PDF attached

CFTC Commitment of Traders

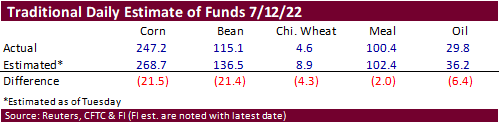

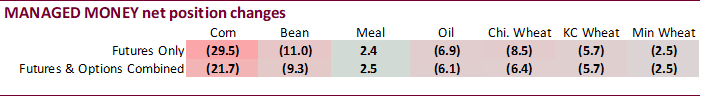

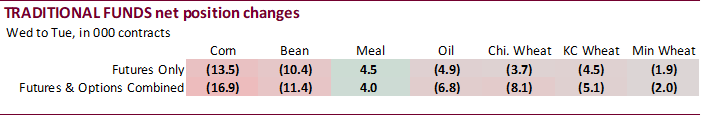

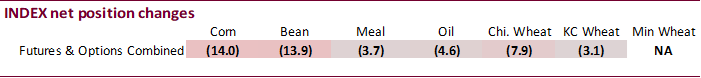

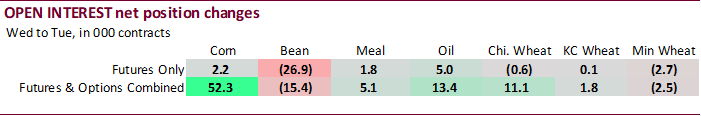

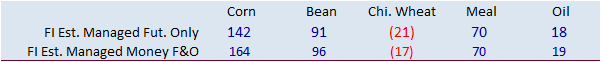

The funds sold more than expected corn and soybeans than expected. The Chicago wheat position was near flat and now thought to be net short 6,400 contracts, futures only, as of Friday. The report is seen neutral for prices.

Reuters Table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 66,874 -6,575 391,553 -14,046 -407,081 13,767

Soybeans 30,653 -2,911 156,331 -13,852 -154,078 11,536

Soyoil 450 -5,855 92,017 -4,614 -95,629 11,686

CBOT wheat -48,176 -739 121,520 -7,919 -64,462 9,063

KCBT wheat -5,518 -2,537 49,713 -3,050 -41,488 5,079

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 151,174 -21,693 262,817 -7,152 -411,514 17,200

Soybeans 95,711 -9,337 100,057 -4,999 -157,180 11,147

Soymeal 68,290 2,513 80,735 -1,393 -189,924 -5,648

Soyoil 18,877 -6,052 76,951 -3,222 -105,576 11,228

CBOT wheat -6,444 -6,402 62,319 821 -51,080 7,658

KCBT wheat 16,387 -5,650 26,161 383 -35,360 4,167

MGEX wheat 2,654 -2,477 1,233 568 -5,324 1,110

———- ———- ———- ———- ———- ———-

Total wheat 12,597 -14,529 89,713 1,772 -91,764 12,935

Live cattle 18,080 3,782 59,636 -1,654 -95,402 -3,492

Feeder cattle -5,809 1,722 3,401 -244 5,895 -652

Lean hogs 39,934 11,450 49,694 -2,851 -77,775 -8,746

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 48,869 4,791 -51,346 6,854 1,906,814 52,306

Soybeans -5,683 -2,038 -32,907 5,226 790,441 -15,400

Soymeal 19,213 1,520 21,686 3,009 440,090 5,054

Soyoil 6,586 -738 3,163 -1,217 427,432 13,408

CBOT wheat 4,087 -1,674 -8,883 -404 398,172 11,096

KCBT wheat -4,482 592 -2,706 508 172,630 1,792

MGEX wheat 2,678 521 -1,241 277 63,187 -2,511

———- ———- ———- ———- ———- ———-

Total wheat 2,283 -561 -12,830 381 633,989 10,377

Live cattle 20,279 633 -2,592 732 330,868 -10,617

Feeder cattle 608 -560 -4,096 -266 52,496 -1,845

Lean hogs -809 271 -11,045 -124 256,385 4,840

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.