PDF attached

Commitment of Traders

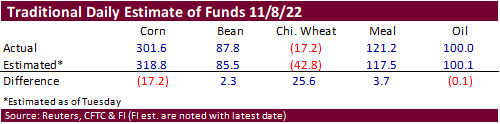

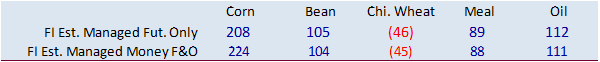

Funds were less long in corn and more long than expected in wheat.

Reuters table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 153,241 -43,445 360,572 1,876 -465,024 37,952

Soybeans 55,763 -1,450 120,152 774 -147,911 -663

Soyoil 64,213 4,263 106,768 2,518 -183,293 -5,285

CBOT wheat -58,482 -6,051 109,036 3,660 -45,106 1,599

KCBT wheat 6,250 1,462 46,331 -1,579 -51,783 -102

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 237,662 -34,297 233,443 11,640 -460,714 29,924

Soybeans 103,908 2,579 76,764 907 -142,429 -1,759

Soymeal 95,420 2,002 81,741 2,261 -225,037 -3,807

Soyoil 105,210 5,092 84,008 2,873 -199,800 -6,491

CBOT wheat -42,902 -5,754 64,946 1,311 -37,443 797

KCBT wheat 24,433 1,024 30,998 2,381 -50,621 -2,764

MGEX wheat 3,055 -759 1,910 734 -5,008 731

Total wheat -15,414 -5,489 97,854 4,426 -93,072 -1,236

Live cattle 62,181 -3,867 53,073 -81 -127,123 2,934

Feeder cattle -5,993 500 3,304 181 4,739 -260

Lean hogs 54,514 -5,055 45,793 -356 -82,827 2,851

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 38,397 -10,884 -48,788 3,617 1,920,077 3,959

Soybeans -10,237 -3,066 -28,004 1,339 703,484 34,362

Soymeal 19,203 -749 28,673 292 453,467 18,374

Soyoil -1,729 24 12,312 -1,497 518,361 25,192

CBOT wheat 20,848 2,853 -5,448 793 443,703 8,679

KCBT wheat -4,011 -861 -798 220 172,714 -6,470

MGEX wheat 2,041 -204 -1,998 -502 52,363 -5,361

Total wheat 18,878 1,788 -8,244 511 668,780 -3,152

Live cattle 16,528 -2,432 -4,658 3,446 351,835 -5,744

Feeder cattle -1,240 -185 -810 -236 58,681 1,239

Lean hogs -6,038 456 -11,442 2,104 252,403 -5,415

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.