PDF attached

CFTC Commitment of Traders Report

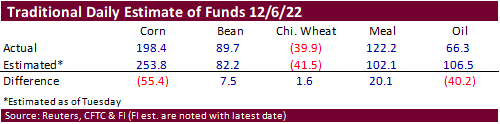

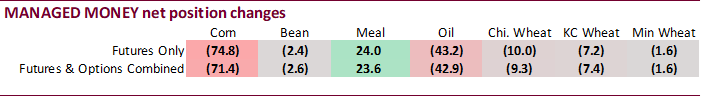

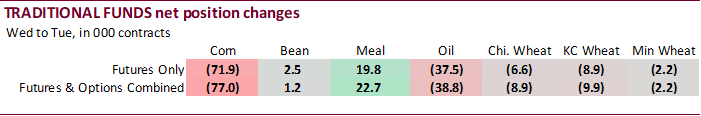

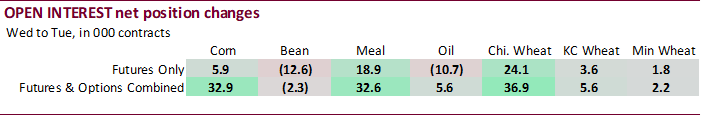

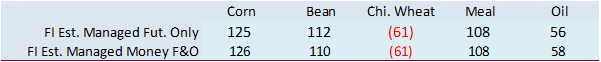

The got it wrong for the fund position for corn and soybean oil, by a mile. Funds sold more than 55,000 contracts and 40,000 contracts than expected by trade estimates. Funds and managed money were large sellers for the week ending December 6 for corn and soybean oil, yet open interest went up for that period.

Reuters table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 32,765 -76,615 358,503 -4,646 -352,865 87,394

Soybeans 53,682 1,441 120,022 -7,382 -142,116 10,787

Soyoil 32,867 -34,717 99,277 -6,372 -145,051 40,770

CBOT wheat -71,771 -6,379 99,826 -2,937 -26,505 8,158

KCBT wheat -10,288 -9,268 46,486 -1,320 -33,725 11,697

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 120,213 -71,418 236,631 -1,175 -356,614 84,313

Soybeans 99,454 -2,650 71,684 -7,596 -133,162 11,226

Soymeal 98,509 23,648 80,529 -2,386 -221,016 -19,464

Soyoil 62,584 -42,920 80,434 501 -161,011 37,971

CBOT wheat -63,382 -9,314 63,906 -401 -20,450 8,109

KCBT wheat 9,729 -7,400 35,108 -411 -35,410 11,416

MGEX wheat -3,048 -1,619 1,759 285 1,061 3,527

———- ———- ———- ———- ———- ———-

Total wheat -56,701 -18,333 100,773 -527 -54,799 23,052

Live cattle 59,317 -526 55,213 1,286 -118,064 2,344

Feeder cattle -3,246 4,989 2,858 -73 5,111 -1,843

Lean hogs 49,754 8,271 44,802 -236 -73,913 -4,901

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 38,174 -5,588 -38,404 -6,132 1,486,178 32,911

Soybeans -6,388 3,868 -31,588 -4,846 719,341 -2,272

Soymeal 20,932 -964 21,045 -834 427,153 32,560

Soyoil 5,085 4,128 12,908 319 485,549 5,563

CBOT wheat 21,476 448 -1,548 1,158 404,705 36,923

KCBT wheat -6,956 -2,497 -2,473 -1,107 159,860 5,582

MGEX wheat 2,380 -624 -2,151 -1,569 48,036 2,179

———- ———- ———- ———- ———- ———-

Total wheat 16,900 -2,673 -6,172 -1,518 612,601 44,684

Live cattle 11,837 -1,689 -8,304 -1,415 346,671 -7,786

Feeder cattle -1,219 659 -3,504 -3,733 56,908 -1,641

Lean hogs -9,897 -1,771 -10,747 -1,363 262,607 -2,021

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.