 -589 -4,906 215 55,684 -1,784

Lean hogs -1,354 791 -8,556 -224 259,639 -5,193

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.