PDF attached

Calls:

Corn 1-5c higher

Wheat 3-7c higher

Soybeans 2-5c higher

Soybean meal $1.50-3.00 higher

Soybean oil 0.50 to 1.50 higher (JD provided that and agree)

Ukraine/Russia situation is not getting any better after heavy shelling occurred over the weekend. Egypt’s GASC seeks vegetable oils on Tuesday for January 10-31 shipment via 180-day letters of credit. They are also in for local vegetable oils. Cargo surveyor ITS reported November 1-20 palm oil shipments from Malaysia at 997,216 tons, up from 909,817 tons previous period month earlier, or up 9.6% increase. Both Reuters and Bloomberg are reporting that Argentina is closer to roll out a second “soybean dollar” sometime in December. Range was estimated between 215-225 pesos per USD. That would be up from 200 back in September when they last rolled it out. Argentine producers sold 72.2% of the 44 million tons soybean production for the 2021-22 crop (USDA 43.9MMT), down slightly from 74.2% during the same period year ago. 49.5 million tons is what USDA has penciled in for 2022-23, down from 51 million tons estimated back in September. We are hearing Argentina crush rates are not as good as they were when they rolled out the September bump, so more soybeans this round could end up exported rather than be crushed. Either way, look for March CBOT soybean oil and meal product premiums to come under pressure versus other contract months as Argentina could boost exportable product supply by as early as January 1.

CFTC Commitment of Traders

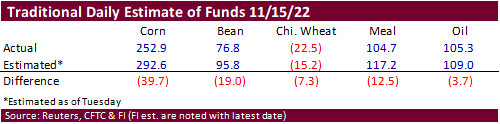

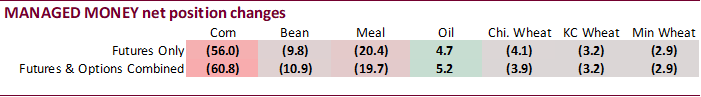

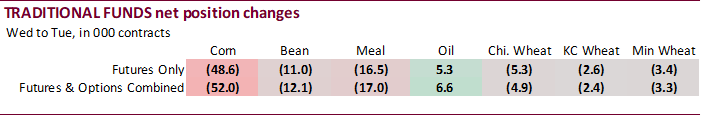

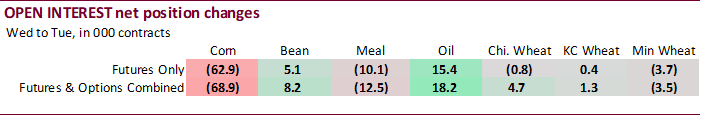

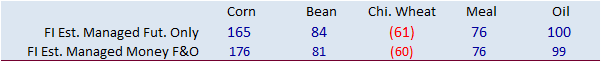

The funds sold a large amount of corn and soybean meal for the week ending Tuesday November 15. For corn, the traditional funds sold 52,000 futures and options (combined) contracts. For soybean meal they sold 17,000. The trade missed the net long position for traditional futures only funds position by a large 39,700 contracts. They were also well off on their net long position for soybeans by 19,000 contracts and soybean meal by 12,500 9all less long than expected). We could see some technical buying in light of the CFTC positions as some longs could bottom pick.

Reuters Table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 103,617 -49,624 361,352 780 -427,394 37,630

Soybeans 44,261 -11,502 125,467 5,315 -140,762 7,149

Soyoil 68,939 4,726 108,636 1,868 -192,536 -9,242

CBOT wheat -60,490 -2,009 107,057 -1,979 -40,428 4,677

KCBT wheat 3,665 -2,584 46,787 454 -49,972 1,811

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 176,831 -60,831 238,170 4,727 -424,628 36,084

Soybeans 92,965 -10,943 82,069 5,306 -134,665 7,765

Soymeal 75,710 -19,710 85,396 3,655 -204,740 20,297

Soyoil 110,371 5,160 82,520 -1,487 -207,549 -7,749

CBOT wheat -46,780 -3,876 66,665 1,719 -33,596 3,847

KCBT wheat 21,281 -3,152 32,505 1,507 -50,065 556

MGEX wheat 158 -2,897 1,622 -288 -1,680 3,329

———- ———- ———- ———- ———- ———-

Total wheat -25,341 -9,925 100,792 2,938 -85,341 7,732

Live cattle 50,160 -12,021 53,326 253 -116,440 10,684

Feeder cattle -6,606 -613 3,235 -69 4,891 152

Lean hogs 55,800 1,287 46,280 487 -84,502 -1,676

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 47,202 8,805 -37,575 11,214 1,851,206 -68,872

Soybeans -11,404 -1,167 -28,966 -961 711,647 8,162

Soymeal 21,875 2,672 21,758 -6,915 440,919 -12,548

Soyoil -302 1,427 14,960 2,648 536,578 18,217

CBOT wheat 19,849 -998 -6,139 -690 448,452 4,749

KCBT wheat -3,241 770 -480 318 173,978 1,264

MGEX wheat 1,623 -418 -1,723 274 48,903 -3,460

———- ———- ———- ———- ———- ———-

Total wheat 18,231 -646 -8,342 -98 671,333 2,553

Live cattle 15,871 -657 -2,918 1,739 348,144 -3,691

Feeder cattle -2,457 -1,217 936 1,746 61,534 2,852

Lean hogs -6,093 -54 -11,485 -43 259,198 6,795

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.