PDF attached

CFTC Commitment of Traders

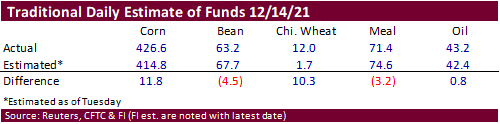

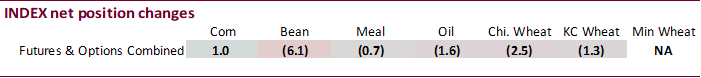

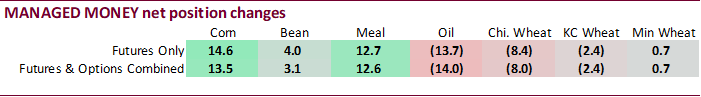

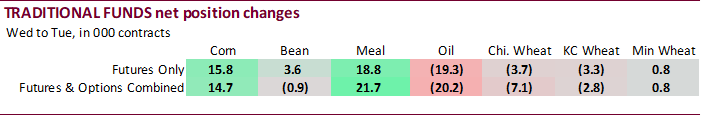

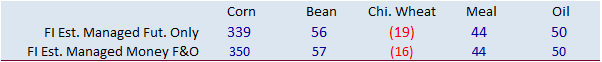

Funds were more long than estimated for corn and wheat, and less long for soybeans and meal. Oil was near expectations. We see no price implication from this week’s report, although some trades may see the net long corn position as slightly bullish.

CFTC COT Snapshot

SUPPLEMENTAL Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn 256,397 13,419 426,816 1,035 -648,643 -13,057

Soybeans 16,920 3,420 177,120 -6,135 -155,806 2,032

Soyoil -2,102 -19,571 119,009 -1,633 -119,410 22,996

CBOT wheat -26,832 -5,455 114,177 -2,501 -81,571 7,032

KCBT wheat 27,276 -1,902 57,586 -1,260 -88,013 3,259

FUTURES + OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn 345,980 13,480 268,121 27 -648,338 -13,337

Soybeans 40,975 3,093 143,619 -2,503 -165,817 2,765

Soymeal 40,534 12,636 87,400 -1,851 -181,517 -21,056

Soyoil 44,783 -14,045 94,136 -1,683 -127,247 23,720

CBOT wheat -7,303 -8,024 68,172 452 -64,841 5,714

KCBT wheat 57,164 -2,411 26,717 -1,439 -75,045 4,300

MGEX wheat 13,210 666 1,035 -21 -27,335 311

Total wheat 63,071 -9,769 95,924 -1,008 -167,221 10,325

Live cattle 82,254 2,404 81,977 147 -165,407 -2,274

Feeder cattle 4,793 -204 3,559 -13 -653 281

Lean hogs 48,492 1,287 57,617 -648 -97,425 -1,370

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn 68,806 1,226 -34,569 -1,396 1,757,032 32,849

Soybeans 19,457 -4,041 -38,234 685 767,185 -24,394

Soymeal 27,644 9,074 25,939 1,197 434,693 16,542

Soyoil -14,175 -6,199 2,502 -1,793 451,435 25,974

CBOT wheat 9,747 935 -5,774 923 444,225 3,494

KCBT wheat -11,989 -355 3,153 -97 239,385 -8,131

MGEX wheat 8,110 123 4,980 -1,079 79,137 -446

Total wheat 5,868 703 2,359 -253 762,747 -5,083

Live cattle 20,335 100 -19,158 -377 354,885 4,725

Feeder cattle -300 202 -7,400 -265 46,885 -299

Lean hogs 8,768 825 -17,452 -93 273,487 -12,297

Source: Reuters, CFTC and FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.