PDF attached

CFTC Commitment of Traders

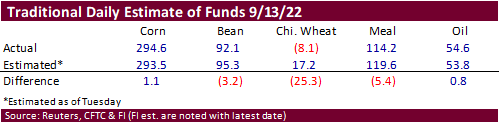

Funds were less long than expected for Chicago wheat. The other 4 major commodities came in near expectations. As of Friday, wheat is the only commodity net short for traditional funds.

Reuters table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 159,454 6,490 370,891 -1,045 -470,012 -68

Soybeans 50,990 17,610 131,897 -7,634 -147,524 -10,959

Soyoil 19,814 6,182 103,791 1,902 -134,035 -11,525

CBOT wheat -53,586 -1,561 118,038 2,017 -60,606 798

KCBT wheat -3,013 6,137 51,549 492 -48,177 -6,335

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 240,643 14,164 229,220 -3,947 -454,897 1,641

Soybeans 112,127 12,498 77,228 -6,307 -140,469 -6,852

Soymeal 87,714 6,093 86,015 -2,276 -218,266 -10,790

Soyoil 55,270 11,288 87,863 -443 -150,806 -10,370

CBOT wheat -20,386 1,046 66,703 72 -52,279 1,580

KCBT wheat 16,992 5,905 28,142 307 -42,423 -6,473

MGEX wheat -151 887 1,430 -126 -2,983 -1,164

———- ———- ———- ———- ———- ———-

Total wheat -3,545 7,838 96,275 253 -97,685 -6,057

Live cattle 69,387 7,501 59,074 466 -138,828 -4,010

Feeder cattle -981 -2,454 3,205 43 3,632 1,243

Lean hogs 51,497 5,999 48,450 -2,156 -86,129 74

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 45,368 -6,481 -60,333 -5,377 1,792,121 61,486

Soybeans -13,522 -323 -35,363 983 794,029 52,209

Soymeal 18,795 2,297 25,741 4,676 428,745 -3,130

Soyoil -2,757 -3,915 10,430 3,441 449,801 10,327

CBOT wheat 9,808 -1,444 -3,846 -1,254 373,189 9,490

KCBT wheat -2,354 554 -359 -293 165,458 4,856

MGEX wheat 2,641 -674 -936 1,078 50,363 2,449

———- ———- ———- ———- ———- ———-

Total wheat 10,095 -1,564 -5,141 -469 589,010 16,795

Live cattle 19,580 -1,148 -9,213 -2,808 364,252 3,390

Feeder cattle -1,652 -892 -4,206 2,061 52,475 354

Lean hogs -3,344 -1,364 -10,475 -2,553 255,557 -20,736

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.