PDF Attached

Noon

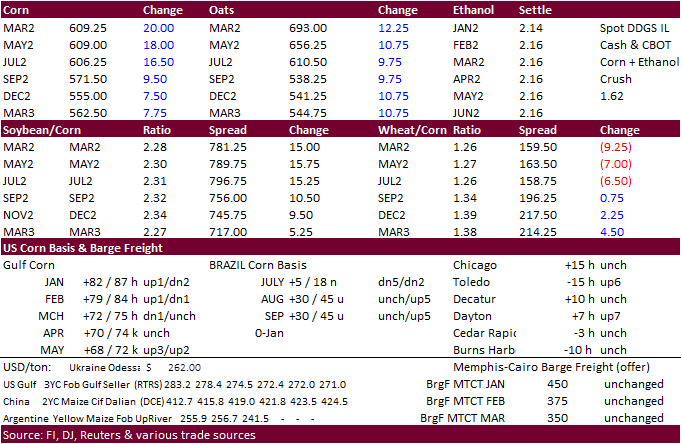

weather maps reduced rainfall for Argentina. Soybeans rallied by more than 30 cents in the front four months, soybean meal was higher led by bull spreading, and soybean oil was up 175-191 points also led by bull spreading. A reversal in product spreading

was due in part to higher overnight palm oil futures and soybean meal failing to find buyers around the $415 area basis the March position, which had been tested three times over the past week. Corn was up 20.25 cents in the March contract on renewed fund

buying and some thinking meal got too expensive relative to other feedgrains. Wheat climbed higher after selected US state crop reports showed winter wheat conditions declined from late November. Higher WTI crude lent a hand to the bullish sentiment.

World

Weather Inc.

WEATHER

EVENTS AND FEATURES TO WATCH

- Relief

to dryness in western Parana, Mato Grosso do Sul and Paraguay has begun with scattered thunderstorms in a part of those areas in the past two days and the trend will continue for the next week to ten days - Relief

is expected to be highly varied with some areas getting significant rain while others only light amounts - Soil

moisture will improve, but it will come a little late for early soybeans and early corn - The

moisture should be good for Safrinha crops later this month and next - Most

of Brazil will see rain over the next two weeks - The

precipitation will perpetuate an excessive moisture situation in northeastern Mato Grosso, Tocantins, southwestern Bahia, Minas Gerais and northern Goias

- Flooding

is possible in some of these areas - Less

rain in central and southeastern Bahia will help flood water from recent dam breaks and excessive rain to recede - Argentina

rain in west-central, northwestern and a few central parts of Cordoba overnight and in central Santa Fe was welcome

- Rain

totals reached over 1.00 inch in a few locations while most of it was less than 0.60 inch

- A

few other showers occurred in northeastern La Pampa and northwestern Buenos Aires and near the south coast of Buenos Aires - Temperatures

were still quite warm, but not as hot as those of the weekend resulting in strong evaporation and minimizing the positive impact of overnight rainfall - Argentina

precipitation is expected to continue restricted for an extended period of time, although southwestern crop areas will get rain Monday and Tuesday

- Rainfall

of 0.30 to 1.00 inch and some 1.00 to 2.00-inch amounts are possible from San Luis and portions of southwestern Cordoba to central and western Buenos Aires - The

precipitation will be timely and should help restore more favorable crop development potential in peanut, soybean, sorghum and sunseed production areas - All

other areas in Argentina will get very little rain over the next ten days and possibly longer causing greater crop stress especially in the north and east-central parts of the nation - The

next best chance for rain in Argentina may occur late next week, but conditions are not very good to bring moisture into the nation keeping rainfall potentials light - A

high pressure ridge returning to Argentina late this weekend and next week will allow warm to hot temperatures to return in the drier areas of the north where extreme temperatures over 100 Fahrenheit are likely once again - Cold

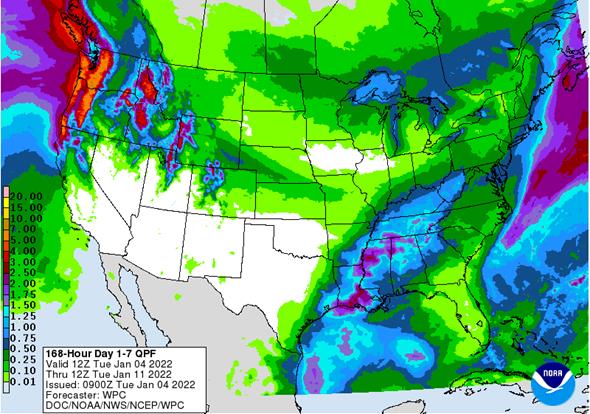

air will return to a part of the central U.S. during the second half of this week and into the weekend, but it will be short-lived, and it may be colder in the Midwest with this surge than in the last cold wave - Snow

is expected to fall lightly in Nebraska, Kansas and northeastern Colorado Wednesday into Thursday ahead of the coldest mornings Thursday and Friday - The

snowfall is expected to be light and temperatures will be in the positive and negative single digits

- Old

snow from last weekend may melt before the new snow falls - The

distribution of new snow will be closely monitored for fears of minimal coverage in a few areas raising concern over crop conditions - Winterkill

might be possible if there is not much snow on the ground when the coldest air is present - Central

Illinois wheat may also be vulnerable to winterkill or crop damage because of little to no snow coverage and bitter cold temperatures Friday morning - Damage

is not likely to be widespread, but some impact cannot be ruled out due to temperatures in the positive and negative single digits and minimal snow cover - A

few areas in Missouri and central Indiana could be facing a similar situation - Impressive

snowstorm occurred Monday from the central Appalachian Mountains through the Washington, D.C. area and reaching to near Philadelphia and southern New Jersey where 8 to nearly 15 inches resulted - Transportation

and commerce were impacted by the storm which has moved off the coast today - A

nor’easter snow event is possible along the northern half of the U.S. Atlantic Coast Thursday night and Friday bringing heavy snow to a part of the region - Snow

accumulations of 3 to 10 inches are expected with greater amounts possible in southeastern Quebec, Canada - A

short term bout of very cold weather will occur in the U.S. Midwest and middle and northern Atlantic Coast states late this week and early in the weekend - Another

cold surge is possible in the central and eastern U.S. late in the weekend and early next week before a greater warming trend impacts the central eastern states late next week and into the following weekend - A

brief bout of warmer weather will impact the Plains this weekend and the Midwest and eastern states early next week before the reinforcing shot of cold arrives - West

and South Texas precipitation will be restricted over the next ten days to two weeks - Not

much rain will fall in California’s central valleys for a while and the heavy snow in the Sierra Nevada is over for a while - Heavy

rain, flooding and strong wind will continue along the U.S. Pacific Northwest coast and British Columbia coast this week impacting shipping in the region - Wednesday

through Friday will be stormiest - Not

much precipitation will impact U.S. hard red winter wheat areas during the next two weeks, although a few brief bouts of snow and a little rain might occur, but moisture content in the precipitation will not change drought status - U.S.

Delta and interior parts of the southeastern U.S. along with most of the central and eastern Midwest will remain plenty moist over the next two weeks - Drying

is needed near and south of the Ohio River into the Tennessee River Basin and northern Delta - Canada’s

Prairies will receive waves of snow during the next two weeks with southern and eastern areas getting the greatest amounts - East-central

and southern Alberta and west-central and southwestern Saskatchewan are still in a serious drought and the snowfall in those areas will be light and provide very little relief when it melts - Europe

weather has been and should continue to be good for dormant winter crops - Concern

about dryness in Spain may continue for a while, but soil moisture and snow cover should be sufficient for crops elsewhere over the next ten days - North

Africa precipitation will increase during mid- to late week this week in north-central and northeastern Algeria and northern Tunisia, but precipitation in Morocco will be quite limited - Southwestern

Morocco continues to be a notable multi-year drought and dryness is also a concern in northwestern Algeria - Crops

elsewhere are doing relatively well - Warmer

temperatures in parts of Ukraine and Russia’s Southern Region recently induced a little rain while snow fell frequently to the north - Snow

cover has been receding from eastern Europe, Ukraine and Russia’s Southern Region, but there is no threatening cold coming anytime soon - No

threatening cold weather is expected anytime soon in Europe or the western CIS - Snow

cover will remain widespread across much of Russia and the northernmost part of Ukraine as well as some areas in eastern Europe - Winter

crops are in good conditions no change is expected - China’s

weather will continue mostly uneventful for a while, although periods of rain and a little snow will impact the Yangtze River Basin during the next couple of weeks.

- The

moisture will preserve the integrity of the 2022 rapeseed and southern wheat crops - Snow

will fall periodically in the far northeast while the Yellow River Basin and southern coastal provinces receive little to no precipitation - Temperatures

will be near to slightly warmer than usual - Northern,

central and eastern India will receive waves of rain over the next ten days that will moisten the topsoil and help support crop development ahead of reproduction - Wheat,

millet, rapeseed and some pulse crops will be among the beneficiaries of the precipitation

- Southern

India will be relatively dry, although significant rain fell along the lower east coast during the weekend - Southeast

Asia oil palm, citrus, sugarcane, coffee, cocoa, rice and other crop areas of Indonesia, Malaysia and Philippines will receive frequent bouts of rain over the next two weeks - Some

heavy rain is possible, but no serious widespread flood problem is expected - Local

flooding will be possible, though - Mainland

areas of Southeast Asia will be mostly dry during the next ten days except Vietnam coastal areas where some heavy rain will occur late this week and into the weekend - Australia

weather outlook has not changed much - Thunderstorms

are expected in eastern parts of New South Wales and a few interior southeastern Queensland locations during the second half of this week and into the weekend - Rainfall

will be greatest along the western slopes of the Great Dividing Range in New South Wales - The

precipitation may continue next week as scattered showers and thunderstorms that will benefit summer crops in both Queensland and New South Wales, although the rain in Queensland will be most restricted - Southeastern

Australia will be wettest including southeastern crop areas of New South Wales and central through eastern crop areas of Victoria - Temperatures

will be near to above normal - Late

season winter crop harvesting in the south should not be seriously impacted by rain since most of the crop has been harvested - South

Africa will experience a good mix of rain and sunshine during the next two weeks, although the precipitation will be limited in the central and west for a while this week - The

long term summer outlook remains favorable - Temperatures

will be seasonable - West-central

Africa precipitation will be limited to coastal areas and temperatures will be a little warmer than usual - East-central

Africa will be erratic, but it is expected daily through the next ten days supporting coffee, cocoa, rice sugarcane and other crops - Middle

East precipitation is expected to be erratically distributed over the next couple of weeks

- Winter

crops will benefit from whatever rain falls, but it is not expected to be evenly distributed for a while - Mexico

will be mostly dry during the coming week, although some rain is expected in the south and eastern most parts of the nation beginning this weekend and continuing next week - Central

America precipitation will be greatest along the Caribbean Coast , but including a fair amount of Panama and Costa Rica during the next ten days - A

few showers will occur in Guatemala periodically as well, although rainfall will be light - Western

Colombia and western Venezuela precipitation is expected to occur periodically in coffee, corn, rice and sugarcane production areas during the next ten days, but no excessive rain is expected - Today’s

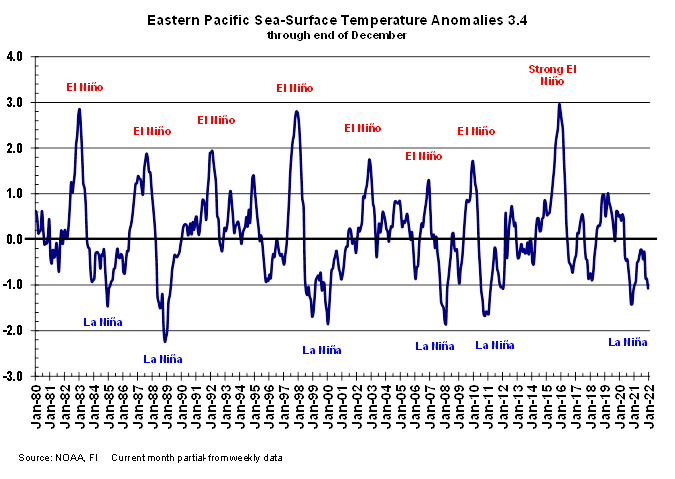

Southern Oscillation Index was +11.59 and it was expected to drift lower for a while this week - New

Zealand rainfall is expected to continue getting less than usual precipitation this week with temperatures near to above normal

Source:

World Weather, inc.

Tuesday,

Jan. 4:

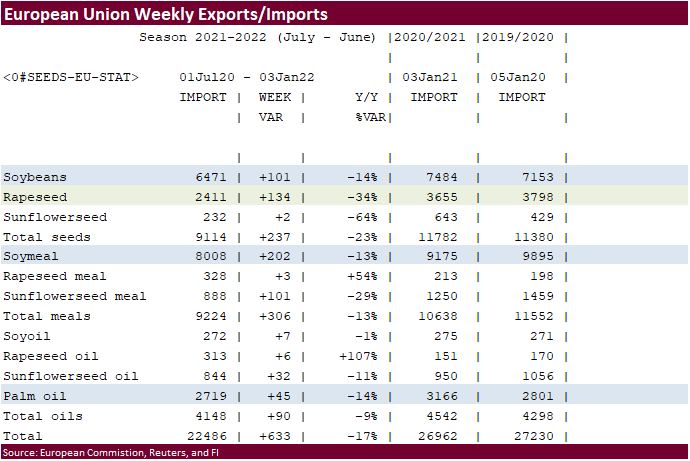

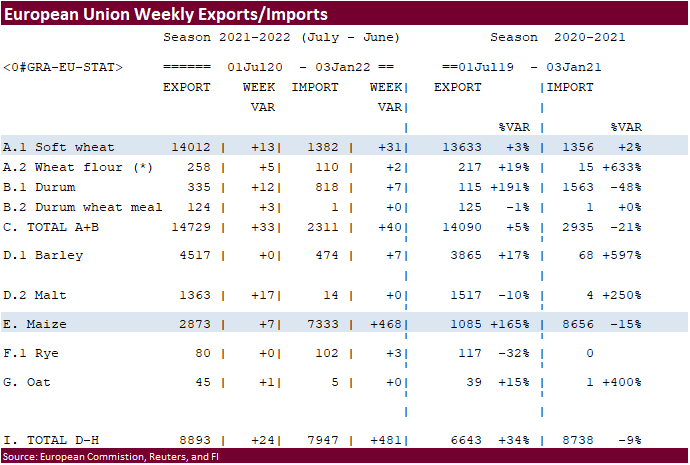

- EU

weekly grain, oilseed import and export data - Australia

Commodity Index - Purdue

Agriculture Sentiment - HOLIDAY:

New Zealand, Russia

Wednesday,

Jan. 5:

- EIA

weekly U.S. ethanol inventories, production - Malaysia’s

Jan. 1-5 palm oil exports - HOLIDAY:

Russia

Thursday,

Jan. 6:

- FAO

World Food Price Index - USDA

weekly net-export sales for corn, soybeans, wheat, cotton, pork and beef, 8:30am - Port

of Rouen data on French grain exports - HOLIDAY:

Russia

Friday,

Jan. 7:

- ICE

Futures Europe weekly commitments of traders report (6:30pm London) - CFTC

commitments of traders weekly report on positions for various U.S. futures and options, 3:30pm - HOLIDAY:

Russia

Source:

Bloomberg and FI

Soybean

and Corn Advisory

2021/22

Brazil Soybean Estimate Lowered 2.0 mt to 138.0 Million (USDA 144)

2021/22

Argentina Soy Estimate Lowered 3.0 mt to 45.0 Million Tons (USDA 49.5)

2021/22

Brazil Corn Estimate Lowered 1.0 mt to 113.0 Million (USDA 118)

2021/22

Argentina Corn Estimate Unchanged at 52.0 Million Tons (USDA 54.5)

2021/22

Paraguay Soybean Estimate Unchanged at 8.0 Million Tons (USDA 10)

Macros

OPEC+

Agrees To Stick To Existing Policy With 400,000 Bpd Output Increase In Feb – RTRS Sources

China

coal prices hit news highs.

Canadian

Manufacturing Market PMI Dec: 56.5 (prev 57.2)

·

Noon weather maps turned more unfavorable for the South American weather outlook and we may start to see additional reductions to Argentina’s corn crop prospects as it was planted later than normal this season. Remember producers

wanted to avoid replanting this season because of high costs.

·

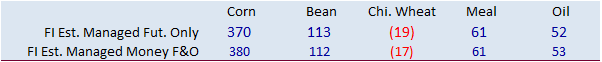

Funds were net buyers of an estimated net 23,000 corn contracts.

·

March corn at its contract high of $6.1775 is not out of reach and we think corn could trade up into the $6.25-$6.35 area if SA weather fails to improve. March settled today at $6.0950.

·

CBOT corn traded 20.25 cents higher basis the March and 18.50 higher May. As we mentioned earlier, ongoing concerns over unfavorable SA weather conditions continue to underpin the market. Argentina soil moisture levels are expected

to decline over the next week with limited rainfall and hot temperatures in the forecast. Argentina corn is generally planted later than first crop Brazil corn.

·

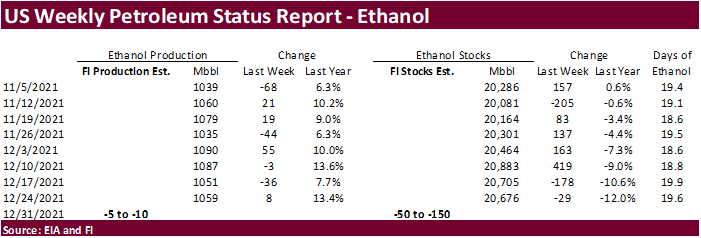

A Bloomberg poll calls for weekly ethanol production to be reported at 1.052 million barrels, down 7,000 from the previous week and stocks to increase to 20.856 million from 20.676 million previous week.

·

IHS Markit will issue its January US and world crop reports Thursday.

Export

developments.

·

None reported

Crude

oil prices increased in 2021 as global crude oil demand outpaced supply

https://www.eia.gov/todayinenergy/detail.php?id=50738&src=email

REVISED

TO REFLECT 12/31

Updated

1/3/22

March

corn is seen in a $5.60 to $6.20 range

·

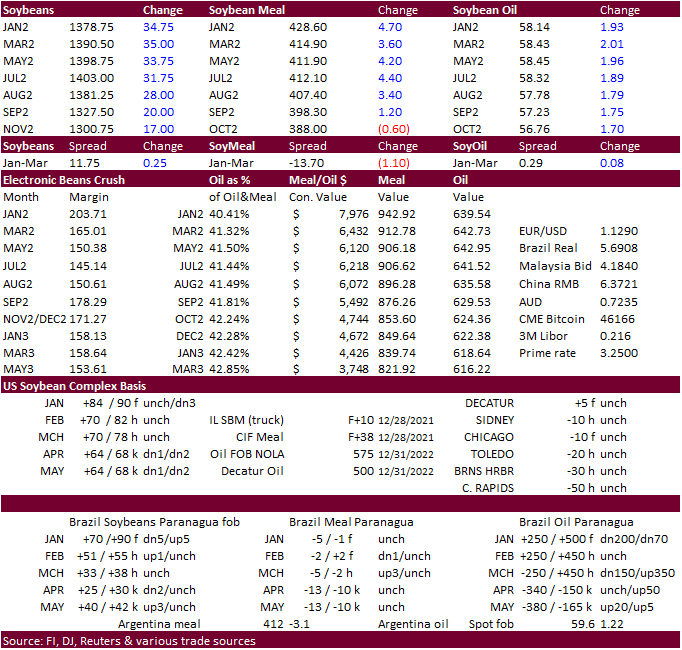

US soybeans roared higher with bull spreading a feature on concerns over South American weather, downgrades to Brazil production prospects, despite expectations for USDA to raise the US 2021-22 soybean carryout next week in large

part to slow shipments of soybeans. Brazil 2021 soybean exports hit a record of 86 million tons with December shipments hitting a large 2.7 million tons, up sharply from the previous year.

·

We see March soybeans trading near $14.00 soon. $14.5450 is the absolute contract high. March crush is expected to stay above $1.55 over the short term.

·

Soybean meal rallied today but gains were capped on a reversal in product spreading. March soybean meal failed to hit buy stops around the $415 area overnight, third such time this has happened over the past week when trading

around this level. $415.10 is the absolute contract high. Some participants believe the market is overbought based on yesterday’s run to the upside and large net long position held by investment funds.

·

Today the funds bought 1,000 soybean meal. Funds also bought 10,000 soybean oil and 18,000 soybeans.

·

A reversal in product spreading supported soybean oil, which settled nearly 200 points higher. Soybean meal was thought to be overbought relative to SBO.

·

Brazil will see rain over the next week, but the southern areas will see deficits while the north will be too wet for early harvesting. Argentina will see variable rain events with hot temperatures. A ridge of high pressure is

still advertised for Argentina around January 12‐13, lasting through mid‐month.

·

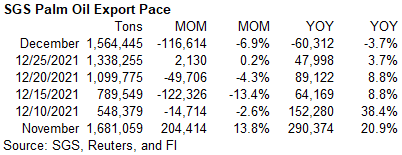

Malaysian palm futures were up three consecutive sessions. Flooding is slowing production across the Peninsular Malaysia and Sabah.

·

Cargo surveyor SGS reported December Malaysian palm exports at 1,564,445 tons, 116,614 tons below month ago or down 6.9%, and 60,312 tons below the same period a year ago or down 3.7%.

Export

Developments

·

The CCC seeks 12,000 tons of soybean oil on Jan 5 for Feb 5-15 delivery for the Dominican Republic.

Updated

1/3/22

Soybeans

– March $13.00-$14.00

Soybean

meal – March $370-$435

Soybean

oil – March 52.00-60.00

·

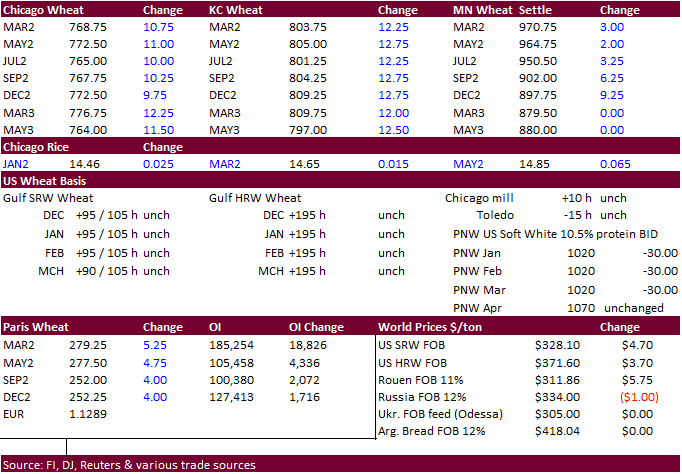

US wheat ended higher on declining US winter wheat ratings. MN traded two-sided, ending higher, but well away Chicago and KC futures. Funds bought an estimated net 7,000 SRW wheat contracts.

·

USDA in its winter monthly selected state crop updates reported declines in winter wheat ratings for key production states. 33% of the Kansas winter wheat crop in good to excellent condition as of Jan. 2, down from 62% in late

November, and down from 51% by Dec. 12. In Oklahoma, 20% of the state’s wheat was rated good to excellent, down from 48% in late November. Wheat ratings declined in Nebraska (39 vs. 64 late Nov. and 37 year ago) and Colorado (25 vs. 38 late Nov. and 19 year

ago).

·

Turkey extended their custom tax exemption on some wheat, rye, barley, oats, maize, chickpea and lentil imports until the end of 2022. They also extended tax exemptions for sunflower oil until the end of June.

·

EU wheat basis the March position was 5.25 higher at 279.25 euros a ton.

·

China plans to sell 50,000 tons of wheat from state reserves on January 5 to flour millers. The sold an estimated 891,938 tons of wheat from reserves in October.

·

Tunisia seeks 125,000 tons of soft wheat, 75,000 tons of durum wheat and 75,000 tons of animal feed barley on Wednesday. For soft wheat was for five consignments of 25,000 tons each for shipment between Feb. 1 and March 25. The

durum tender was for three 25,000 tons each for shipment between Jan. 25 and Feb. 25 and barley for three 25,000 tons each for shipment between Feb. 1 and March 5.

·

Ethiopia Bought 400,000 tons of wheat in October and November and 12.5 million liters of cooking oil-Ministry of Finance.

·

Jordan’s state grain buyer seeks 120,000 tons of milling wheat, optional origins, on Jan. 5, for shipment in 2022 between July 1-15, July 16-31, Aug. 1-15 and Aug. 16-31.

·

Results awaited: Iraq seeks 50,000 tons of wheat on January 3 from the US, Canada and Australia.

Rice/Other

·

Results awaited: Bangladesh

seeks 50,000 tons of non-basmati parboiled rice for delivery 50 days from contract award and letter of credit opening.

Updated

12/9/21

Chicago

March $7.40 to $8.60 range

KC

March $7.55 to $9.00 range

MN

March $9.50‐$11.00

Terry Reilly

Senior Commodity Analyst – Grain and Oilseeds

Futures International

One Lincoln Center

18 W 140 Butterfield Rd.

Oakbrook Terrace, Il. 60181

W: 312.604.1366

ICE IM:

treilly1

Skype: fi.treilly

Trading of futures, options, swaps and other derivatives is risky and is not suitable for all persons. All of these investment products are leveraged, and you can lose more than your initial deposit. Each investment product is offered

only to and from jurisdictions where solicitation and sale are lawful, and in accordance with applicable laws and regulations in such jurisdiction. The information provided here should not be relied upon as a substitute for independent research before making

your investment decisions. Futures International, LLC is merely providing this information for your general information and the information does not take into account any particular individual’s investment objectives, financial situation, or needs. All investors

should obtain advice based on their unique situation before making any investment decision. The contents of this communication and any attachments are for informational purposes only and under no circumstances should they be construed as an offer to buy or

sell, or a solicitation to buy or sell any future, option, swap or other derivative. The sources for the information and any opinions in this communication are believed to be reliable, but Futures International, LLC does not warrant or guarantee the accuracy

of such information or opinions. Futures International, LLC and its principals and employees may take positions different from any positions described in this communication. Past results are not necessarily indicative of future results.