PDF attached

CFTC Commitment of Traders

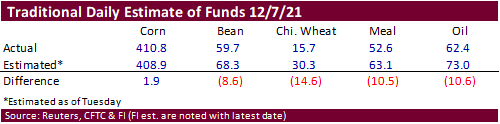

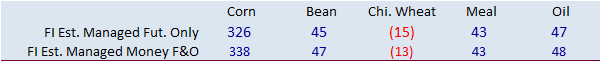

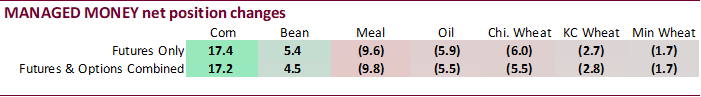

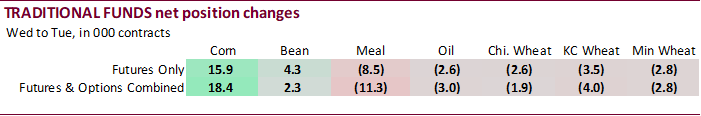

Funds were buyers of corn and soybeans for the week ending 12/7 while they sold Chicago wheat, soybean meal and soybean oil. Funds were less long beans, wheat, and the products. For corn they were, for a change, near expectations. The managed money net long position for soybean oil was down 23,600 contracts to 58,800 contracts since November 23.

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 242,978 21,334 425,782 -5,261 -635,586 -28,904

Soybeans 13,500 6,946 183,256 -8,256 -157,837 -1,219

Soyoil 17,470 839 120,642 -7,632 -142,406 6,108

CBOT wheat -21,377 718 116,678 -3,685 -88,604 2,304

KCBT wheat 29,177 -4,027 58,846 476 -91,272 1,551

=================================================================================

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 332,501 17,232 268,095 -2,402 -635,001 -28,826

Soybeans 37,882 4,457 146,122 -2,972 -168,583 -1,829

Soymeal 27,898 -9,783 89,251 -3,450 -160,461 16,327

Soyoil 58,828 -5,532 95,821 -2,780 -150,966 5,126

CBOT wheat 721 -5,480 67,720 -843 -70,555 2,070

KCBT wheat 59,575 -2,793 28,156 408 -79,345 1,582

MGEX wheat 12,545 -1,659 1,056 -289 -27,646 1,324

———- ———- ———- ———- ———- ———-

Total wheat 72,841 -9,932 96,932 -724 -177,546 4,976

Live cattle 79,850 1,333 81,830 1,134 -163,132 -1,618

Feeder cattle 4,998 92 3,572 -267 -934 532

Lean hogs 47,204 -9,168 58,265 980 -96,055 4,798

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 67,578 1,165 -33,173 12,831 1,724,182 42,788

Soybeans 23,499 -2,185 -38,919 2,529 791,580 700

Soymeal 18,569 -1,549 24,742 -1,545 418,151 -12,166

Soyoil -7,977 2,501 4,295 685 425,461 -11,057

CBOT wheat 8,812 3,589 -6,697 665 440,731 -8,799

KCBT wheat -11,634 -1,198 3,249 2,001 247,516 -3,863

MGEX wheat 7,987 -1,129 6,059 1,753 79,583 259

———- ———- ———- ———- ———- ———-

Total wheat 5,165 1,262 2,611 4,419 767,830 -12,403

Live cattle 20,234 -920 -18,782 72 350,160 -19,220

Feeder cattle -501 -505 -7,135 148 47,184 1,647

Lean hogs 7,943 1,234 -17,358 2,157 285,784 -3,454

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.