PDF attached

CFTC Commitment of Traders

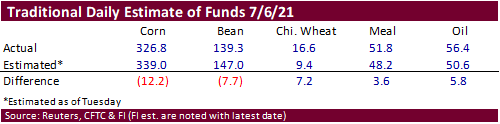

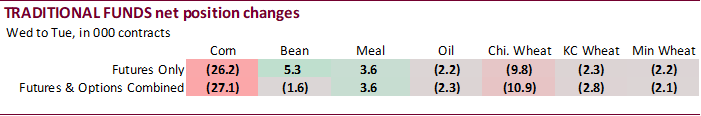

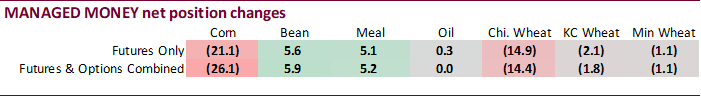

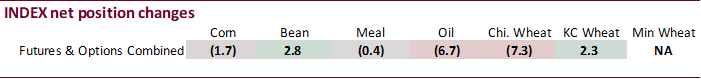

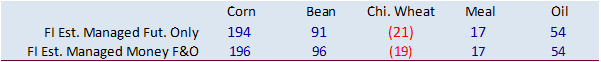

We see no price implications from the results of the CFTC Commitment of Traders report. Funds were a little less long for corn and soybeans and more long for Chicago wheat, but given the high open interest, discrepancies are small, in out opinion. Funds have room to rebuild long positions.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 159,115 -24,711 440,558 -1,736 -547,126 24,079

Soybeans 27,395 -3,614 171,047 2,771 -183,479 154

Soyoil 19,310 903 118,277 -6,735 -144,943 6,565

CBOT wheat -46,724 -8,276 149,615 -7,258 -87,740 18,464

KCBT wheat 3,979 -3,972 64,298 2,341 -65,659 861

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 219,371 -26,063 251,219 1,038 -513,343 23,711

Soybeans 82,180 5,923 81,797 -948 -159,245 1,837

Soymeal 20,964 5,151 89,608 64 -152,881 -4,470

Soyoil 48,174 0 110,254 -3,429 -163,964 6,501

CBOT wheat -13,617 -14,392 68,227 -4,481 -59,614 18,288

KCBT wheat 20,880 -1,844 44,169 1,265 -59,641 750

MGEX wheat 8,826 -1,143 2,841 -101 -24,979 3,158

———- ———- ———- ———- ———- ———-

Total wheat 16,089 -17,379 115,237 -3,317 -144,234 22,196

Live cattle 62,881 -2,843 87,158 1,637 -164,884 -883

Feeder cattle 7,829 664 5,931 -453 -1,692 54

Lean hogs 67,207 -462 62,995 -1,471 -130,935 5,390

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 95,301 -1,055 -52,547 2,368 2,095,646 32,551

Soybeans 10,230 -7,503 -14,962 690 945,291 18,630

Soymeal 17,300 -1,502 25,009 758 426,916 -4,265

Soyoil -1,819 -2,340 7,356 -732 575,457 -1,890

CBOT wheat 20,154 3,516 -15,150 -2,930 410,630 -6,547

KCBT wheat -2,790 -941 -2,619 770 200,791 6,421

MGEX wheat 1,441 -967 11,870 -948 80,503 -1,450

———- ———- ———- ———- ———- ———-

Total wheat 18,805 1,608 -5,899 -3,108 691,924 -1,576

Live cattle 26,925 983 -12,080 1,105 345,288 1,571

Feeder cattle 1,641 -112 -13,707 -153 53,478 3,032

Lean hogs 13,216 -1,584 -12,484 -1,872 335,768 -1,068

Source: CFTC, Reuters and FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.