PDF attached

CFTC Commitment of Traders

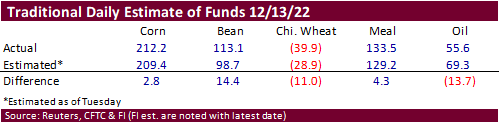

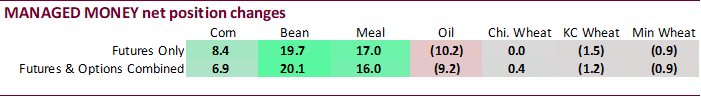

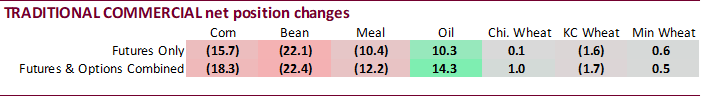

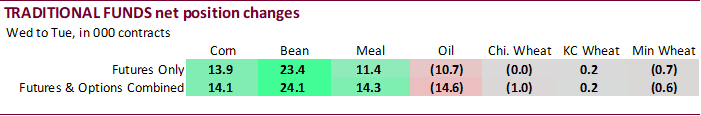

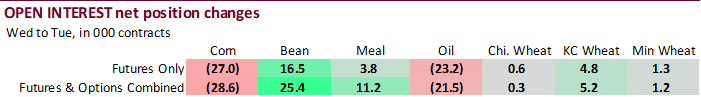

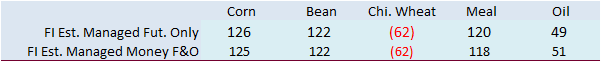

Funds and commercials changed their tune for the week ending December 13, exception soybean oil and wheat. There were no major surprises to the fund positions. For soybeans, traditional funds were a little more long than expected and Chicago wheat 11,000 contracts more short than what the trade estimated.

Reuters table

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 53,133 20,369 346,837 -11,666 -365,732 -12,867

Soybeans 77,962 24,279 124,630 4,607 -169,282 -27,166

Soyoil 18,835 -14,031 98,911 -365 -130,984 14,068

CBOT wheat -71,197 574 98,062 -1,764 -25,284 1,223

KCBT wheat -9,888 401 46,317 -169 -35,497 -1,772

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 127,106 6,892 229,535 -7,096 -367,770 -11,156

Soybeans 119,580 20,126 76,275 4,591 -160,124 -26,963

Soymeal 114,486 15,977 78,699 -1,830 -231,434 -10,418

Soyoil 53,349 -9,235 84,357 3,923 -150,651 10,360

CBOT wheat -63,004 378 64,729 823 -20,231 220

KCBT wheat 8,540 -1,191 34,736 -372 -36,776 -1,366

MGEX wheat -3,922 -874 1,761 2 1,521 460

———- ———- ———- ———- ———- ———-

Total wheat -58,386 -1,687 101,226 453 -55,486 -686

Live cattle 66,919 7,602 53,186 -2,026 -122,356 -4,293

Feeder cattle -747 2,499 2,733 -126 4,020 -1,092

Lean hogs 40,116 -9,638 46,853 2,051 -68,702 5,212

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 45,369 7,195 -34,239 4,165 1,457,563 -28,616

Soybeans -2,421 3,967 -33,310 -1,720 744,707 25,365

Soymeal 19,286 -1,645 18,961 -2,084 438,398 11,245

Soyoil -292 -5,377 13,237 329 464,030 -21,520

CBOT wheat 20,088 -1,388 -1,582 -33 405,051 346

KCBT wheat -5,567 1,389 -933 1,540 165,081 5,221

MGEX wheat 2,651 272 -2,011 140 49,229 1,192

———- ———- ———- ———- ———- ———-

Total wheat 17,172 273 -4,526 1,647 619,361 6,759

Live cattle 10,570 -1,268 -8,319 -16 354,855 8,184

Feeder cattle -1,978 -760 -4,028 -523 57,281 372

Lean hogs -8,164 1,732 -10,104 643 256,091 -6,516

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.