PDF Attached

Happy

New Year!

A

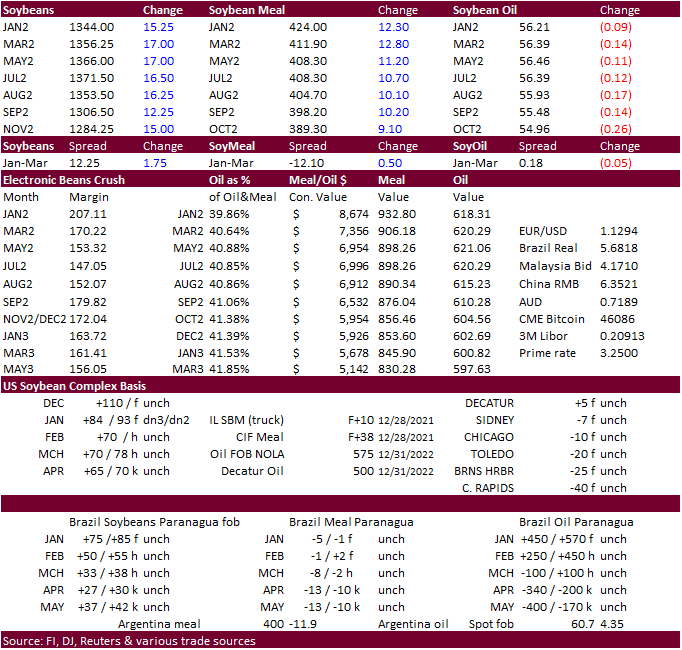

strong USD capped early fund buying to the start of the new quarter/year in grains. Soybeans ended higher in large part to another strong day in soybean meal. US soybean inspections fell to their lowest level since late September. NASS reported a soybean crush

below expectations and November corn crush above expectations.

The

GFS model for South America is drier this morning while the European model suggests about unchanged from Friday’s outlook. Brazil saw rain over the weekend across the northern areas and spotty rain southern of southern MG and Sao Paulo. Argentina saw spotty

but beneficial rain over the weekend. Northern Cordoba western BA and La Pampa was mostly dry. Brazil will see rain over the next week, but the southern areas will see deficits while the north will be too wet for early harvesting in some areas. Argentina will

see variable rain, but the greatest concern are hot temperatures keeping the dry areas dry from evaporation during rain events. Looking forward, a ridge of high pressure is expected to build up across Argentina after day ten of the forecast (around January

12-13) and prevail through mid-month which may lead to drier and warmer weather for Argentina, southern Brazil, Uruguay and Paraguay. The US southern Great Plains will see limited precipitation and cold temperatures this week.

Weather

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

- Northern

Argentina was excessively hot during the weekend, but should cool down this week for a little while - Extreme

highs reached 115 Fahrenheit in Santiago del Estero while 100 to 111 was common in the north half of the nation - A

short term bout of warming is expected ahead of a Sunday/Monday rain event - The

precipitation Sunday into Monday will be greatest from southern Cordoba through central Buenos Aires and will restore favorable topsoil moisture after a bout of rising stress this workweek - Rain

fell beneficially in central parts of Argentina Friday through Sunday - Some

of the rain was greater than expected with up to 1.50 inches resulting - Most

of the rain fell from southern and central Cordoba into northern Buenos Aires and east across most of Santa Fe and much of Entre Rios - Most

areas received 0.20 to 0.75 inch - Greater

rain fell in central and southwestern Chaco where 1.00 to nearly 2.00 inches resulted - A

few showers also occurred in northern Santiago del Estero with one location reporting 2.38 inches in the northeast - Northern

and central Cordoba, southern Santiago del Estero, La Pampa and much of central Buenos Aires were dry along with Corrientes - Far

southern Buenos Aires reported up to 0.57 inch - The

next greatest rain event in Argentina will be Sunday and Monday of next week at which time some significant rain “may” occur from southern Cordoba to central Buenos Aires - The

models are not in agreement with this event, but the European model has been outperforming the GFS and it suggests some 1.00 to 2.00-inch rain totals will be possible

- If

that that occurs as advertised, the key crop areas from Cordoba to central Buenos Aires will see relief from recent drying and a restoration of more favorable crop development - Argentina

will experience a new ridge of high pressure evolving in the latter part of next week and lasting through January 18 restoring dryness and crop stress through limited rain and warm to hot temperatures - Southern

Brazil will begin receiving periodic showers and thunderstorms this week and that trend will last into next week

- The

precipitation will be erratic and more favorable for some areas than others, but most of the dry areas in the south will get enough rain to induce at least a short term improvement in crop and field conditions - Drier

weather is expected at the end of next week through Jan. 19 with some warmer temperatures possible as well - Northern

Brazil’s frequent rainfall pattern will prevail through the next couple of weeks maintaining a wet environment for crops and raising a little concern for maturation and harvest progress of early season soybeans - The

wettest conditions are expected from eastern Mato Grosso to Tocantins, western Bahia, Minas Gerais and northeastern Sao Paulo where the ground will stay saturated and areas of standing and running water are expected - Most

of the early planted soybeans are farther to the west where rainfall will not be as heavy or persistent from western and central Mato Grosso to southwestern Sao Paulo and Parana - Fieldwork

will advance around the showers and thunderstorms - Safrinha

corn and cotton planting prospects are still very good in Mato Grosso and areas south into Parana and Sao Paulo this year - U.S.

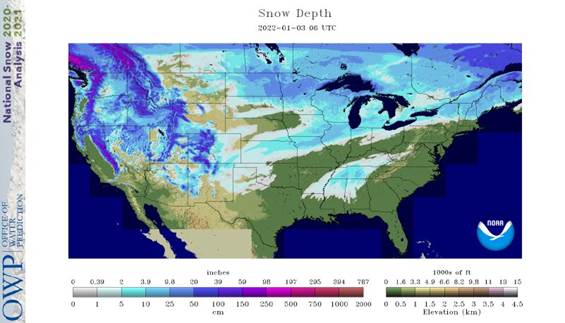

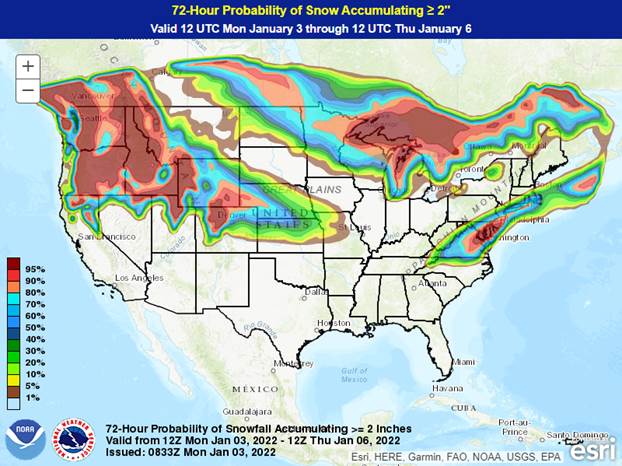

hard red winter wheat damage may have occurred during the weekend due to bitter cold temperatures and a few areas of very limited or no snow cover - Extreme

lows fell to -20 at North Platte, Neb. and -18 at Limon, Colorado while readings of -16 to -10 occurred in several other pockets in Nebraska, Kansas and Colorado - Northwestern

half of Kansas reported lows below zero while positive single digit readings occurred in the southeast half of Kansas and the Texas Panhandle - Crop

damage was most likely in southwestern Nebraska, northeastern Colorado and in a few counties of northwestern Kansas where snow cover was lightest or non-existent - Very

little damage likely occurred in the Texas Panhandle because of single digit low temperatures and a little snow, but the region’s crops were shocked after being in the 60s and 70s before the coldest weather hit - Damage

assessments will not be complete until spring - Another

bout of bitter cold is expected in the central Plains late this week and snow cover may be limited in a few areas - The

cold will occur after sufficient warming takes place to melt most of the snow that fell during the weekend - Some

snow will precede the coolest conditions Wednesday and Thursday, but it may not cover all areas that may slip below zero Friday.

- The

situation will be closely monitored for possible winterkill - Snow

fell across many U.S. hard red winter wheat production areas during the weekend with depths of 1 to 5 inches across southeastern Colorado west-central through north-central Kansas and from extreme northeastern Colorado to the North Platte area of Nebraska

with North Platte reporting 6 inches - A

trace to 2 inches occurred in other areas from eastern Colorado to southwestern Nebraska; including far northwestern Kansas

- A

trace to 1 inch of snow fell in the Texas Panhandle and south-central into eastern wheat areas of Kansas

- Snow

also fell significantly from far northern Kansas and southern Nebraska to southeastern Wisconsin and southern Michigan where 3 to 9 inches resulted - One

more band of significant snow fell in southern South Dakota in the Interstate Highway 90 corridor where a trace to 2 inches occurred most often and local totals to 4 inches - Heavy

snow in Tennessee River Basin overnight has snarled traffic - The

storm will shift to North Carolina and Virginia today where more than a foot of snow is possible resulting in transportation delays in that region, as well - Heavy

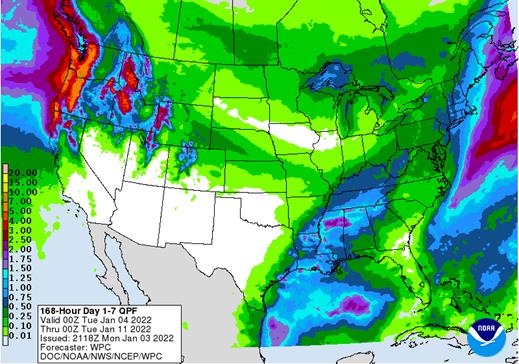

rain fell during the weekend in the lower U.S. Midwest and especially in the Ohio River Valley southward into the Tennessee River Basin and northern Arkansas - Rain

totals varied from 1.00 to 4.00 inches and locally more from northern Arkansas to central Kentucky and there were a few reports of wind damage - Minor

flooding is occurring in the lower Midwest, a part of the northern Delta and in a few Tennessee River Basin locations - Lighter

precipitation fell in the lower U.S. Delta and southeastern states during the weekend, but one to three inches was noted Sunday in the Carolinas and Virginia and up to 2.10 inches occurred in southwestern Georgia and the Florida Panhandle - This

precipitation was helpful in easing recent drying - Some

areas in West Texas received up to 0.44 inch of moisture during the weekend which was welcome, but most amounts were no more than 0.20 inch

- West

Texas is not likely to see much more precipitation of significance for a while - U.S.

temperatures during the weekend turned bitterly cold in the Plains and western Corn Belt and continued quite cold in the northern Plains, although Sunday was warmer in this latter area - Extreme

lows of -20 to -37 Fahrenheit occurred from northern Montana to northern Minnesota with Grand Forks, N.D. coldest - Subzero

degree lows occurred as far south as northern New Mexico extreme northwestern parts of the Texas Panhandle, Central Kansas and northern Missouri - U.S.

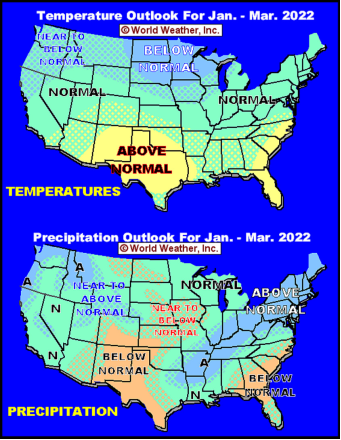

weather over the next ten days will downplay precipitation in the central and southern Plains, although it will not be completely dry - Precipitation

totals will be well below average - Frequent

precipitation will impact the lower Ohio River Valley, the Tennessee River Valley, portions of the Delta and the middle and northern Atlantic Coast states - Storminess

in the far western states will be more restricted to the Pacific Northwest over these next ten days and probably for two weeks

- Some

excessive wind and rain have impacted the Puget Sound and Cascade Mountains recently - Temperatures

in the western United States will likely trend warmer than usual as time moves along in this first half of January - Snow

should fall most significantly in the coming ten days from Canada’s western Prairies and the northwestern U.S. Plains to the Great Lakes region and in a small part of the west-central high Plains region and in northern parts of the lower Midwest

- Some

waves of snow will impact the middle and northern Atlantic Coast states during the coming week - Europe

weather has been and should continue to be good for dormant winter crops - Concern

about dryness in Spain may continue for a while, but soil moisture and snow cover should be sufficient for crops elsewhere over the next ten days - North

Africa precipitation will increase during mid- to late week this week in north-central and northeastern Algeria and northern Tunisia, but precipitation in Morocco will be quite limited - Southwestern

Morocco continues to be a notable multi-year drought and dryness is also a concern in northwestern Algeria - Crops

elsewhere are doing relatively well - Warmer

temperatures in parts of Ukraine and Russia’s Southern Region during the weekend induced a little rain while snow fell frequently to the north - No

threatening cold weather is expected anytime soon in Europe or the western CIS - Snow

cover will remain widespread across much of Russia and the northernmost part of Ukraine as well as some areas in eastern Europe - Winter

crops are in good conditions no change is expected - China’s

weather will continue mostly uneventful for a while, although periods of rain and a little snow will impact the Yangtze River Basin during the next couple of weeks.

- The

moisture will preserve the integrity of the 2022 rapeseed and southern wheat crops - Snow

will fall periodically in the far northeast while the Yellow River Basin and southern coastal provinces receive little to no precipitation - Temperatures

will be near to slightly warmer than usual - Northern,

central and eastern India will receive rain this week and during the weekend that will moisten the topsoil and help support crop development ahead of reproduction - Wheat,

millet, rapeseed and some pulse crops will be among the beneficiaries of the precipitation

- Southern

India will be relatively dry, although significant rain fell along the lower east coast during the weekend - Southeast

Asia oil palm, citrus, sugarcane, coffee, cocoa, rice and other crop areas of Indonesia, Malaysia and Philippines will receive frequent bouts of rain over the next two weeks - Some

heavy rain is possible, but no serious widespread flood problem is expected - Local

flooding will be possible, though - Mainland

areas of Southeast Asia will be mostly dry during the next ten days except Vietnam coastal areas where some heavy rain will occur late this week and into the weekend - Australia

weekend precipitation was limited the far northeastern New South Wales and extreme southeastern Queensland where 0.15 to 1.18 inches occurred with a few coastal areas getting more than 2.00 inches - Most

other areas were dry and temperatures were very warm to hot from interior eastern parts of the nation into interior parts of Western Australia

- Rain

is needed in western sorghum and western cotton areas in Queensland and New South Wales as well as in many livestock grazing areas in the two states - Australia

weather will not change much through Tuesday - Thunderstorms

are expected in eastern parts of New South Wales and a few interior southeastern Queensland locations during the second half of this week and into the weekend - Rainfall

will be greatest along the western slopes of the Great Dividing Range in New South Wales - The

precipitation may continue next week as scattered showers and thunderstorms that will benefit summer crops in both Queensland and New South Wales - Southeastern

Australia will be wettest including southeastern crop areas of New South Wales and central through eastern crop areas of Victoria - Temperatures

will be near to above normal - Late

season winter crop harvesting in the south should not be seriously impacted by rain since most of the crop has been harvested - South

Africa will experience a good mix of rain and sunshine during the next two weeks, although the precipitation will be limited in the central and west for a while this week - The

long term summer outlook remains favorable - Temperatures

will be seasonable - West-central

Africa precipitation will be limited to coastal areas and temperatures will be a little warmer than usual - East-central

Africa will be erratic, but it is expected daily through the next ten days supporting coffee, cocoa, rice sugarcane and other crops - Middle

East precipitation is expected to be erratically distributed over the next couple of weeks

- Winter

crops will benefit from whatever rain falls, but it is not expected to be evenly distributed for a while - Northwestern

Mexico received some welcome rain during the weekend with moisture totals to 1.25 inches western Chihuahua and parts of Baja California

- The

precipitation was welcome to winter crops in the region lifted topsoil moisture briefly, but much more rain is needed - The

region will be dry, like most of Mexico during the coming week to ten days. - Some

showers are expected in the far south and a few extreme eastern parts of the nation late this week into early next week

- Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica during the next ten days - A

few showers will occur in Guatemala periodically as well, although rainfall will be light - Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Today’s

Southern Oscillation Index was +12.00 and it was expected to drift lower for a while this week - New

Zealand rainfall is expected to continue getting less than usual precipitation this week with temperatures near to above normal

Source:

World Weather, inc.

Bloomberg

Ag Calendar

Monday,

Jan. 3:

- USDA

export inspections – corn, soybeans, wheat, 11am - CFTC

and ICE commitments of traders reports (delayed from Dec. 31) - Honduras

and Costa Rica coffee exports - Global

cotton balance report from the International Cotton Advisory Committee - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - Ivory

Coast cocoa arrivals - HOLIDAY:

U.K, New Zealand, Thailand, Russia, Japan, China, Canada, Australia

Tuesday,

Jan. 4:

- EU

weekly grain, oilseed import and export data - Australia

Commodity Index - Purdue

Agriculture Sentiment - HOLIDAY:

New Zealand, Russia

Wednesday,

Jan. 5:

- EIA

weekly U.S. ethanol inventories, production - Malaysia’s

Jan. 1-5 palm oil exports - HOLIDAY:

Russia

Thursday,

Jan. 6:

- FAO

World Food Price Index - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Russia

Friday,

Jan. 7:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Russia

Source:

Bloomberg and FI

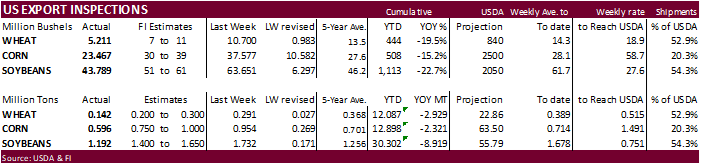

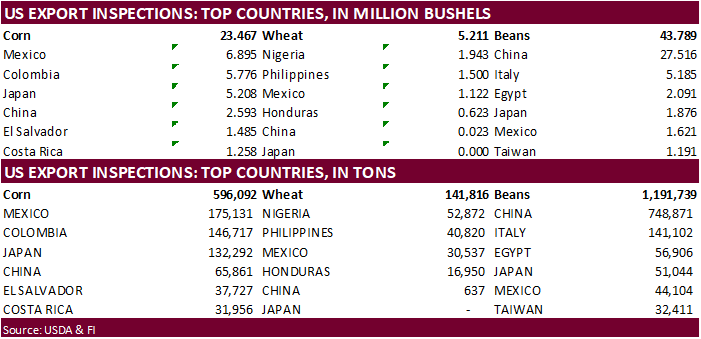

USDA

inspections versus Reuters trade range

Wheat

141,816 versus 200000-450000 range

Corn

596,092 versus 500000-1000000 range

Soybeans

1,191,739 versus 1400000-1900000 range

Soybean

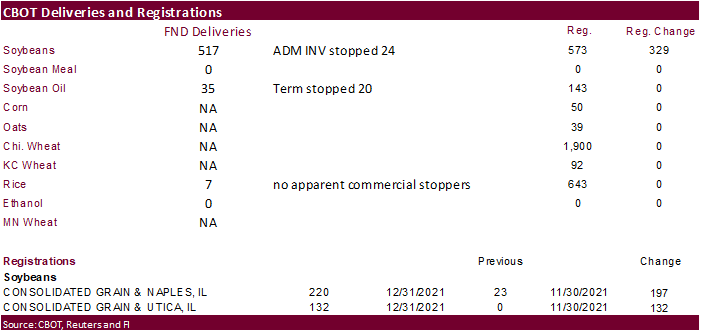

inspections were lowest since late September. China took 748,871 tons of soybeans and only a cargo of corn. Big upward revision to corn for the previous weeks. Soybeans were also upward revised.

GRAINS

INSPECTED AND/OR WEIGHED FOR EXPORT

REPORTED IN WEEK ENDING DEC 30, 2021

— METRIC TONS —

—————————————————————————

CURRENT PREVIOUS

———–

WEEK ENDING ———- MARKET YEAR MARKET YEAR

GRAIN 12/30/2021 12/23/2021 12/31/2020 TO DATE TO DATE

BARLEY

0 0 0 10,010 20,944

CORN

596,092 954,488 1,089,440 12,898,120 15,218,768

FLAXSEED

0 0 0 224 461

MIXED

0 0 0 0 0

OATS

0 0 0 300 2,593

RYE

0 0 0 0 0

SORGHUM

1,879 175,385 156,802 1,729,267 2,348,260

SOYBEANS

1,191,739 1,732,291 1,764,078 30,301,724 39,220,494

SUNFLOWER

0 0 0 432 0

WHEAT

141,816 291,207 475,901 12,086,652 15,015,437

Total

1,931,526 3,153,371 3,486,221 57,026,729 71,826,957

—————————————————————————

CROP

MARKETING YEARS BEGIN JUNE 1 FOR WHEAT, RYE, OATS, BARLEY AND

FLAXSEED;

SEPTEMBER 1 FOR CORN, SORGHUM, SOYBEANS AND SUNFLOWER SEEDS.

INCLUDES

WATERWAY SHIPMENTS TO CANADA.

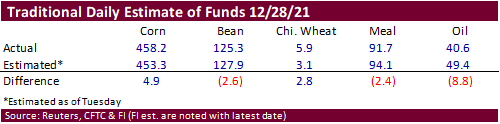

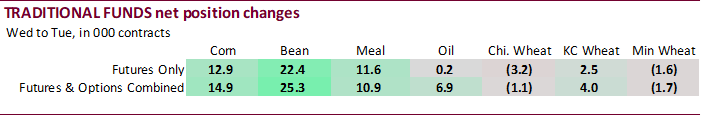

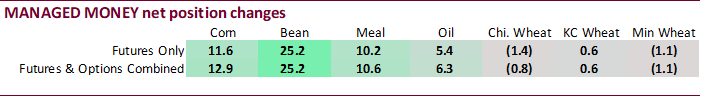

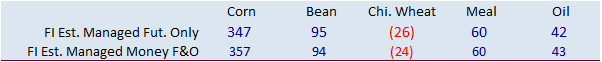

CFTC

Commitment of Traders

Commitment

of Traders

SUPPLEMENTAL

Non-Comm Indexes Comm

Net Chg Net Chg Net Chg

Corn

282,789 7,775 434,234 6,544 -683,314 -13,494

Soybeans

80,710 23,464 177,111 1,588 -224,854 -23,704

Soyoil

1,589 6,717 118,271 425 -124,729 -11,609

CBOT

wheat -30,498 -2,423 121,414 4,852 -84,223 -2,313

KCBT

wheat 29,651 -116 61,712 4,291 -92,738 -2,437

FUTURES

+ OPTS Managed Swaps Producer

Net Chg Net Chg Net Chg

Corn

373,345 12,929 260,246 -2,632 -674,323 -11,411

Soybeans

98,080 25,154 134,757 -2,340 -228,233 -21,576

Soymeal

61,162 10,611 87,016 -498 -203,326 -10,997

Soyoil

45,394 6,316 94,119 -567 -132,434 -10,815

CBOT

wheat -11,773 -766 73,505 3,289 -66,458 -2,030

KCBT

wheat 59,406 599 25,597 11 -79,583 -2,312

MGEX

wheat 12,030 -1,148 1,127 -32 -24,172 3,010

Total

wheat 59,663 -1,315 100,229 3,268 -170,213 -1,332

Live

cattle 69,602 850 81,043 -270 -155,363 -1,748

Feeder

cattle 1,679 1,293 3,552 11 763 -579

Lean

hogs 57,720 3,736 57,219 -954 -105,071 -2,149

Other NonReport Open

Net Chg Net Chg Interest Chg

Corn

74,442 1,940 -33,710 -825 1,843,102 41,913

Soybeans

28,363 110 -32,968 -1,349 767,439 -21,966

Soymeal

29,360 252 25,788 630 430,303 -22,160

Soyoil

-11,948 599 4,869 4,468 419,844 -36,371

CBOT

wheat 11,418 -377 -6,692 -116 433,728 -11,061

KCBT

wheat -6,793 3,439 1,374 -1,738 244,520 -3,024

MGEX

wheat 7,040 -566 3,975 -1,263 77,597 -1,051

Total

wheat 11,665 2,496 -1,343 -3,117 755,845 -15,136

Live

cattle 17,448 246 -12,732 921 361,314 11,315

Feeder

cattle 436 208 -6,431 -933 46,242 -690

Lean

hogs 6,808 -1,084 -16,674 449 262,948 4,718

Source:

CFTC, Reuters and FI

Selected

Brazil Commodity December 2021 December 2020

CRUDE

OIL (TNS) 6,150,307 5,282,467

IRON

ORE (TNS) 31,426,947 33,120,248

SOYBEANS

(TNS) 2,711,907 274,082

CORN

(TNS) 3,438,330 4,856,570

GREEN

COFFEE(TNS) 207,640 254,552

SUGAR

(TNS) 1,943,706 2,880,667

BEEF

(TNS) 126,915 142,524

POULTRY

(TNS) 383,517 350,857

PULP

(TNS) 1,643,000 1,276,018

Monday,

Jan. 3:

- USDA

export inspections – corn, soybeans, wheat, 11am - CFTC

and ICE commitments of traders reports (delayed from Dec. 31) - Honduras

and Costa Rica coffee exports - Global

cotton balance report from the International Cotton Advisory Committee - USDA

soybean crush, DDGS production, corn for ethanol, 3pm - Ivory

Coast cocoa arrivals - HOLIDAY:

U.K, New Zealand, Thailand, Russia, Japan, China, Canada, Australia

Tuesday,

Jan. 4:

- EU

weekly grain, oilseed import and export data - Australia

Commodity Index - Purdue

Agriculture Sentiment - HOLIDAY:

New Zealand, Russia

Wednesday,

Jan. 5:

- EIA

weekly U.S. ethanol inventories, production - Malaysia’s

Jan. 1-5 palm oil exports - HOLIDAY:

Russia

Thursday,

Jan. 6:

- FAO

World Food Price Index - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Russia

Friday,

Jan. 7:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Russia

Source:

Bloomberg and FI

·

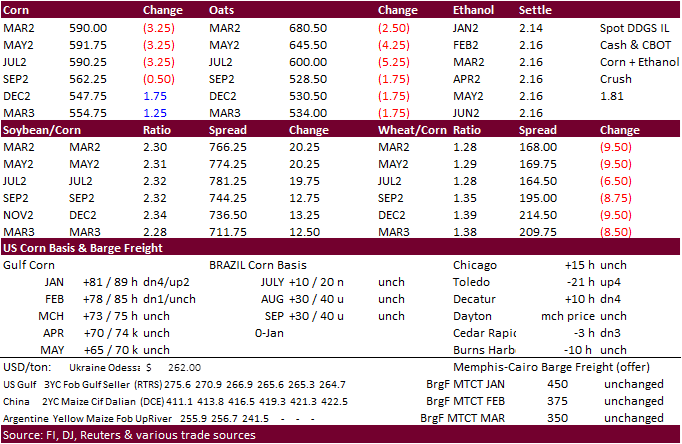

CBOT corn ended lower by 4 cents on weakness in US wheat and a sharply higher USD pressured price. The session low in March corn bounced tested the low end of a 4-month trading channel.

·

Prices were higher early on South American weather concerns and higher energy markets, but that didn’t last long after the day session open. News was light with no notable global export developments were announced over the weekend.

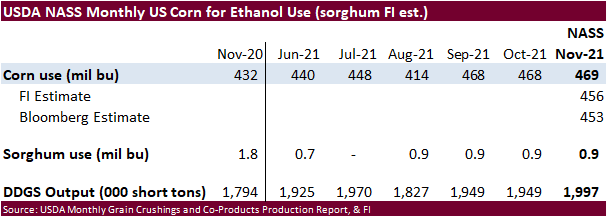

USDA NASS reported the November corn for ethanol use above trade expectations.

·

USDA US corn export inspections as of December 30, 2021 were 596,092 tons, within a range of trade expectations, below 954,488 tons previous week and compares to 1,089,440 tons year ago. Major countries included Mexico for 175,131

tons, Colombia for 146,717 tons, and Japan for 132,292 tons.

·

President Biden plans to invest 1 billion USD in funding fir meat processors and ranchers to help boost competition to lower meat prices.

·

Argentina extended its export suspension for some beef cuts until the end of 2023.

·

France reported bird flu at a farm of about 13,000 turkeys in Beaufou (western France).

·

Bulgaria culled 39,000 chickens after a bird flu outbreak was reported in the southern village of Krivo Pole.

·

USDA reported the November corn for ethanol use at 469 million bushels, 13 million above an average trade guess, one million above October and 37 million bushels above November 2020.

Export

developments.

·

None reported

Energy

prices rose more than other commodities in 2021

https://www.eia.gov/todayinenergy/detail.php?id=50718&src=email

Updated

1/3/22

March

corn is seen in a $5.60 to $6.20 range (up 10 cents, unchanged)

·

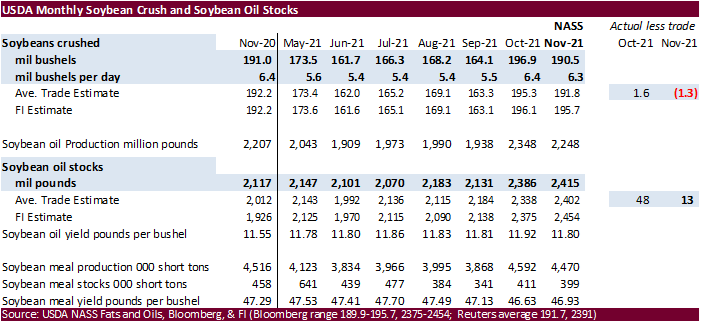

South American weather concerns lifted prices higher overnight but a strong rally in the USD capped gains in soybeans. After the close NASS reported the November crush at 190.5 million bushels, 1.3 million bushels below expectations.

·

Cold US temperatures over the weekend expected to last beyond this week was supporting soybean meal feed demand, and to an extent corn futures before wheat pulled that market lower.

·

The March crush spread is trading at $170.50 per bushel, close to its contract high.

·

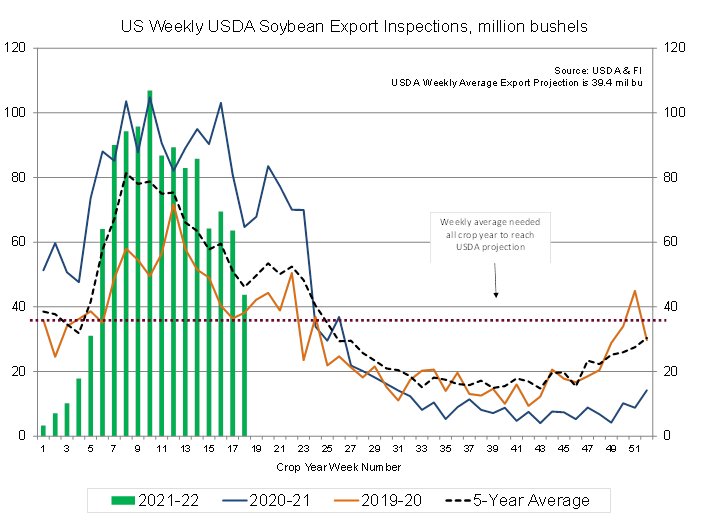

USDA US soybean export inspections as of December 30, 2021 were 1,191,739 tons, below a range of trade expectations, below 1,732,291 tons previous week and compares to 1,764,078 tons year ago. Major countries included China for

748,871 tons, Italy for 141,102 tons, and Egypt for 56,906 tons.

·

USDA US soybean export inspections were lowest since the last week of September and concerning since they are well below average. With Brazil coming online soon, the US has a small window of exports to catch up to the pace to

reach USDA’s 2.050 billion projection. US soybean export commitments are running 23 percent below this time year ago while USDA’s 2.050 billion soybean export projection is 9 percent below 2020-21.

·

The slow export inspections comes when China’s weekly soybean stocks hit a 32-month low of 3.63 million tons, 2.84 million tons below this time year ago (AgriCensus).

·

December soybean inspections could end up near 290 million bushels, down from the record 383.8 million exported year ago. The previous 2015-2019 average was 225 million bushels for December. We look for USDA to lower US soybean

exports next week by 25 million bushels to 2.025 billion and compares to 2.265 billion year ago. For the crop-year, we are using 2.000 billion bushels, 50 below USDA.

·

It was reported StoneX estimated Brazil’s soybean production at 134 million tons and corn at 117.5 million tons. USDA December for Brazil was at 144.0 beans / 118 corn. USDA Argentina soybeans 49.5 beans / 54.5 corn.

·

Egypt said they have enough vegetable oil reserves for 6.4 months, largest amount in years.

·

China’s Heilongjiang Province will increase its soybean planting area by 10 million mu (about 666,667 hectares) in 2022.

·

China was on holiday, returning Tuesday.

Export

Developments

·

The CCC seeks 12,000 tons of soybean oil on Jan 5 for Feb 5-15 delivery for the Dominican Republic.

Updated

1/3/22

Soybeans

– March $13.00-$14.00 (unch, up 15 cents)

Soybean

meal – March $370-$435 (up $15, up $20)

Soybean

oil – March 52.00-60.00 (up 100, up 100)

·

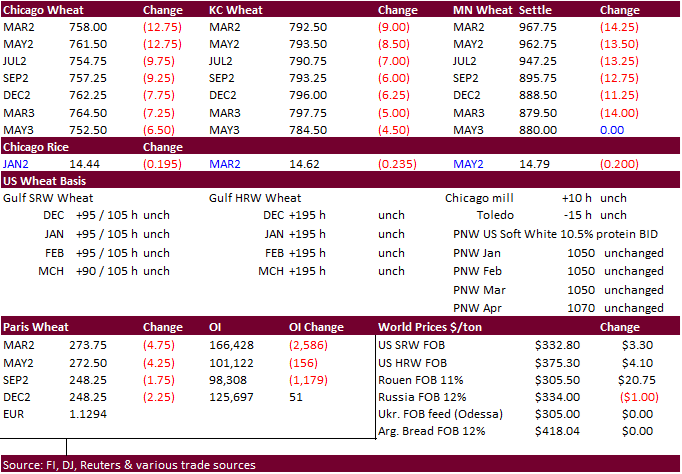

US wheat started higher led by higher protein wheat, but prices collapsed after the USD rallied more than 60 points during the day session.

·

EU wheat basis the March position was 4.75 lower at 274 euros a ton.

·

USDA US all-wheat export inspections as of December 30, 2021 were 141,816 tons, below a range of trade expectations, below 291,207 tons previous week and compares to 475,901 tons year ago. Major countries included Nigeria for

52,872 tons, Philippines for 40,820 tons, and Mexico for 30,537 tons.

·

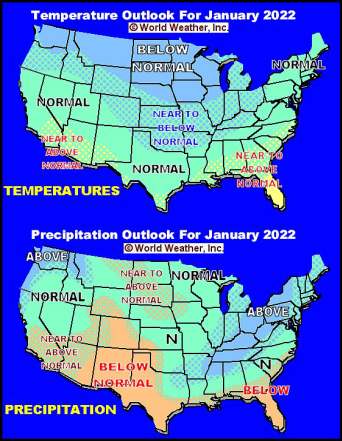

US weather improved over the weekend with Great Plains snowfall coverage expanding across the central and northern Plains. The US southern Great Plains will see limited precipitation and cold temperatures this week. The January

outlook calls for below normal precipitation for the southern Great Plains.

·

Jordan and Iraq are in for wheat early this week.

·

China plans to sell 50,000 tons of wheat from state reserves on January 5 to flour millers. The sold an estimated 891,938 tons of wheat from reserves in October.

·

Jordan’s state grain buyer seeks 120,000 tons of milling wheat, optional origins, on Jan. 5, for shipment in 2022 between July 1-15, July 16-31, Aug. 1-15 and Aug. 16-31.

·

Iraq seeks 50,000 tons of wheat on January 3 from the US, Canada and Australia.

Rice/Other

·

Egypt said they have enough sugar reserves for 3 months.

·

Results awaited: Bangladesh

seeks 50,000 tons of non-basmati parboiled rice for delivery 50 days from contract award and letter of credit opening.

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.