Good morning.

I will be traveling through Thursday, February 10, but will be sending out limited emails. S&D’s are due out Wednesday and will update accordingly.

Private exporters reported sales of 295,000 metric tons of soybeans for delivery to unknown destinations. Of the total, 252,000 metric tons is for delivery during the 2021/2022 marketing year and 43,000 metric tons is for delivery during the 2022/2023 marketing year.

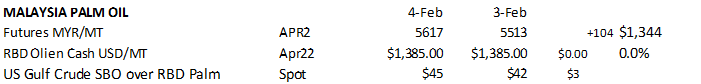

$92.80/barrel WTI crude oil and other higher energy prices lifted palm oil futures overnight and is currently limiting losses in CBOT soybean oil as soybeans trade lower. Dorab forecast higher palm oil futures over for first half 2022. Meal is on the defensive led by the March contract. CBOT grains are seeing some support despite a higher USD. South Korea’s MFG bought 110,000 tons of feed wheat for April/March shipment. 55,000 tons was bought at $328.50 a ton c&f. Another 55,000 tons at $331.90 a ton c&f. South Korea’s KFA bought 65,000 tons of animal feed corn at an estimated $340.99 a ton c&f for arrival in South Korea around May 25. Iran’s SLAL bought 180,000 tons of soybean meal from South America for shipment in February and March. China lifted restrictions on Russian imports of wheat and barley, allowing imports from all regions.

World Weather Inc.

WEATHER EVENTS AND FEATURES TO WATCH

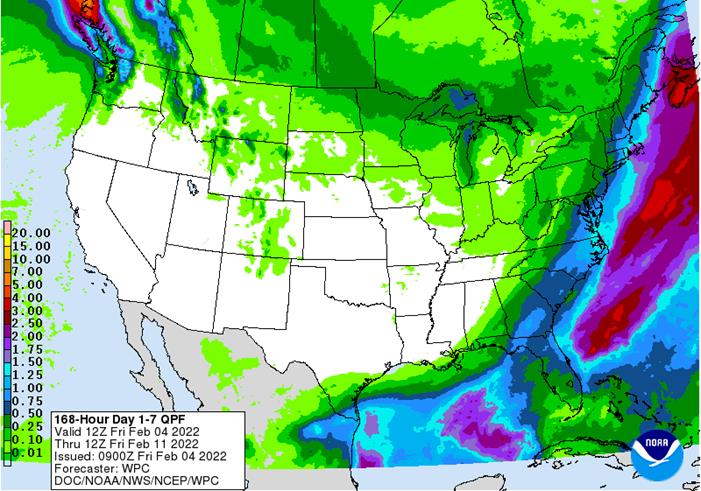

- Bitter cold temperatures occurred in the southern U.S. Plains this morning

- Temperature extremes in West Texas fell into the upper single digits as far south as Midland, Texas

- Lows were in the teens and 20s in central Texas

- Cloudiness protected fruit and vegetable crops in southern Texas from much damage

- Another cold night is expected in Texas tonight

- Frost and freezes will reach into the fruit and vegetable areas of southern Texas with a little damage possible

- Extreme lows in the central Texas will be in the teens with a few single digit readings

- Strong heating fuel demand will continue through Saturday in the southern Plains

- Cold temperatures will impact most of the U.S. Midwest, Delta and interior southeastern states Saturday and Sunday mornings

- No crop damaging cold will impact areas from southern Georgia to Florida

- U.S. weather will improve after today

- Impressive winter storm is abating today

- Total snow accumulations reached 15 inches in northern Indiana

- Significant ice and snow fell from central Texas to the Ohio River Valley and of course the central Plains and lower Missouri River Valley was also impacted on Wednesday

- Significant rain fell in the Delta and Tennessee River Basin causing some flooding

- Power outages were widespread Thursday from then southern Plains to the Ohio River Valley

- Snow, freezing rain and rain will continue this morning in the northeastern U.S.

- The storm will abate this afternoon

- Rain will fall in Florida this weekend again early next week

- U.S. weather will be more tranquil for the next ten days

- Weak weather systems will bring shots of cooler air periodically from the northern Plains into the Midwest and eastern states, but no major winter storm systems are likely

- The next larger storm will impact the lower Midwest and southeastern Plains as well as the Delta after Feb. 14

- Greater cooling should resume in the north-central U.S. during the week of Nov. 14 as well

- Warming is likely this weekend and next week with temperatures above normal from the central Plains into western Canada’s Prairies and in a part of the western U.S.

- No significant snow cover was on the ground the past two days in South Dakota, Nebraska, Montana and north-central Kansas may have led to a little crop damage because of bitter cold temperatures, but losses should be very light relative to the nation’s total crop

- West Texas has received some snow earlier this week, but moisture totals were not enough to seriously change soil conditions

- Snow will linger today and bitter cold will occur into Saturday morning

- Livestock stress will ease this weekend with warming temperatures and melting snow

- Argentina’s rain Thursday and this morning was greatest in Cordoba and northwestern Buenos Aires

- The moisture maintained very good soil moisture in the region which is going to carry normal crop development through the drier week that lies ahead after today

- Central Argentina is not expecting much rain for the next ten days and crop areas will dry out enough to become more stressful for plant development

- The area includes central and northern Santa Fe, northeastern Cordoba, Santiago del Estero, southern Chaco and portions of Entre Rios and southern Corrientes

- Northeastern Argentina, Paraguay and neighboring areas of southern Brazil will get some much needed rainfall this weekend that will bring relief to persistent heat and dryness

- The moisture will improve topsoil conditions with some locations getting 1.00 to 3.00 inches and possibly a little more

- Dry weather will resume in all of these areas during the following full week and possibly for ten days returning some dryness in time

- Soybeans are too badly damaged in some areas of Paraguay and Rio Grande do Sul to recover much from the expected rain

- Second season and late full season crops will benefit most from the moisture

- Crops in Parana and Mato Grosso do Sul will benefit from the moisture

- Safrinha planting in Paraguay and southern Brazil will increase after this weekend’s rain passes

- Too much rain will continue to fall across portions of center west and center south Brazil during the coming week raising concern over crop quality and over delays in harvest progress

- Mato Grosso to Sao Paulo and Minas Gerais are already saturated with moisture and frequent rainfall will maintain those conditions through all of next week

- Heavier rainfall for a while during early to mid-week will result in flooding especially in Minas Gerais, but perhaps in a few Goias, Sao Paulo and Mato Grosso locations as well

- Less intensive rain will be impacting Brazil’s center west and center south crop areas during the second week of the forecast, but the those areas will not be dry.

- Southwestern Europe and northwestern Africa will continue to receive a limited amount of rain for the next ten days leaving parts of Morocco and northwestern Algeria too dry

- Spain is also a little dry, but as long as these areas get improved precipitation later in this month and in March wheat and barley performance should go relatively well

- Some rain is expected in northeastern Algeria and Tunisia during the second week of the forecast

- Eastern Europe and the western CIS will continue to receive frequent snow and some rain through the next ten days maintaining moisture abundance and snow cover will remain widespread

- There is no threatening cold for the next two weeks in any of these areas

- South Africa has been and will continue to receive alternating periods of rain and thunderstorms through the next two weeks

- Sufficient rain will fall to maintain good soil moisture for all summer crops over the next two weeks

- Temperatures will be seasonable with a few locations a little cooler biased this week and then a little warmer again next week

- Rain fell in Queensland, Australia Wednesday and Thursday improving topsoil moisture, but will now turn drier again

- Tropical Cyclone Batsirai was located 213 miles northwest of St. Denis Reunion Island at 1200 GMT today

- The storm was moving west southwesterly at 7 mph while producing maximum sustained wind speeds to 126 mph

- Hurricane force wind was occurring out 50 miles from the center of the storm

- Batsirai will move west southwesterly and will make landfall over Madagascar by 1500 GMT Saturday

- Flooding and some damaging wind are expected

- The storm may produce some serious crop and property damager

- India’s latest rain event in the north and extreme east will linger through the weekend

- Sufficient moisture will occur to support reproducing winter crops, but the area impacted will be limited to the far north, areas near Nepal and from Bihar and Jharkhand and West Bengal through Bangladesh to India’s far Eastern states

- Net drying is expected elsewhere

- Eastern China’s weather will be typical for this time of year over the next couple of weeks with waves of rain and a little snow occurring across the east-central and southeastern parts of the nation favoring the Yangtze River Basin

- Rainfall of 1.00 to 4.00 inches will occur from near the Yangtze River southward to the coast during the next ten days with a few greater amounts possible

- Some significant snow may impact northern parts of the Yangtze River Basin as well

- Local moisture totals may reach up over 5.00 inches in the interior southeast

- Sufficient moisture is expected to maintain a very good outlook for rapeseed and winter wheat

- Local flooding is possible, but crop damage is not very likely

- Limited moisture in the north is not unusual for this time of year and the soil is favorably rated for the start of spring

- There are no areas of drought in eastern China

- Concern has been rising over the lack of precipitation in Xinjiang this winter and especially the mountains which may cut into spring runoff potential for irrigated summer crops

- Middle East snow cover is more widespread than usual reaching across most of Turkey and into western and northern Iran

- Some snow melt is expected

- The moisture will be good for winter crops when warming melts the snow

- Ethiopia has been seasonably dry recently while light showers occur in Uganda and southwestern Kenya

- Tanzania has been and will continue wettest which is normal for this time of year in east-central Africa

- Little change is expected in these patterns through the next two weeks

- West-central Africa will continue seasonably dry with near normal temperatures for the next ten days

- Indonesia, Malaysia and Philippines rainfall should occur routinely over the next two weeks support most crop needs.

- No excessive rainfall is expected

- Mainland Southeast Asia’s weather is expected be a little unsettled for a while with sporadic light showers periodically, but no general soaking rain is expected

- Vietnam’s Central Highlands may get rain next week, but confidence is low

- Today’s Southern Oscillation Index is +4.46

- The index will move higher during the next seven days

- New Zealand will receive some welcome rain today through the weekend easing a long period of below average precipitation

- Follow up precipitation is possible next week

- The moisture will be welcome and help to raise topsoil moisture

- Temperatures will trend a little warmer than usual

- Mexico will experience slightly cooler than usual weather with a few showers in the east during the coming week

- The remainder of the nation will be dry

- Central America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica

- Guatemala will also get some showers periodically

- Western Colombia, Ecuador and Peru rainfall may be greater than usual in the coming week

- Western Venezuela will soon begin receiving rain once again after a bout of dryness

- The remainder of Venezuela will remain dry

Source: World Weather Inc.

Bloomberg Ag Calendar

Friday, Feb. 4:

- ICE Futures Europe weekly commitments of traders report, ~1:30pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- HOLIDAY: China, Vietnam

Monday, Feb. 7:

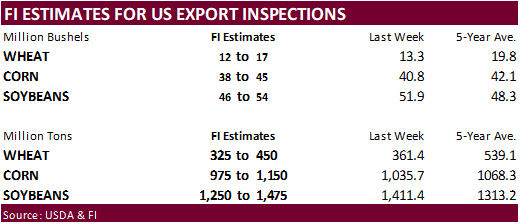

- USDA export inspections – corn, soybeans, wheat, 11am

- Ivory Coast cocoa arrivals

- HOLIDAY: New Zealand

Tuesday, Feb. 8:

- Canada’s StatCan releases wheat, durum, canola, soybeans and barley stockpile data, 8:30am

- EU weekly grain, oilseed import and export data

Wednesday, Feb. 9:

- EIA weekly U.S. ethanol inventories, production

- USDA’s monthly World Agricultural Supply and Demand (WASDE) report, 12pm

Thursday, Feb. 10:

- USDA weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am

- Malaysian Palm Oil Board’s data on palm oil reserves, output and exports

- French agriculture ministry releases 2022 winter grain and rapeseed planting estimates

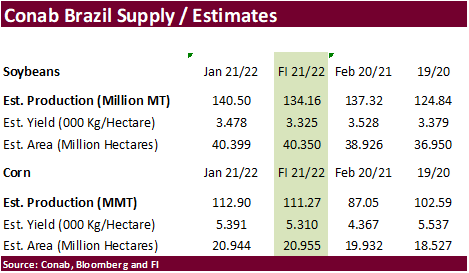

- Brazil’s Conab report on yield, area and output of corn and soybeans

- Brazil’s Unica releases sugar output and cane crush data (tentative)

- IKAR grain conference in Moscow

- Vietnam’s customs department to publish data on coffee, rice and rubber exports in January

- Malaysia’s Feb. 1-10 palm oil exports

Friday, Feb. 11:

- ICE Futures Europe weekly commitments of traders report, ~1:30pm

- CFTC commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm

- March ICE white sugar contract expiry

- HOLIDAY: Japan

Source: Bloomberg and FI

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM: treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.