PDF attached

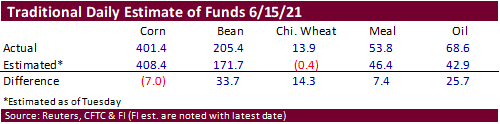

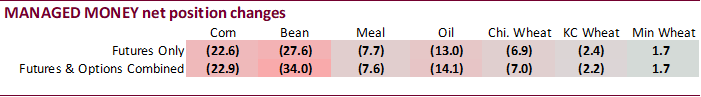

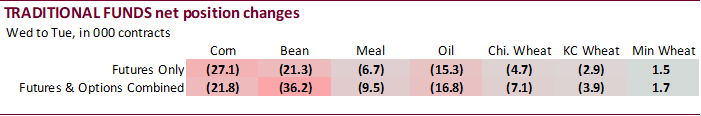

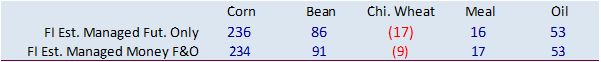

Money managers were not as long in corn but were much more long than expected for soybeans, soybean oil, meal and Chicago wheat. This comes after they reduced long positions for the major agricultural commodities for the week ending 6/15. We see this as slightly supportive, but with the one business day in reporting, some traders may look past the positions as we are four trading days beyond actual data.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 213,016 -23,542 432,760 5,983 -606,016 35,404

Soybeans 61,643 -33,417 184,081 32 -236,409 45,354

Soyoil 40,429 -14,309 122,040 -1,373 -177,669 17,979

CBOT wheat -44,886 -8,252 160,564 2,423 -107,435 7,539

KCBT wheat 1,944 -3,096 62,228 -299 -59,161 6,635

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 252,730 -22,868 239,446 3,649 -567,686 35,964

Soybeans 107,492 -33,991 86,751 1,318 -208,124 46,900

Soymeal 19,092 -7,628 87,809 3,648 -154,785 7,402

Soyoil 67,226 -14,093 118,141 3,737 -201,079 15,364

CBOT wheat -8,396 -7,022 76,762 128 -77,838 8,699

KCBT wheat 17,487 -2,226 43,084 1,902 -52,907 5,206

MGEX wheat 15,298 1,708 3,301 -635 -27,909 141

———- ———- ———- ———- ———- ———-

Total wheat 24,389 -7,540 123,147 1,395 -158,654 14,046

Live cattle 63,573 10,633 86,205 -184 -161,038 -7,769

Feeder cattle 4,378 1,105 6,756 97 -1,249 -89

Lean hogs 86,503 1,882 63,768 337 -155,685 -1,880

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 115,268 1,100 -39,760 -17,846 2,538,875 -20,169

Soybeans 23,196 -2,257 -9,315 -11,969 1,165,967 -29,894

Soymeal 21,322 -1,903 26,562 -1,519 468,746 5,463

Soyoil 511 -2,709 15,201 -2,298 662,386 -5,074

CBOT wheat 17,714 -95 -8,243 -1,710 532,513 7,918

KCBT wheat -2,654 -1,642 -5,010 -3,239 222,545 -5,092

MGEX wheat 1,129 -49 8,181 -1,164 88,059 -451

———- ———- ———- ———- ———- ———-

Total wheat 16,189 -1,786 -5,072 -6,113 843,117 2,375

Live cattle 24,402 751 -13,142 -3,430 341,491 2,474

Feeder cattle 2,024 460 -11,909 -1,572 49,444 57

Lean hogs 15,202 1,005 -9,788 -1,344 389,751 8,034

=================================================================================

Source: Reuters, CFTC, & FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.